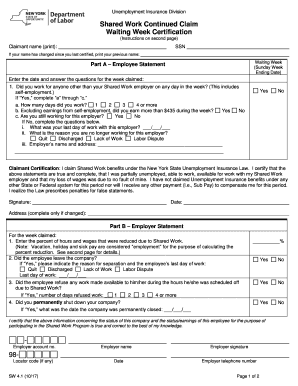

Form Sw4 1 Nys 2017-2026

Understanding the Continued Claim Certification Form

The continued claim certification form online SDI is a critical document for individuals receiving disability benefits in California. This form is used to certify ongoing eligibility for benefits under the State Disability Insurance (SDI) program. It ensures that recipients continue to meet the necessary criteria for receiving financial support during their recovery period. Understanding this form is essential for maintaining uninterrupted benefits.

Steps to Complete the Continued Claim Certification Form

Completing the continued claim certification form involves several straightforward steps:

- Access the form through the official EDD website or designated online portal.

- Fill in your personal information, including your name, Social Security number, and contact details.

- Provide information regarding your current medical condition and any treatments you are undergoing.

- Indicate whether you are able to work and any job-search activities you have engaged in.

- Review your entries for accuracy before submitting the form.

Ensuring all information is accurate is crucial for avoiding delays in benefit payments.

Eligibility Criteria for Continued Claim Certification

To qualify for continued claim certification, applicants must meet specific eligibility criteria, including:

- Being currently enrolled in the SDI program.

- Experiencing a medical condition that prevents them from working.

- Submitting the certification form on time to avoid lapses in benefits.

It is important to regularly check for updates to eligibility requirements, as these can change based on state regulations.

Form Submission Methods

The continued claim certification form can be submitted through various methods to enhance accessibility:

- Online submission via the EDD's secure website.

- Mailing a printed version of the completed form to the appropriate EDD address.

- In-person submission at designated EDD offices, if necessary.

Choosing the online submission method is often the fastest and most efficient way to ensure timely processing.

Required Documents for Submission

When completing the continued claim certification form, certain documents may be required to support your claim. These can include:

- Medical documentation from your healthcare provider.

- Proof of identity, such as a driver's license or state ID.

- Any previous claim forms or correspondence from the EDD.

Having these documents ready can streamline the submission process and help avoid potential delays.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for maintaining your benefits. The EDD typically provides specific dates for submitting the continued claim certification form, which may vary based on your initial claim date. Missing these deadlines can result in a loss of benefits, so it is advisable to mark these dates on your calendar and submit your forms promptly.

Quick guide on how to complete form sw4 1 nys

Effortlessly Prepare Form Sw4 1 Nys on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form Sw4 1 Nys on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Modify and eSign Form Sw4 1 Nys with Ease

- Find Form Sw4 1 Nys and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Form Sw4 1 Nys and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form sw4 1 nys

Create this form in 5 minutes!

How to create an eSignature for the form sw4 1 nys

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a continued claim certification form online SDI?

A continued claim certification form online SDI is a crucial document used for filing continued claims for State Disability Insurance benefits. It certifies your ongoing eligibility for benefits due to a qualifying condition. With airSlate SignNow, you can complete and submit this form quickly and easily online.

-

How can I fill out the continued claim certification form online SDI using airSlate SignNow?

Filling out the continued claim certification form online SDI using airSlate SignNow is straightforward. Simply upload your form to our platform, and use our intuitive editing tools to complete the necessary fields. Once done, you can eSign and submit the form directly from the platform.

-

What features does airSlate SignNow offer for handling the continued claim certification form online SDI?

airSlate SignNow provides a range of features for handling the continued claim certification form online SDI, including real-time collaboration, customizable templates, and secure eSigning. These tools ensure that you can manage your claim efficiently and with complete security.

-

Are there any costs associated with submitting the continued claim certification form online SDI?

While airSlate SignNow offers various pricing plans, submitting the continued claim certification form online SDI typically incurs no additional fees if you subscribe to our service. Our plans are designed to be cost-effective, providing great value for businesses looking to streamline their documentation processes.

-

What are the benefits of using airSlate SignNow for the continued claim certification form online SDI?

Using airSlate SignNow for the continued claim certification form online SDI provides signNow benefits, including time savings and increased accuracy. Our platform simplifies the submission process, allowing you to focus on your recovery while ensuring your forms are submitted correctly.

-

Can I integrate airSlate SignNow with other tools for managing continued claims?

Yes, airSlate SignNow offers several integrations with popular business tools and applications, which can enhance your management of the continued claim certification form online SDI. This flexibility allows you to streamline your workflow and maintain organized records across your systems.

-

Is my data safe when using airSlate SignNow for my continued claim certification form online SDI?

Absolutely! airSlate SignNow prioritizes the security of your data. We use industry-standard encryption and comply with relevant regulations, ensuring that your continued claim certification form online SDI and any associated personal information are kept secure and confidential.

Get more for Form Sw4 1 Nys

- Claim for one sum payment government life insurance form

- Va form 40 10007 fill out ampamp sign online

- Va form 22 5490 dependents application for

- Community college of rhode island home page form

- Fafsa signature sheet institutional student information

- 20222023financial aid officeidentity and statement form

- Apply for or renew a blue badge online form

- Get the esrs employer enrollment form pdffiller

Find out other Form Sw4 1 Nys

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe