Sf 3106 2013-2026

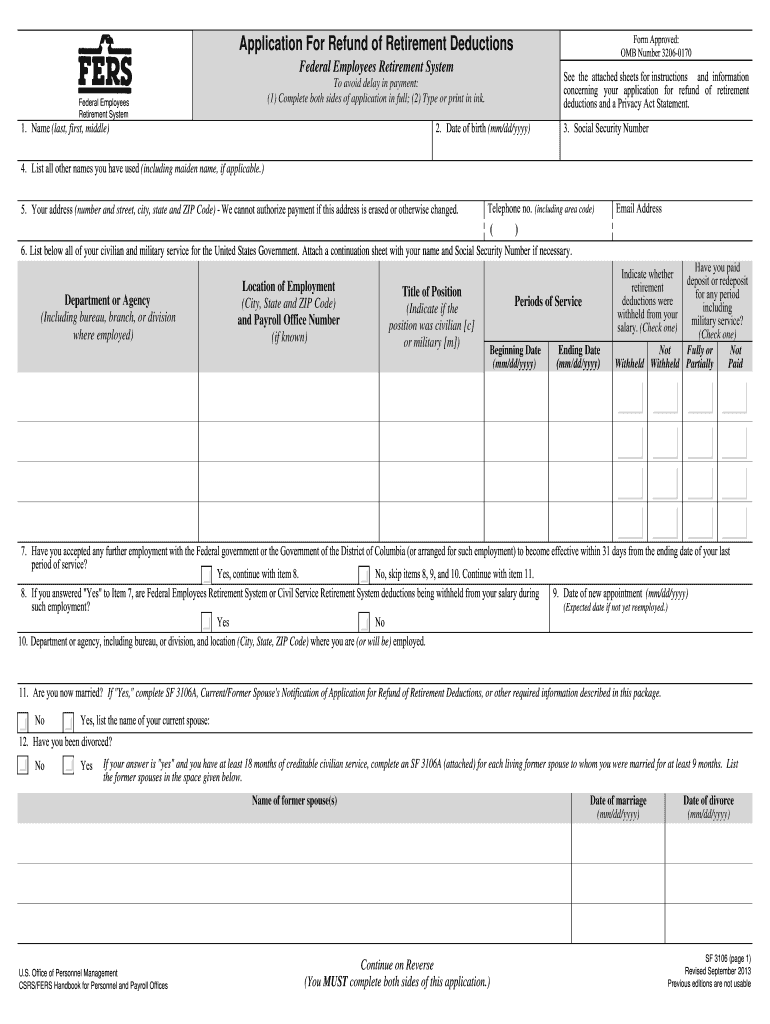

What is the SF 3106?

The SF 3106, also known as the Standard Form 3106, is a form used by federal employees to apply for a refund of their retirement contributions. This form is essential for those who have separated from federal service and wish to withdraw their contributions from the Federal Employees Retirement System (FERS). It is a critical document for ensuring that former employees can access their retirement savings efficiently.

How to Use the SF 3106

The SF 3106 is primarily used to initiate the process of withdrawing retirement contributions. To use the form, individuals must complete all required sections accurately. This includes providing personal information, employment details, and the reason for separation from federal service. Once completed, the form should be submitted to the appropriate retirement office for processing. It is important to ensure that all information is correct to avoid delays in processing.

Steps to Complete the SF 3106

Completing the SF 3106 involves several key steps:

- Gather necessary personal information, including your Social Security number and employment history.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your retirement office, either online or by mail, as per the guidelines provided.

Legal Use of the SF 3106

The SF 3106 is legally binding once completed and submitted. It is crucial to provide accurate information, as submitting false details can lead to legal repercussions, including potential fraud charges. The form must be used in compliance with federal regulations regarding retirement withdrawals. Understanding the legal implications ensures that former employees protect their rights and benefits.

Eligibility Criteria for the SF 3106

To be eligible to use the SF 3106, individuals must have been a participant in the FERS and must have separated from federal service. Additionally, they should not have transferred their retirement contributions to another retirement system. Understanding these criteria is essential for ensuring that the form is applicable to your situation.

Form Submission Methods

The SF 3106 can be submitted through various methods, including:

- Online submission via the designated retirement office portal.

- Mailing the completed form to the appropriate retirement office.

- In-person submission at a federal agency's human resources or retirement office.

Choosing the right submission method can help expedite the processing of your request.

Quick guide on how to complete to avoid delay in payment

An uncomplicated manual on how to create Sf 3106

Submitting digital documents has shown to be more efficient and secure compared to conventional pen-and-paper techniques. Unlike physically writing on paper, making an error or entering data in the wrong section is simple to amend. These errors can be a signNow hindrance when preparing applications and petitions. Consider utilizing airSlate SignNow for finalizing your Sf 3106. Our robust, user-friendly, and compliant electronic signature platform will simplify this process for you.

Follow our instructions on how to swiftly complete and sign your Sf 3106 with airSlate SignNow:

- Verify your chosen document’s purpose to ensure it meets your needs, and click Get Form if it aligns with your requirements.

- Find your template uploaded to our editor and explore the features our tool provides for editing forms.

- Fill in the empty fields with your information and select options using Check or Cross.

- Insert Text boxes, replace existing content, and add Images wherever needed.

- Utilize the Highlight function to emphasize what you want to draw attention to, and conceal irrelevant information from your recipient using the Blackout feature.

- In the right-side panel, create extra fillable fields allocated to specific individuals if necessary.

- Secure your document with watermarks or set a password upon completing the editing process.

- Insert Date, click Sign → Add signature and choose your signature method.

- Sketch, type, upload, or generate your legally binding electronic signature with a QR code or use the camera on your device.

- Review your responses and click Done to finalize editing and move on to sharing the form.

Utilize airSlate SignNow to create your Sf 3106 and handle other professional fillable templates securely and efficiently. Register today!

Create this form in 5 minutes or less

Find and fill out the correct to avoid delay in payment

FAQs

-

What would you do if a perfect stranger stopped by your house, gave you a bag containing a million dollars, said to you, "Take it, it's yours", and then walked away?

