Form 8916 Rev 12 Reconciliation of Schedule M 3 Taxable Income with Tax Return Taxable Income for Mixed Groups

Understanding Form 8916 Rev 12

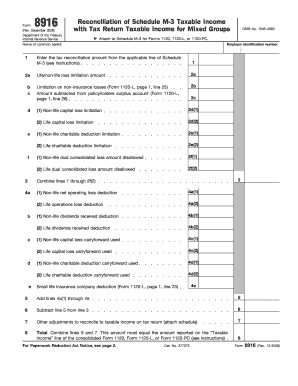

Form 8916 Rev 12, titled "Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups," is a crucial document for corporations that are part of a mixed group of entities. This form is used to reconcile differences between the taxable income reported on Schedule M-3 and the taxable income reported on the corporate tax return. It is particularly relevant for entities that must comply with complex tax regulations, ensuring that accurate income reporting aligns with IRS requirements.

How to Use Form 8916 Rev 12

To effectively use Form 8916 Rev 12, taxpayers should first gather all relevant financial data, including income statements and tax returns. This form requires detailed information about the corporation's income and deductions, as well as adjustments made in Schedule M-3. After completing the form, it must be submitted along with the corporate tax return to ensure compliance with IRS regulations. Proper completion of this form helps in mitigating potential tax discrepancies and penalties.

Steps to Complete Form 8916 Rev 12

Completing Form 8916 Rev 12 involves several key steps:

- Gather all necessary financial documents, including previous tax returns and Schedule M-3.

- Review the instructions provided with the form to understand the required information.

- Fill out the form, ensuring that all income and deduction figures are accurate and consistent with Schedule M-3.

- Double-check calculations to avoid errors that could lead to penalties.

- Attach Form 8916 Rev 12 to the corporate tax return before submission.

Key Elements of Form 8916 Rev 12

Form 8916 Rev 12 includes several important sections that taxpayers must complete:

- Entity Information: Basic details about the corporation, including name, address, and Employer Identification Number (EIN).

- Income Reconciliation: A detailed reconciliation of taxable income as reported on Schedule M-3 and the tax return.

- Adjustments: Any adjustments made to reconcile differences in reported income.

- Signatures: Required signatures of authorized representatives to validate the form.

Legal Use of Form 8916 Rev 12

The legal use of Form 8916 Rev 12 is essential for compliance with IRS regulations. Corporations that fail to file this form when required may face penalties, including fines and increased scrutiny from tax authorities. It is important for mixed groups to understand their filing obligations to avoid legal complications. Proper use of this form also supports transparency in financial reporting, which is beneficial for both the corporation and the IRS.

Filing Deadlines for Form 8916 Rev 12

Form 8916 Rev 12 must be filed according to the deadlines set by the IRS for corporate tax returns. Typically, this means it should be submitted by the due date of the corporate tax return, which is generally the fifteenth day of the fourth month following the end of the corporation's tax year. Extensions may be available, but it is crucial to check IRS guidelines to ensure compliance and avoid penalties for late filing.

Quick guide on how to complete form 8916 rev 12 reconciliation of schedule m 3 taxable income with tax return taxable income for mixed groups

Complete [SKS] effortlessly on any gadget

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important segments of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups

Create this form in 5 minutes!

How to create an eSignature for the form 8916 rev 12 reconciliation of schedule m 3 taxable income with tax return taxable income for mixed groups

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups?

Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups is a tax form used to reconcile differences in taxable income between financial statements and tax returns for mixed groups. This form ensures compliance with IRS regulations and aids in accurately reporting income. Understanding this reconciliation is essential for businesses to avoid penalties.

-

How can airSlate SignNow help with the preparation of Form 8916 Rev 12?

airSlate SignNow simplifies the process of eSigning and sending documents related to the preparation of Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups. Our platform allows for seamless collaboration and document management, ensuring timely submissions. With its user-friendly interface, businesses can efficiently handle their tax documentation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses of all sizes. By providing affordable packages, including options for small teams and larger organizations, you can choose a plan that fits your needs while ensuring compliance with the Form 8916 Rev 12 requirements. Each plan includes essential features to streamline your document management workflow.

-

What features does airSlate SignNow offer for eSigning documents?

With airSlate SignNow, users benefit from advanced eSigning features such as customizable templates, secure electronic signatures, and real-time tracking. This makes it easier to manage documents related to Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups. The platform enhances efficiency and ensures you never miss an important document.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, allowing you to streamline processes related to Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups. These integrations enhance data accuracy and simplify workflows. You can connect your existing tools for a more cohesive experience.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and uses advanced encryption to protect all user data. When working with sensitive documents such as Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups, you can trust that your information is safe. We comply with industry standards to ensure the confidentiality and integrity of your documents.

-

How quickly can I get started with airSlate SignNow?

Getting started with airSlate SignNow is quick and easy. Simply sign up for an account, and you can immediately begin preparing and sending documents related to Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups. Our intuitive platform allows you to be operational within minutes.

Get more for Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups

- Bank of america unemployment card az form

- Form xix see rule 78 2 b wage slip in excel 398089386

- Dyslexiaparent information form orenglish non speaking

- Jaiv vividhata project in marathi pdf form

- Td 72 56 form

- Church reimbursement form 331120471

- Foothills hospital dental clinic form

- Examples of form 3160 5

Find out other Form 8916 Rev 12 Reconciliation Of Schedule M 3 Taxable Income With Tax Return Taxable Income For Mixed Groups

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online