Wi Form Amended

What is the Wisconsin Amended Tax Form?

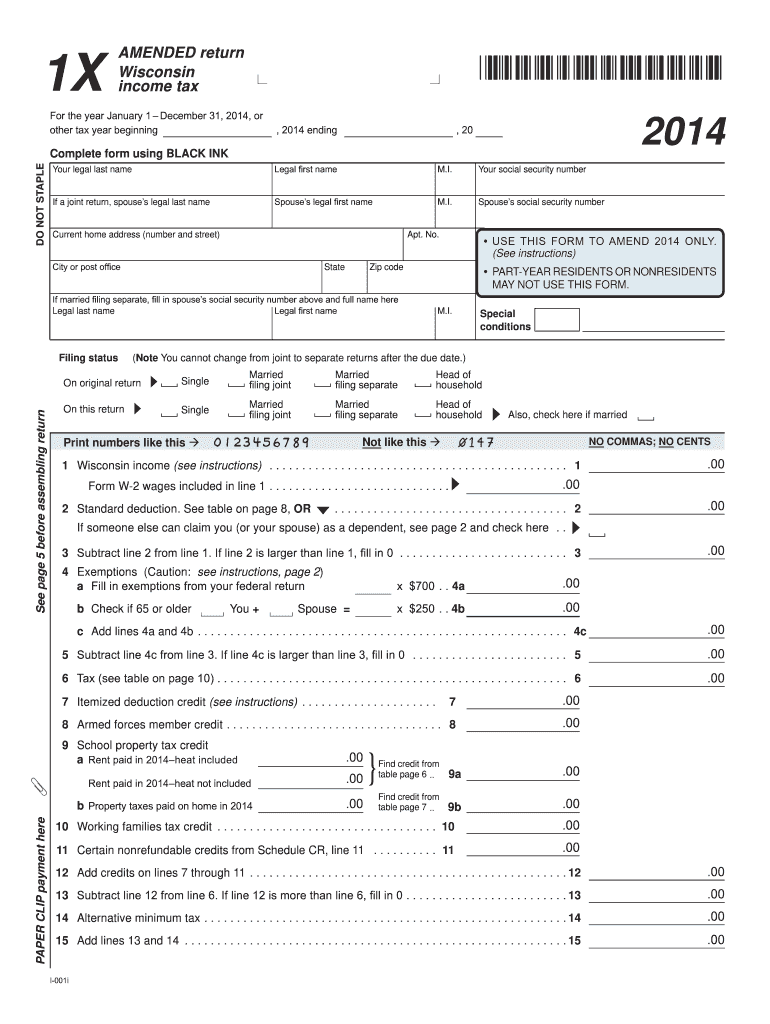

The Wisconsin amended tax form, commonly referred to as the Form 1X, is used by taxpayers to correct errors or make changes to their original Wisconsin income tax return. This form is essential for ensuring that any discrepancies in reported income, deductions, or credits are accurately addressed. It allows individuals to amend their tax filings for various reasons, such as correcting mistakes, claiming additional deductions, or adjusting income amounts. Understanding the purpose and function of the Form 1X is crucial for maintaining compliance with state tax regulations.

Steps to Complete the Wisconsin Amended Tax Form

Completing the Wisconsin amended tax form involves several key steps to ensure accuracy and compliance. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Next, clearly indicate the changes on the Form 1X, providing detailed explanations where necessary. It is important to double-check all calculations to avoid further errors. Once completed, sign and date the form. Finally, submit the amended return to the Wisconsin Department of Revenue, either electronically or by mail, depending on your preference.

Legal Use of the Wisconsin Amended Tax Form

The Wisconsin amended tax form is legally binding when completed correctly and submitted in accordance with state regulations. To ensure its legal validity, the form must be signed by the taxpayer or an authorized representative. Additionally, compliance with eSignature laws is essential if the form is submitted electronically. The use of a secure eSigning platform can enhance the legitimacy of the submission, providing an electronic certificate and maintaining compliance with relevant legal frameworks.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin amended tax form are critical to avoid penalties and interest. Generally, taxpayers have up to three years from the original filing due date to submit an amended return. However, if the amendment relates to a claim for a refund, it is important to file within the specified timeframe to ensure eligibility. Keeping track of these deadlines is essential for maintaining compliance with Wisconsin tax laws.

Form Submission Methods

The Wisconsin amended tax form can be submitted through various methods, including online, by mail, or in person. For electronic submissions, taxpayers can utilize secure eSigning platforms to ensure their forms are processed efficiently. If opting for mail, it is advisable to send the form via certified mail to confirm its delivery. In-person submissions can be made at designated Wisconsin Department of Revenue offices, providing an opportunity for immediate assistance if needed.

Required Documents

When filing the Wisconsin amended tax form, certain documents are necessary to support the changes being made. These may include the original tax return, any W-2 forms, 1099s, and documentation for additional deductions or credits claimed. Having all relevant paperwork organized and accessible will facilitate the completion of the Form 1X and ensure that the submission is accurate and complete.

Examples of Using the Wisconsin Amended Tax Form

There are various scenarios in which a taxpayer may need to use the Wisconsin amended tax form. For example, if an individual realizes they omitted a significant deduction after filing their original return, they can submit the Form 1X to claim that deduction. Another common scenario is when a taxpayer receives corrected income statements, such as a revised W-2, which necessitates adjustments to the reported income. These examples highlight the importance of the Form 1X in maintaining accurate tax records and ensuring compliance with state tax regulations.

Quick guide on how to complete wi form amended

Accomplish Wi Form Amended effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Wi Form Amended on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Wi Form Amended without hassle

- Obtain Wi Form Amended and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then hit the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from any device you prefer. Edit and eSign Wi Form Amended and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi form amended

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is a Wisconsin amended return form?

The Wisconsin amended return form is used to revise a previously filed tax return. If you discover errors or need to update information such as income or deductions, this form allows you to correct those details. By filing the Wisconsin amended return form, you ensure compliance and avoid issues with the tax authorities.

-

How do I file a Wisconsin amended return form?

You can file a Wisconsin amended return form electronically using eSignature solutions like airSlate SignNow. This user-friendly platform streamlines the process, allowing you to fill out, sign, and submit your amended return with ease. Following the instructions carefully ensures your form is processed without delays.

-

What are the benefits of using airSlate SignNow for my Wisconsin amended return form?

airSlate SignNow provides a seamless way to manage your Wisconsin amended return form. It enhances efficiency with features like templates, cloud storage, and secure eSigning. Moreover, it saves time and minimizes errors, giving you peace of mind when making amendments to your tax returns.

-

Is airSlate SignNow affordable for filing Wisconsin amended return forms?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for individuals and businesses alike. With tiered options, you can choose a plan that fits your needs while ensuring you can efficiently handle your Wisconsin amended return forms. This pricing flexibility makes it an ideal choice for budget-conscious users.

-

Can I integrate airSlate SignNow with other tools for filing my Wisconsin amended return form?

Absolutely! airSlate SignNow integrates with a variety of applications, enhancing your workflow for filing Wisconsin amended return forms. By connecting with platforms like Google Drive, Dropbox, and others, you can easily store and share documents. This integration makes managing your returns simpler and more efficient.

-

What features does airSlate SignNow offer for the Wisconsin amended return form?

airSlate SignNow provides a range of features tailored for filing Wisconsin amended return forms, including customizable templates and secure eSignature options. It also allows you to track document status and send reminders, ensuring timely submission. These features collectively simplify the amendment process.

-

How does airSlate SignNow ensure the security of the Wisconsin amended return form?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption technologies to protect your Wisconsin amended return form and other sensitive documents. By ensuring data integrity and confidentiality, airSlate SignNow offers a trustworthy environment for handling your tax-related documents.

Get more for Wi Form Amended

Find out other Wi Form Amended

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure