Vat Return Form PDF

What is the VAT Return Form PDF

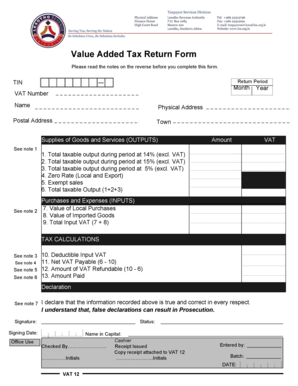

The VAT Return Form PDF is a crucial document used by businesses to report their value-added tax (VAT) obligations to the Internal Revenue Service (IRS). This form allows taxpayers to detail their sales, purchases, and the VAT they have collected and paid. The information provided helps determine the net VAT due or refundable. Understanding the VAT return is essential for compliance with tax regulations and maintaining accurate financial records.

How to Use the VAT Return Form PDF

Using the VAT Return Form PDF involves several steps to ensure accurate reporting. First, download the form from a reliable source. Next, gather all necessary financial information, including sales records, purchase invoices, and any previous VAT returns. Fill out the form by entering the required details in the designated fields. After completing the form, review it for accuracy before submitting it to the IRS. Utilizing digital tools can streamline this process, making it easier to fill out and sign the document electronically.

Steps to Complete the VAT Return Form PDF

Completing the VAT Return Form PDF involves a systematic approach:

- Download the latest version of the VAT Return Form PDF.

- Collect all relevant financial documents, such as invoices and receipts.

- Fill in your business information, including name, address, and tax identification number.

- Report your total sales and purchases, ensuring to include any exempt transactions.

- Calculate the VAT collected and the VAT paid on purchases.

- Determine the net VAT amount due or refundable.

- Review all entries for accuracy before saving the completed form.

Legal Use of the VAT Return Form PDF

The VAT Return Form PDF holds legal significance as it serves as an official record of a business's tax obligations. To ensure its validity, it must be completed accurately and submitted within the designated deadlines set by the IRS. Compliance with eSignature laws is essential when submitting the form electronically. Utilizing a trusted digital signature platform can provide the necessary authentication and ensure that the form meets legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the VAT Return Form PDF are critical to avoid penalties. Typically, businesses must submit their VAT returns quarterly or annually, depending on their revenue and filing status. It is essential to keep track of these deadlines to ensure timely submission. Missing a deadline can result in fines and interest on unpaid taxes, impacting the overall financial health of the business.

Examples of Using the VAT Return Form PDF

Examples of using the VAT Return Form PDF include various business scenarios. For instance, a small retail business may use the form to report VAT collected from sales and VAT paid on inventory purchases. Similarly, a service-based company can utilize the form to declare VAT on service fees charged to clients. Each example illustrates the importance of accurately reporting VAT to maintain compliance and avoid potential tax issues.

Quick guide on how to complete vat return form pdf

Complete Vat Return Form Pdf effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Vat Return Form Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Vat Return Form Pdf without hassle

- Find Vat Return Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Vat Return Form Pdf to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat return form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT return example PDF and how can it be useful?

A VAT return example PDF is a sample document that illustrates how to properly fill out and submit your VAT return. This template is useful for businesses to understand the required information and format needed for compliance. By reviewing a VAT return example PDF, you can ensure your submissions are accurate and timely.

-

How does airSlate SignNow simplify the eSigning of VAT return example PDFs?

airSlate SignNow streamlines the process by allowing you to upload your VAT return example PDF and easily add eSignatures. With our user-friendly platform, you can send, sign, and manage your documents in one place, simplifying compliance and minimizing the risk of errors. This efficiency can save you time and ensure timely submissions.

-

What features does airSlate SignNow offer for managing VAT return example PDFs?

Our platform offers features such as customizable templates, secure cloud storage, and tracking for your VAT return example PDFs. You can create, edit, and share documents easily with team members or clients, ensuring that everyone has access to the most up-to-date versions. Additionally, our integration capabilities allow you to connect with your existing accounting tools.

-

Is airSlate SignNow cost-effective for small businesses handling VAT returns?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses, making it affordable to manage VAT return example PDFs efficiently. With our subscription plans, you can access essential features without breaking the bank. This value ensures your business can stay compliant without incurring excessive costs.

-

Can I import my existing VAT return example PDFs into airSlate SignNow?

Absolutely! airSlate SignNow allows users to import their existing VAT return example PDFs directly into our platform. This feature makes it easy to transition to our solution without starting from scratch, saving you time as you manage your document signing process.

-

How secure is airSlate SignNow for eSigning VAT return example PDFs?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to ensure that your VAT return example PDFs are protected. With features like two-factor authentication and audit trails, you can trust that your sensitive information is safe throughout the signing process.

-

What integrations does airSlate SignNow offer to assist with VAT return processing?

airSlate SignNow seamlessly integrates with popular accounting and productivity tools, enhancing your ability to manage VAT return example PDFs. Whether you're using platforms like QuickBooks or Salesforce, our integrations allow for a smooth workflow and ensure your documents are aligned with your overall financial processes.

Get more for Vat Return Form Pdf

Find out other Vat Return Form Pdf

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe