Schedule G Form

What is the Schedule G

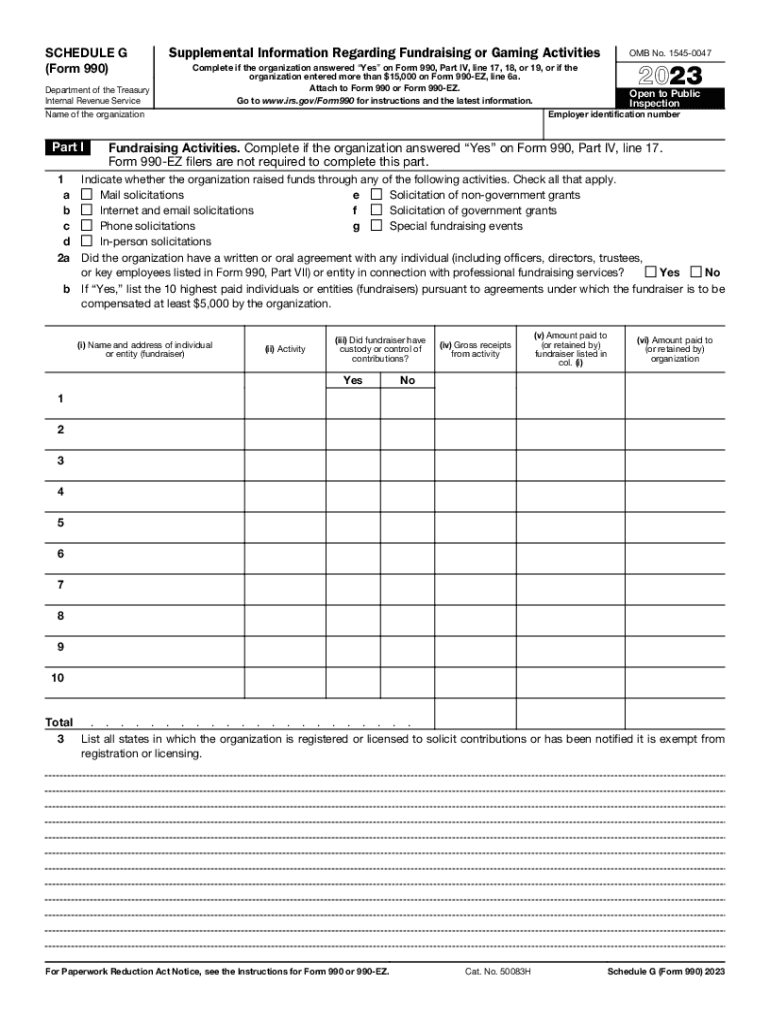

The Schedule G of the IRS Form 990-EZ is a crucial component for organizations that file this form. It is designed to provide detailed information about the organization's professional fundraising services. This schedule helps the IRS and the public understand how much revenue is generated from fundraising activities and the associated expenses. By filling out Schedule G, organizations can ensure transparency in their financial reporting, which is essential for maintaining public trust and compliance with federal regulations.

How to use the Schedule G

Using Schedule G involves accurately reporting the organization's fundraising activities. This includes detailing the total revenue generated from fundraising events and the expenses incurred in these activities. Organizations must list each fundraising event separately, providing information such as the event name, date, and the amount raised. Additionally, organizations should disclose any professional fundraising services used and the fees paid to these services. This information is vital for the IRS to assess the effectiveness of the fundraising efforts and ensure compliance with tax regulations.

Steps to complete the Schedule G

Completing Schedule G requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial data related to fundraising activities for the tax year.

- List each fundraising event, including the name, date, and total revenue generated.

- Document all expenses associated with each fundraising event, including any fees paid to professional fundraisers.

- Calculate the net revenue from fundraising activities by subtracting expenses from total revenue.

- Ensure all information is accurate and complete before submitting the form.

Legal use of the Schedule G

The legal use of Schedule G is mandated by the IRS for organizations that meet specific criteria. Nonprofit organizations that engage in fundraising activities must complete this schedule to comply with federal tax laws. Failure to accurately report fundraising activities can lead to penalties, including fines and loss of tax-exempt status. Therefore, it is essential for organizations to understand their legal obligations regarding the completion and submission of Schedule G.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for IRS Form 990-EZ and its associated schedules, including Schedule G. Typically, the deadline for filing is the 15th day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can apply for an extension if needed, but it is crucial to adhere to these deadlines to avoid penalties.

Required Documents

To complete Schedule G, organizations need to gather several documents, including:

- Financial statements detailing fundraising revenue and expenses.

- Records of all fundraising events conducted during the tax year.

- Contracts or agreements with professional fundraisers, if applicable.

- Any correspondence with the IRS related to fundraising activities.

Penalties for Non-Compliance

Non-compliance with the requirements for Schedule G can result in significant penalties for organizations. These may include monetary fines, increased scrutiny from the IRS, and potential loss of tax-exempt status. It is essential for organizations to ensure that they accurately complete and file Schedule G to avoid these consequences. Regular training and updates on IRS requirements can help organizations stay compliant.

Quick guide on how to complete schedule g

Effortlessly prepare Schedule G on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Schedule G on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Schedule G with ease

- Obtain Schedule G and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Alter and eSign Schedule G and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the IRS Form 990 EZ Schedule G?

The IRS Form 990 EZ Schedule G is used to report professional fundraising services and activities conducted by tax-exempt organizations. This schedule helps the IRS understand how organizations raise funds and ensure compliance with regulations. Accurately completing this form is essential to maintain your nonprofit's tax-exempt status, and using airSlate SignNow can simplify the e-signing process.

-

How can airSlate SignNow assist with IRS Form 990 EZ Schedule G?

AirSlate SignNow provides an easy-to-use platform for signing and managing IRS Form 990 EZ Schedule G. With our solution, organizations can quickly gather signatures and securely store their completed forms. This not only streamlines the process but also helps ensure compliance and enhances organizational efficiency.

-

Is there a cost associated with using airSlate SignNow for IRS Form 990 EZ Schedule G?

Yes, airSlate SignNow offers a cost-effective subscription model that allows users to manage documents like the IRS Form 990 EZ Schedule G. Our pricing plans are designed to cater to various organizational sizes and needs, ensuring that you can access the features required to efficiently handle your documents without breaking the bank.

-

What features does airSlate SignNow offer for managing IRS Form 990 EZ Schedule G?

AirSlate SignNow includes essential features like document templates, eSignature capabilities, and secure cloud storage. This helps organizations effectively manage IRS Form 990 EZ Schedule G by simplifying the signing process and ensuring that all necessary documents are easily accessible. Additionally, our platform supports real-time tracking of signed documents to enhance transparency.

-

How does airSlate SignNow ensure the security of IRS Form 990 EZ Schedule G?

We prioritize document security at airSlate SignNow, employing advanced encryption measures to protect your IRS Form 990 EZ Schedule G. Our platform adheres to industry standards for privacy and data protection, ensuring that your sensitive information remains secure. Moreover, we offer an audit trail for all transactions to further enhance accountability.

-

Can I integrate airSlate SignNow with other software for IRS Form 990 EZ Schedule G?

Absolutely! AirSlate SignNow offers seamless integrations with various tools and platforms to enhance your workflow when managing IRS Form 990 EZ Schedule G. Whether you use accounting software or CRM systems, our integrations help streamline your processes and ensure that all your documents are organized and easily accessible.

-

What benefits does using airSlate SignNow provide for nonprofits filing IRS Form 990 EZ Schedule G?

By leveraging airSlate SignNow, nonprofits can save time and reduce paperwork when filing IRS Form 990 EZ Schedule G. Our user-friendly eSigning solution minimizes delays in document approvals and enhances collaboration. Additionally, our platform helps maintain compliance with IRS regulations, ensuring peace of mind for your organization's fundraising efforts.

Get more for Schedule G

Find out other Schedule G

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document