Insurance Contract Defined Form

What is the Insurance Contract Defined

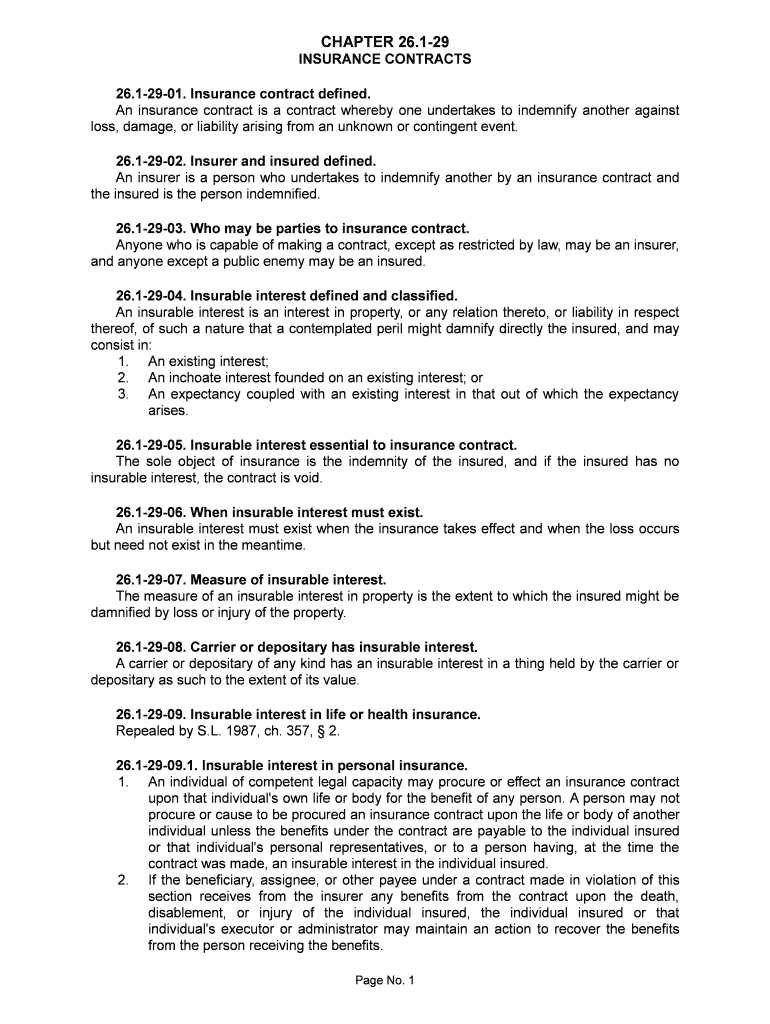

An insurance contract is a legally binding agreement between an insurer and an insured party. This contract outlines the terms under which the insurer agrees to provide financial protection against specific risks in exchange for premium payments from the insured. Key components of this contract include the coverage details, premium amounts, deductibles, and the duration of the policy. Understanding the specifics of the insurance contract is crucial for policyholders to ensure they receive the intended benefits when needed.

Key Elements of the Insurance Contract Defined

Several essential elements constitute an insurance contract, including:

- Offer and Acceptance: The insurer offers coverage, and the insured accepts the terms, forming the basis of the agreement.

- Consideration: This refers to the premium paid by the insured in exchange for the coverage provided by the insurer.

- Insurable Interest: The insured must have a legitimate interest in the subject of the insurance, ensuring that the contract is valid.

- Conditions: Specific conditions must be met for the contract to be enforceable, including the duties of both parties in the event of a claim.

- Exclusions: These are specific situations or conditions that are not covered by the policy, which the insured should be aware of.

How to Use the Insurance Contract Defined

Using an insurance contract effectively involves understanding its terms and conditions. Policyholders should:

- Review the coverage details to know what risks are covered.

- Understand the claims process outlined in the contract.

- Keep a copy of the contract accessible for reference during the policy period.

- Contact the insurer for clarification on any terms that are unclear.

Legal Use of the Insurance Contract Defined

The insurance contract is governed by state laws, which vary across the United States. It is essential for both parties to adhere to these legal standards to ensure the contract is enforceable. This includes compliance with regulations regarding disclosures, fair practices, and the handling of claims. Understanding the legal implications of the contract can help prevent disputes and ensure that both parties fulfill their obligations.

Steps to Complete the Insurance Contract Defined

Completing an insurance contract typically involves several steps:

- Application: The insured fills out an application form, providing necessary personal and financial information.

- Underwriting: The insurer assesses the risk associated with the application to determine the premium and coverage options.

- Review: The insured reviews the proposed terms and conditions before finalizing the contract.

- Payment: The insured makes the initial premium payment to activate the policy.

- Documentation: Both parties retain copies of the signed contract for their records.

Examples of Using the Insurance Contract Defined

Examples of common scenarios involving insurance contracts include:

- Homeowners insurance, which protects against damages to property and personal belongings.

- Auto insurance, covering liability and damages resulting from vehicle accidents.

- Health insurance, which provides coverage for medical expenses and treatments.

- Life insurance, ensuring financial support for beneficiaries upon the policyholder's death.

Quick guide on how to complete insurance contract defined

Effortlessly complete [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files quickly and without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the files or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Insurance Contract Defined

Create this form in 5 minutes!

How to create an eSignature for the insurance contract defined

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance contract defined?

An insurance contract defined is a legal agreement between an insurer and the insured, outlining the terms of coverage, rights, and responsibilities. This contract serves to protect the policyholder against specific risks in exchange for premium payments. Understanding an insurance contract defined is crucial for anyone looking to navigate insurance policies effectively.

-

How does airSlate SignNow facilitate the signing of insurance contracts?

AirSlate SignNow allows users to send and eSign insurance contracts seamlessly, streamlining the contract management process. The platform provides a secure and compliant way to handle sensitive documents, ensuring both parties can sign from any device. By simplifying the eSigning process, airSlate SignNow helps businesses manage their insurance contracts more efficiently.

-

What features does airSlate SignNow offer for managing insurance contracts?

AirSlate SignNow offers features such as automated reminders, customizable templates, and robust tracking capabilities for managing insurance contracts. These tools help businesses save time and reduce errors during the contract signing process. With airSlate SignNow, you can easily create and manage insurance contracts defined according to your specific needs.

-

What are the benefits of using airSlate SignNow for insurance contracts?

Using airSlate SignNow for insurance contracts provides numerous benefits, including enhanced security, improved efficiency, and reduced turnaround times. You can protect sensitive information while expediting the signing process. Ultimately, airSlate SignNow simplifies the complexity of an insurance contract defined, making it easy for businesses to manage their contract needs.

-

Is airSlate SignNow cost-effective for small businesses dealing with insurance contracts?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their insurance contracts efficiently. With flexible pricing plans tailored to different business needs, it provides essential features without breaking the bank. Small businesses can achieve a professional edge when handling insurance contracts defined with airSlate SignNow.

-

How does airSlate SignNow integrate with other platforms for insurance contract management?

AirSlate SignNow offers seamless integrations with popular platforms, facilitating better management of insurance contracts. Whether you use CRM systems or other document management solutions, integrating airSlate SignNow ensures that your workflows remain synchronized. This flexibility enhances the overall efficiency of handling insurance contracts defined.

-

Can I customize insurance contract templates using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize insurance contract templates to fit your specific requirements. You can modify the language, terms, and sections of each template, ensuring they are tailored to your business's needs. Customizing insurance contracts defined helps you present a professional image while protecting your interests.

Get more for Insurance Contract Defined

Find out other Insurance Contract Defined

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed