2848a Alabama 2018-2026

What is the Alabama Form 2848A?

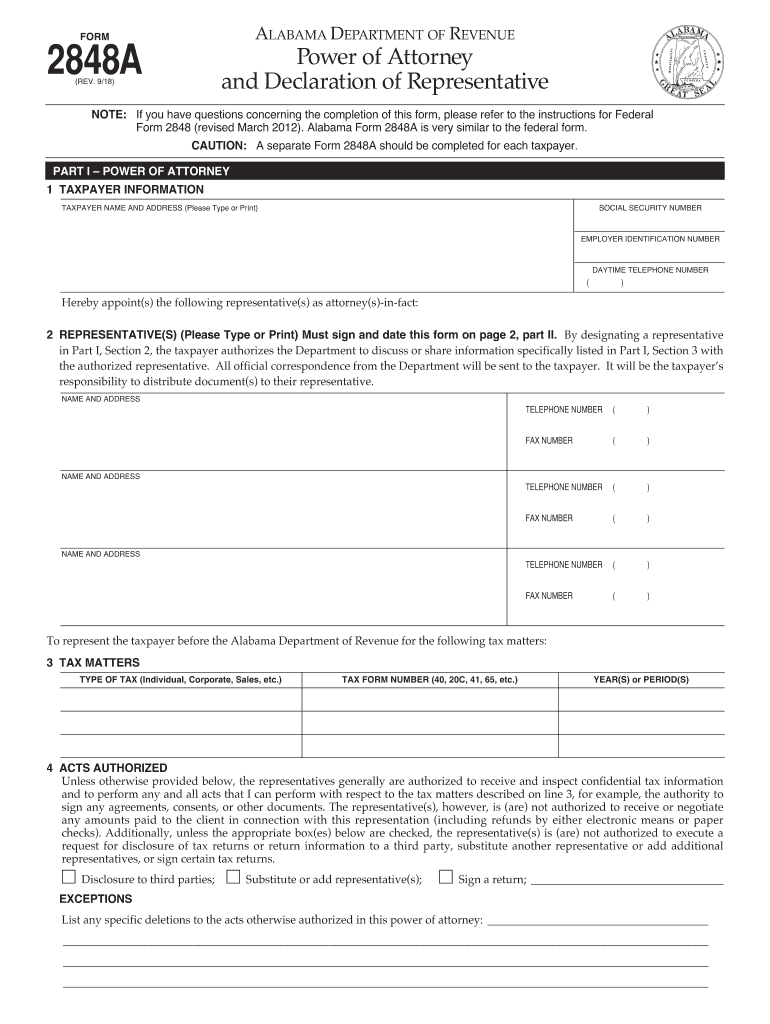

The Alabama Form 2848A is a power of attorney document that allows taxpayers to authorize an individual or entity to represent them before the Alabama Department of Revenue. This form is essential for those who need assistance with tax matters, including filing returns, responding to inquiries, and handling audits. It is specifically designed to grant authority to a representative to act on behalf of the taxpayer in various tax-related situations.

Steps to Complete the Alabama Form 2848A

Completing the Alabama Form 2848A involves several key steps to ensure accuracy and compliance. Begin by providing your personal information, including your name, address, and Social Security number or taxpayer identification number. Next, identify the representative you are appointing by including their name, address, and phone number. It is also important to specify the tax matters for which the representative is authorized to act, such as income tax or sales tax. Finally, both the taxpayer and the representative must sign and date the form to validate it.

Legal Use of the Alabama Form 2848A

The Alabama Form 2848A is legally binding when properly executed. It grants the designated representative the authority to perform specific actions on behalf of the taxpayer, including receiving confidential information and signing documents. It is crucial to ensure that the form is filled out correctly and submitted to the appropriate authority to avoid any legal complications. Understanding the legal implications of this form can help taxpayers navigate their tax obligations more effectively.

How to Obtain the Alabama Form 2848A

The Alabama Form 2848A can be obtained directly from the Alabama Department of Revenue's official website or through local tax offices. It is available in a fillable PDF format, allowing taxpayers to complete the form electronically. Additionally, physical copies can often be found at tax preparation offices and legal resource centers. Ensuring you have the most current version of the form is important for compliance with state regulations.