Did you know that a million dollars in U.S. currency weighs just ten kilograms? It's true. A freshly-minted $100 bill weighs in at slightly over a gram, and 100 of them is ten thousand dollars. 100 of those stacks, and there's your million.It’s not often that 10 kilograms - 22 lbs of anything can change your life. But on February 25th, 2014, that’s exactly what happened. Day 1: $1,000,000 As the man in the gray suit walks away, I shout after him “Hey, come back here. Who are you? What’s this all about?” He does not look back and quickens his pace. Between the choice of chasing down a stranger, or securing what appeared to be stacks of currency, I chose the currency. We can resolve the issue of his identity later, but a loose sack of cash is, well, a loose sack of cash. I look through the contents again. Bundles of US$100 bills, stacked a hundred bills deep, wrapped in standard $10,000 bank bands. A quick count revealed that there were precisely a hundred of those stacks in the bag, and spot-check riffle-counts of the $10k bands suggest that there are no short-stacks within. These were full bands of $10,000 apiece of non sequential USD$100 bills, and I was holding what appears to be a million even in cash. And it feels like just as many question are swirling in my head, as I feel my pulse pounding in my skull. Who was that guy? Why me? What is this all about? But the most urgent thoughts swim past the dizzying deluge of unanswerable questions. Fakes. It’s one thing to inadvertently be the recipient of counterfeit currency; as you’re reading this very sentence, a clerk at a retail store somewhere in your city just accepted a counterfeit bill and made change from the real money in the till. But to be in possession of a life-changing amount of counterfeit currency of the United States of America? Well, that’s sort of thing that can bring the full might and wrath of their law enforcement apparatus on your head. My emotions swing wildly between the elation of instantaneous wealth, and sheer terror that I was minutes away from being snatched from my home and corralled into a Federal holding cell, where I will grow old within its walls. Terror was the stronger of the two emotions, and I quickly went to work. First things first: the bag had to go. If there is a GPS tracking device embedded in its seams, it would take too long for me to root it out. Better to incinerate it, and make sure that whatever trail it was laying stops at a dead-end for its pursuers. I pour the stacks of bills into an empty duffle back from my garage, and lock the bag in my condo. There’s an abandoned marina just a mile from my home and I get in my car and drive straight to the docks, at the top of the posted speed limit. After pouring enough Kerosene on the bag to see the shimmering mist of petroleum evaporate above it, I lit a book of matches and threw it in the middle of the mass. A satisfying “Whoomph” lights up the fire, and I watch the edges of the bag curl and burn - sizzling in the midmorning sun. As the remnants of the bag’s embers swirl around the scorched mark on the docks, I drive back to my condo, pulse still pounding in my skull.I still haven’t figured out if the bills are real or not, but if this morning’s bag-drop was an attempt to pin a piece of deeply incriminating evidence bearing a tracking device … well that plan has been thwarted. Or delayed, at the very least. What do I do? What should I do? Call the authorities? Consider how it would sound: “Hi, Police? Somebody dropped a million dollars in cash at my home. I don’t know if it’s fake or not. Please help.” Would you believe such a ridiculous story? I wouldn't. Any reasonable law enforcement dispatcher would consider the caller legally insane, and I'd be arrested on the spot and sent to psychiatric care. If the money was real, it’d be seized and I'll never see it or spend it. If it was fake, they’d find a way to stick “possession of counterfeit currency” charge on me, and I'll be shoved into a Federal concrete box, draining the best years of my life away, only to be released when I can’t chew solid food any more. No. The only recourse is to handle this myself. I call an old college friend practicing criminal defense law in New York City: “Hey Roger, it’s Kai. How’ve you been?” “I'm cool. It's been a while. What’s up man.” “We should catch up soon in person. But I’m calling because I need something.” “Ok, shoot.” I swallow hard - it’s difficult to even say the words: “Who’s the best CrimDef lawyer you know in California, who defends against Federal charges?” A moment. His voice lowers noticeably. “Shit, man. You in some kind of trouble?” “I’m not sure yet.” I said, truthfully. “But I need someone experienced and smart ... someone who you’d hire, if you’re facing serious attention from the Feds." He lets out a long exhale. “Vincent King. Former rockstar DOJ prosecutor in D.C. Had a change of heart halfway through his rotation in Maryland, when he was securing Life sentences for “interstate drug transportation” charges on young Black kids who were busted muling for the cartels. Was offered a fast-track promotion straight to the U.S. Attorney’s office but went rogue. He set up independent shop in San Francisco, fighting Fed cases. Heavy hitter clients, but makes a point of refusing to represent anyone accused of murder or human trafficking. Intimate knowledge of Federal prosecutorial procedures and evidence-collection protocol. Smart. Methodical. Very expensive.” “Perfect.” “I did mention ‘very expensive?’” “You did.” “I’ll send his contact information now.” =================================“I’m sorry - Mr. King is in court all day and won’t be back in the office. His earliest appointment is tomorrow morning after a client meeting. Shall I book him for 11am for you?” “Yes, thank you Marta.” “We’ll see you tomorrow at 11 then.” I look at the digital clock in my kitchen - it reads 10:44am. Just me and a stack of bills which may or may not be fake, no formal legal representation for over 24 hours. It’s going to be a long day. Taking even a few of these bills to a bank to corroborate their authenticity is out of the question. If a bank officer confirms they are fraudulent, I’ll be arrested on the spot, and since I haven’t hired counsel, I’d be at the mercy of the Public Defender’s Office - the most overworked and underpaid division of the American Criminal Justice system. No, thank you. The next number I dial is an old friend, Robert Kendrick, sole proprietor of ‘Secher Nbiw - The Golden Path,’ a gold bullion dealer with a whimsical Dune reference in the name of his shop. I’ve known Robert for over a decade; his business deals in large amounts of (mostly) legal cash. By necessity, he has a high-end currency counter/ counterfeit detection device in his office, which can swiftly count and verify large sums of money with precision. “Bobby, it’s me.” “Hey, what’s up.” “Can I come to your office - like right now?” “Sure, what do you need?” “I, uh, came into some money. Long story, and I really don’t want to get too much into the details … but I’m wondering if you’d be willing to run the bills through your counter for me? I’m not 100% sure they’re real, and I’d like a discreet way of verifying them. If they are, I’m going to pick up some bullion as well.” “Sure man. Happy to help. How much money are we talking about?”“$60,000” I flinch at that - I hate lying to friends, but at this point, I have no idea who to trust. Though if you want to be technical about it, I did come across $60,000. I am just simply not telling Kendrick about the other $940,000 that accompanied the $60k in the satchel that dropped into my life just three hours ago. “Come on by.” I pull apart a few $10,000 currency bands and start plucking random $100 bills from the middle of every 10k stack to assemble a randomized sample of the entire million. 100 bills, wrap it up. 100 bills, wrap it up. 100 bills, wrap it up. Three bands, thirty thousand dollars, randomized and fully assembled to be tested for authenticity. “Half” of my alleged $60k windfall. The rest of the loose bills are refolded back so there remains 97 stacks of $10k racks, re-wrapped and properly sorted. In 30 minutes, I will figure out if I’m rich, or holding on to enough illicit contraband to send me to Federal Prison for the rest of my life. =============================The Golden Path, like most bullion dealers, work out of small, highly secured office covered by multiple layers of security. At any given moment, Robert may have several hundred thousand dollars in cash or gold, silver and platinum bullion on the premise, it pays to be careful. One of the few civilians in California with a Concealed Carry Weapons permit, Kendrick and I met on pistol gun range ten years ago; we bonded over shooting .45 ACP slugs down-range. He and I spent countless hours debating the relative merits of his preference for single-action 1911s, vs my bias toward double-action SIG-Sauer P220s. In the bullion business, you learn to know the boundaries of money-laundering laws, and know how to walk right up to the edge without triggering reporting thresholds. Drop US$10,000 in cash or more at a car dealership, bank or bullion dealer in a single day’s transaction, and the U.S. authorities gets very interested in the source of your funds. By law, these business that receive such sums of cash must fill out invasive forms to tie the transaction to you and your Social Security Number. Keep cash transactions below US$10,000, and you can avoid much of that intense scrutiny. “Welcome back man. I haven’t seen you in a while.” A discreet man, Kendrick does not inquire further about the source of the cash. In the business of buying and selling gold bullion, you learn to comply with the letter of the law, while avoiding conversational topics that can jeopardize one’s own plausible deniability. While his clientele is mostly legitimate, I’m certain the most lucrative of his customers are criminals - and he smart enough to know not to ask the sort of questions that open up a line of liability for him. So long as the proper theatrics of anti-money-laundering protocols are observed, everyone is technically in the clear. I hand him the three $10k stacks and he pulls the bands off them and puts the entire block in his high-speed currency counter. After a second, the machine spools up and the digital counter swiftly runs from zero to three hundred. Thirty thousand dollars. “It’s real.” It’s real. His words hang in the air for a moment, and it takes a moment for them to sink in. One million dollars. Genuine currency of the United States of America, the most recognized and accepted form of money in the world - denominated in crisp, non-sequential bills. I hold my face as neutral as possible, but my excitement made me slightly dizzy, and I am glad I was sitting down. “What’s the spot price of Gold today?” Kendrick’s eyes drift to his laptop computer, where the current day’s commodities prices were fed to him via a live stream. “$1334 Ask, $1335 Bid.” I nodded my understanding.Precious metals bullion trade in troy ounces, and prices are quoted on a per troy oz basis; depending on the specific type of bullion (bars, coins, make), there are different markups from the quoted price. Depending on the specific form, Gold is typically marked up by USD$20 to $60 over the day’s quoted Bid price, and sells for $5~10 over the Ask. “What do you have in inventory right now for gold?” “The usual. South African Kugerrands. American Eagles. Canadian Maples. Oh, I do have a lovely Credit Suisse 5oz bar that somebody just sold to me, and I’m happy to let it go for $25/oz over spot.” I quickly did the mental math calculation. With the hard-cap spending limit of $10,000 before I trigger any mandatory anti-money-laundering paperwork, $1335/oz works out to about seven troy ounces of bullion I can buy, without forcing Robert to fill out invasive forms about me and my identity. “I’ll take the 5oz Credit Suisse bar, and two American Gold Eagles.” Kendrick pulls out a calculator and taps in the numbers, “So five troy ounces at 25 over spot plus Eagles at $50 over spot works out to nine thousand six hundred and -“ “Take ten grand and keep the change.” I interrupt. “I will be back for more.” He raises his eyebrow, but says nothing. “Thank you. I’ll be right back.” He counts back $20,000 and hands it to me, taking the $10,000 in the back room of his office and returning with the 5oz Swiss bar and two heavy 1oz American Eagles, along with a receipt for US$9675. I pause for a moment and hand him back one of the $10,000 stacks. “I know the limit is $10k in transactions per day. Consider this pre-payment for a purchase tomorrow. Your call, on a mix of anything up that totals up to $9500. Keep the rest for you and Katie.” A barely-perceptible smile flickers across his face, then his face was clear again. “Sure thing.” There’s nothing like the feeling of holding physical gold - the density, color and heft of the metal is like no other substance on earth, and it is no wonder that since its discovery, every culture on Earth treated gold with awe and respect. With 18 hours left before I can understand my legal options, there’s only two things I know for certain: 1. The money is real. 2. At least one person knows exactly where I live, and where the money was dropped off. I need to get mobile. I need to get mobile and off the grid ASAP.... to be continuedIf you'd like to be the first to get updates to this story, please add me kai chang 張敦楷 (kaichang) on Twitter. Part 2 (of 10) is being written right now, will be announced on Twitter. Please follow for updates on the saga of the Quora Millionaire! :D

