Washington State, Department of Revenue, Business Tax 2022

Understanding the Washington State Department of Revenue Business Tax

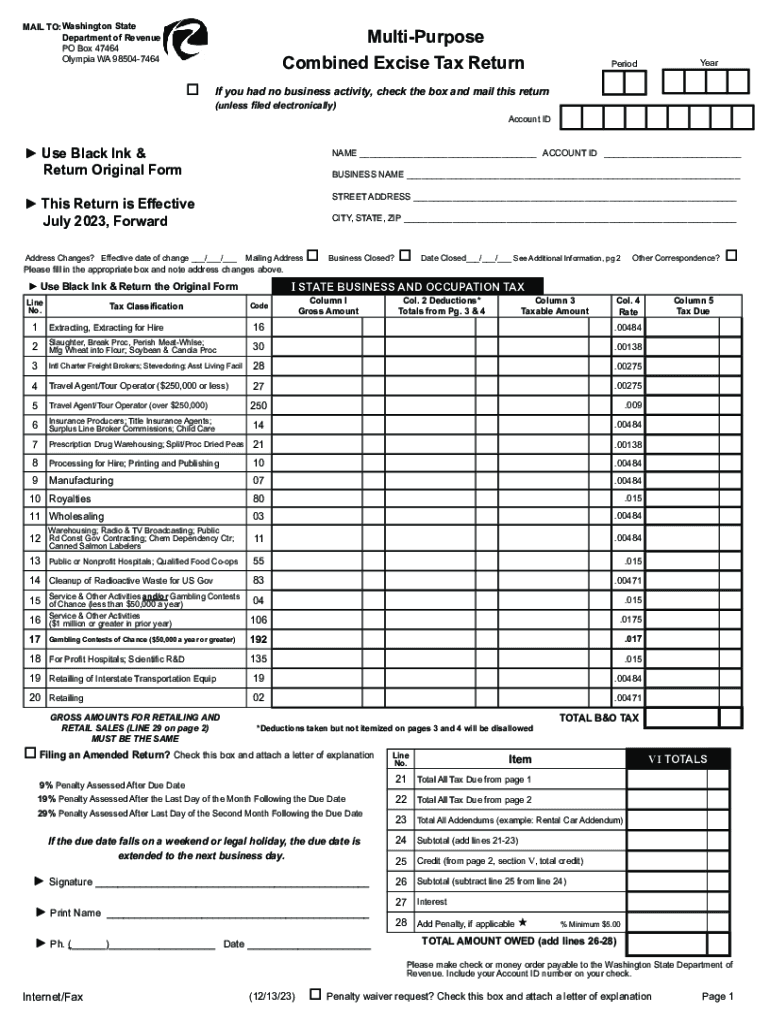

The Washington State Department of Revenue administers various business taxes that apply to different types of businesses operating within the state. These taxes include the Business and Occupation (B&O) tax, which is a gross receipts tax imposed on businesses for the privilege of conducting business in Washington. The tax rate varies depending on the type of business activity. Additionally, businesses may be subject to other taxes such as sales and use tax, property tax, and various excise taxes. Understanding these taxes is crucial for compliance and effective financial planning.

Steps to Complete the Washington State Department of Revenue Business Tax

Completing the Washington State business tax forms involves several key steps:

- Determine your business type and applicable tax rates.

- Gather necessary financial records, including income statements and expense reports.

- Access the appropriate tax forms from the Washington State Department of Revenue website.

- Fill out the forms accurately, ensuring all required information is included.

- Review the completed forms for accuracy before submission.

- Submit the forms either online, by mail, or in person, depending on your preference.

Required Documents for Business Tax Filing

When filing business taxes in Washington State, certain documents are essential to ensure a smooth process. These typically include:

- Federal tax identification number (EIN or SSN)

- Financial statements, including profit and loss statements

- Records of sales and purchases

- Previous tax returns, if applicable

- Any relevant licenses or permits required for your business type

Filing Deadlines and Important Dates

Staying informed about filing deadlines is critical for compliance. In Washington State, business tax filings are generally due on the last day of the month following the end of the reporting period. Common reporting periods include monthly, quarterly, and annual filings. Specific deadlines may vary based on the type of tax and business activity, so it's important to check the Washington State Department of Revenue website for the most accurate and up-to-date information.

Form Submission Methods

Businesses can submit their tax forms through various methods, providing flexibility based on preference:

- Online: The Washington State Department of Revenue offers an online portal for electronic filing, which is often the quickest and most efficient method.

- Mail: Forms can be printed and mailed to the appropriate department. Ensure that you allow sufficient time for delivery.

- In-Person: Businesses may also choose to submit forms in person at designated Department of Revenue offices.

Penalties for Non-Compliance

Failure to comply with Washington State business tax regulations can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time

- Interest on unpaid taxes

- Potential audits or increased scrutiny from the Department of Revenue

It is essential for businesses to stay informed and comply with all tax obligations to avoid these consequences.

Quick guide on how to complete washington state department of revenue business tax

Effortlessly Prepare Washington State, Department Of Revenue, Business Tax on Any Gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed materials, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Washington State, Department Of Revenue, Business Tax across any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to Modify and eSign Washington State, Department Of Revenue, Business Tax with Ease

- Access Washington State, Department Of Revenue, Business Tax and then select Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your edits.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Washington State, Department Of Revenue, Business Tax to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct washington state department of revenue business tax

Create this form in 5 minutes!

How to create an eSignature for the washington state department of revenue business tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Washington State Department Of Revenue regarding Business Tax?

The Washington State Department Of Revenue is responsible for administering business taxes, ensuring compliance, and providing support to businesses regarding their tax obligations. They offer resources and guidance to help businesses understand their tax responsibilities, including registration and filing requirements related to Business Tax.

-

How can airSlate SignNow help me with my Washington State Business Tax documentation?

airSlate SignNow streamlines the process of sending and signing documents needed for your Washington State Business Tax compliance. With user-friendly features, you can quickly eSign and manage all tax-related documents, ensuring they are submitted on time and accurately.

-

Are there any costs associated with using airSlate SignNow for Washington State Business Tax documents?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there are subscription plans that vary based on your business needs. Investing in airSlate SignNow can save you time and help you avoid penalties related to your Washington State Business Tax documentation.

-

What key features does airSlate SignNow offer for managing Washington State Business Tax documents?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage that make managing Washington State Business Tax documents easier. These features help ensure that all your documentation is organized and accessible whenever it’s needed.

-

Can airSlate SignNow integrate with other tools I use for managing Washington State Business Tax?

Absolutely! airSlate SignNow offers various integrations with CRM and accounting software, which can enhance your ability to manage Washington State Business Tax documents. This seamless integration allows for better workflow and ensures all your business tax records are kept in sync.

-

What are the benefits of using airSlate SignNow for Washington State Business Tax management?

Using airSlate SignNow for Washington State Business Tax management provides you with enhanced efficiency and lower operational costs. The platform simplifies the process of preparing and submitting tax-related documents, allowing you to focus more on growing your business and less on paperwork.

-

How secure is my information when using airSlate SignNow for Washington State Business Tax?

airSlate SignNow prioritizes your security with industry-standard encryption and strict data protection measures. Your information related to Washington State Business Tax will be safeguarded, ensuring that your sensitive financial documents remain confidential and secure.

Get more for Washington State, Department Of Revenue, Business Tax

- Tax attribute carryovers tax alaska form

- Alaska veteran employment tax credit as 4320048 6325010114 veterans alaska form

- Tax alaska 6967150 form

- Tax alaska 6967310 form

- 662sf mining license tax return short form

- Instructions for form 1120 w estimated tax for corporations

- Abc limited special occasion permit checklist the form

- Bpp5 authorization to the department of nyc gov form

Find out other Washington State, Department Of Revenue, Business Tax

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form