Form Submission Methods for the Alabama Form 2848A

Once the Alabama Form 2848A is completed, it can be submitted through various methods. Taxpayers have the option to mail the form to the Alabama Department of Revenue or deliver it in person at a local office. Additionally, some forms may be accepted electronically, depending on the specific requirements of the department. It is advisable to check the latest submission guidelines to ensure proper processing.

Key Elements of the Alabama Form 2848A

Understanding the key elements of the Alabama Form 2848A is essential for effective use. The form includes sections for taxpayer information, representative details, and the scope of authority granted. It also contains a declaration section where both parties must affirm the accuracy of the information provided. These elements are crucial for ensuring that the form meets all legal requirements and that the appointed representative can act on behalf of the taxpayer without issues.

Quick guide on how to complete al form declaration 2018 2019

Your assistance manual for preparing your 2848a Alabama

If you’re curious about how to finalize and submit your 2848a Alabama, here are some concise directions on how to simplify tax declarations.

First off, you just need to set up your airSlate SignNow profile to transform the way you handle documents online. airSlate SignNow is an intuitive and powerful document management solution that enables you to edit, create, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to modify details as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your 2848a Alabama in minutes:

- Register your account and start processing PDFs in no time.

- Utilize our directory to find any IRS tax form; peruse different versions and schedules.

- Select Get form to access your 2848a Alabama in our editor.

- Populate the necessary fillable fields with your information (text, figures, checkmarks).

- Employ the Sign Tool to add your legally-valid eSignature (if needed).

- Examine your document and correct any mistakes.

- Save changes, print your copy, deliver it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to increased errors and delayed refunds. Be sure to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct al form declaration 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the al form declaration 2018 2019

How to generate an electronic signature for your Al Form Declaration 2018 2019 online

How to create an eSignature for your Al Form Declaration 2018 2019 in Chrome

How to make an eSignature for putting it on the Al Form Declaration 2018 2019 in Gmail

How to create an electronic signature for the Al Form Declaration 2018 2019 straight from your mobile device

How to create an electronic signature for the Al Form Declaration 2018 2019 on iOS

How to generate an electronic signature for the Al Form Declaration 2018 2019 on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 2848a Alabama?

airSlate SignNow is a user-friendly platform that allows businesses to send and eSign documents efficiently. It is particularly beneficial for those in Alabama, including areas governed by regulations like 2848a Alabama, ensuring compliance and streamlining document workflows.

-

How much does airSlate SignNow cost for users in 2848a Alabama?

The pricing for airSlate SignNow is competitive and designed to suit various business needs. For users in 2848a Alabama, the platform offers flexible subscription options that can fit any budget, allowing businesses to choose the plan that best meets their document signing needs.

-

What features does airSlate SignNow offer that are relevant to 2848a Alabama users?

airSlate SignNow provides a variety of features tailored for users in 2848a Alabama, including customizable templates, secure cloud storage, and advanced eSignature options. These features help streamline the signing process and ensure compliance with local regulations.

-

Can airSlate SignNow integrate with other software used in 2848a Alabama?

Yes, airSlate SignNow seamlessly integrates with popular software applications, making it an ideal choice for businesses in 2848a Alabama. This integration capability enhances productivity by allowing users to manage their documents and workflows efficiently.

-

What are the benefits of using airSlate SignNow for businesses in 2848a Alabama?

Using airSlate SignNow offers numerous benefits for businesses in 2848a Alabama, including improved efficiency, reduced turnaround times, and enhanced document security. By automating the signing process, businesses can focus on their core operations while ensuring compliance with local laws.

-

Is airSlate SignNow compliant with regulations in 2848a Alabama?

Absolutely! airSlate SignNow is designed to meet various legal and compliance standards, including those relevant to 2848a Alabama. This ensures that all eSignatures and document processes are legally binding and secure.

-

How does airSlate SignNow support mobile users in 2848a Alabama?

airSlate SignNow is fully optimized for mobile devices, allowing users in 2848a Alabama to send and eSign documents on the go. The mobile app provides the same functionality as the desktop version, ensuring that businesses can operate efficiently from anywhere.

Get more for 2848a Alabama

- Settlement conference statement l 0052 form

- Continuity of care form anthem

- Su07 58 state of rhode island department of polarismep form

- Spanish 1b student reference guide form

- Employee perance agreement template form

- Employee probationary period agreement template form

- Gym contract template form

- Gym cancellation contract template form

Find out other 2848a Alabama

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online