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Applying for PayPal adaptive payments, how to fill in the form?

Adaptive Accounts: is an API that allows you to provision creation of PayPal accounts through your application. You could collect all the user's profile information, call Adaptive Accounts API to create a PayPal account, and redirect the user to PayPal for them to setup their password and security information. Usually this API is highly vetted since you'll be collecting user's pii information. So unless you really need it don't select. 3rd Party Permissions - Request users grant you permission to make API calls on their behalf.: 3rd party permissions are when you need to do something on behalf of some one else. Collecting payments doesn't need 3rd party permissions since the end user explicitly approves the pre-approval in your case. But if you have a use case for your app to be able to issue refunds on behalf of your sellers, them yes you would need to use the permissions service to obtain approval from your sellers to issue refunds from their accounts.Testing Information: Basically the application review team wants to make sure they can verify the money flow. So if you can provide any information on how they can act both as a seller and also as a buyer that would help. It doesn't need to be in live - sandbox env should be more than enough. I've helped several go through this process - it's actually not that bad. But it could get frustrating when there is lack of complete information. So the more information you provide - presentations, mocks, flows, testing env/app, etc.. the better it would help the app review team understand what you're trying to use payments for. Money Aggregation and laundering are the biggest concerns they watch out for - so the more transparent your money trail is the better and quicker the process would be. Good luck!

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

Create this form in 5 minutes!

How to create an eSignature for the to avoid delay in payment

How to create an electronic signature for your To Avoid Delay In Payment online

How to generate an eSignature for your To Avoid Delay In Payment in Chrome

How to create an electronic signature for putting it on the To Avoid Delay In Payment in Gmail

How to make an electronic signature for the To Avoid Delay In Payment right from your smart phone

How to generate an electronic signature for the To Avoid Delay In Payment on iOS

How to generate an electronic signature for the To Avoid Delay In Payment on Android OS

People also ask

-

What is the sf 3106 form used for?

The sf 3106 form is primarily used for retirement benefits eligibility by federal employees. It provides essential information for the processing of retirement applications, ensuring that all relevant data is captured for a smooth retirement process.

-

How can airSlate SignNow help with filling out the sf 3106?

airSlate SignNow simplifies the process of filling out the sf 3106 form by allowing users to electronically sign and send documents quickly. This platform ensures that your data is securely entered and saved, making the entire experience hassle-free.

-

Is there a cost associated with using airSlate SignNow for sf 3106?

Yes, airSlate SignNow offers subscription plans that cater to different business needs. The cost is competitive and tailored to ensure that you receive a cost-effective solution for handling your sf 3106 and other documents efficiently.

-

What features does airSlate SignNow provide for the sf 3106?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for sf 3106 forms. These functionalities enhance the user experience and improve the turnaround time for important documents.

-

Can I integrate airSlate SignNow with other applications for processing sf 3106?

Absolutely! airSlate SignNow offers seamless integrations with various applications that help in managing your sf 3106 and other document workflows. This ensures that you can streamline your processes without disrupting your existing systems.

-

What are the benefits of using airSlate SignNow for the sf 3106 form?

Using airSlate SignNow for your sf 3106 form brings signNow benefits, including time savings, enhanced security, and improved collaboration. The platform is designed to simplify document management, thus expediting your retirement application process.

-

Is it easy to navigate the airSlate SignNow platform for the sf 3106?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for users to navigate and manage their sf 3106 forms. The intuitive interface helps users complete their tasks quickly without requiring technical expertise.

Get more for Sf 3106

- New york general power of attorney for care and custody of child or children form

- Client forms gen contr

- Justice for all poster printable form

- Dqa memo 10 020 form

- Release of information 16093227

- Bmo bank statement template form

- Form 9400 060 fish stocking permit application

- Employee bond agreement template form

Find out other Sf 3106

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure