Al Form Declaration 2017

What is the Al Form Declaration

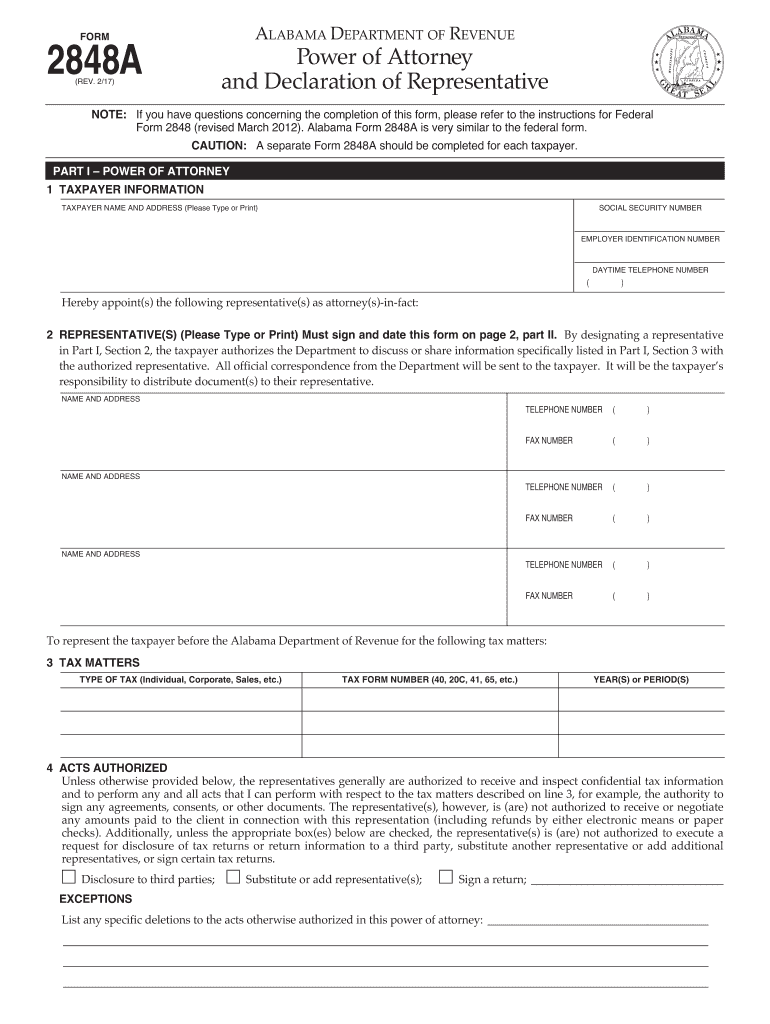

The Al Form Declaration is an essential document used primarily for tax purposes in the United States. It serves as a formal declaration to ensure compliance with federal tax regulations. This form is designed to gather specific information from taxpayers, allowing them to accurately report their financial activities to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Al Form Declaration is crucial for anyone involved in tax reporting, whether as an individual or a business entity.

How to use the Al Form Declaration

Using the Al Form Declaration involves several straightforward steps. First, obtain the form from an official source, ensuring it is the most current version. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form by entering the necessary details, such as personal identification information and financial data. Once completed, review the form for accuracy before submitting it. It's important to keep a copy for your records, as this will assist in future filings or inquiries.

Steps to complete the Al Form Declaration

Completing the Al Form Declaration requires attention to detail and adherence to specific guidelines. Follow these steps:

- Download the latest version of the form from a reliable source.

- Read the accompanying instructions to familiarize yourself with the requirements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide accurate financial details as required by the form.

- Review all entries for completeness and correctness.

- Sign and date the form, ensuring that your signature is in accordance with IRS guidelines.

- Submit the completed form electronically or via mail, depending on your preference and the guidelines provided.

Legal use of the Al Form Declaration

The Al Form Declaration is legally recognized as a valid document for tax reporting purposes. When completed accurately and submitted on time, it fulfills the requirements set forth by the IRS. It is crucial for taxpayers to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The use of eSignature technology for this form is also permissible, enhancing the convenience and security of the filing process.

Filing Deadlines / Important Dates

Adhering to filing deadlines is essential when submitting the Al Form Declaration. Generally, the deadline for filing tax forms is April 15 of each year, but this date may vary depending on weekends or holidays. It's important to stay informed about any changes in deadlines, especially in light of circumstances such as federal extensions or changes in tax law. Marking these dates on your calendar can help ensure timely submission and avoid potential penalties.

Required Documents

To complete the Al Form Declaration, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Financial records, including income statements and expense receipts.

- Previous tax returns for reference.

- Any additional documentation specified in the instructions accompanying the form.

Gathering these documents in advance can streamline the completion process and ensure that all necessary information is accurately reported.

Examples of using the Al Form Declaration

The Al Form Declaration can be utilized in various scenarios, including:

- Individuals reporting their annual income to the IRS.

- Small businesses declaring earnings and expenses for tax purposes.

- Self-employed individuals documenting their income and deductions.

Each of these examples highlights the form's versatility and importance in maintaining compliance with tax regulations.

Quick guide on how to complete al form declaration 2017

Your assistance manual on how to prepare your Al Form Declaration

If you’re curious about how to finalize and submit your Al Form Declaration, here are a few concise instructions on how to make tax filing signNowly easier.

To begin, you simply need to register your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Al Form Declaration in just minutes:

- Set up your account and begin editing PDFs within moments.

- Use our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Al Form Declaration in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and fix any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Use this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase return mistakes and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct al form declaration 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the al form declaration 2017

How to make an electronic signature for your Al Form Declaration 2017 in the online mode

How to create an eSignature for the Al Form Declaration 2017 in Chrome

How to create an eSignature for signing the Al Form Declaration 2017 in Gmail

How to make an electronic signature for the Al Form Declaration 2017 from your mobile device

How to make an electronic signature for the Al Form Declaration 2017 on iOS

How to make an eSignature for the Al Form Declaration 2017 on Android devices

People also ask

-

What is the Al Form Declaration and how does it work with airSlate SignNow?

The Al Form Declaration is a crucial document that outlines the specifics of your agreement or transaction. With airSlate SignNow, you can easily create, send, and eSign your Al Form Declaration, ensuring that all parties have access to a secure and legally binding document. Our platform streamlines the entire process, making it simple to manage your declarations.

-

How can I create an Al Form Declaration using airSlate SignNow?

Creating an Al Form Declaration with airSlate SignNow is straightforward. Simply log in to your account, choose the document template, and customize it as needed. You can add text fields, signatures, and dates, then send it out for eSignature with just a few clicks.

-

What are the benefits of using airSlate SignNow for my Al Form Declaration?

Using airSlate SignNow for your Al Form Declaration offers numerous benefits, including time savings and increased efficiency. Our platform allows for quick document preparation and secure electronic signatures, reducing the need for physical paperwork. Additionally, you can track the status of your declaration in real-time.

-

Is there a cost associated with sending an Al Form Declaration through airSlate SignNow?

Yes, there is a cost associated with sending an Al Form Declaration through airSlate SignNow, but it is designed to be cost-effective. We offer various pricing plans tailored to different business needs, allowing you to choose the best option for your volume of document transactions. Check our pricing page for details.

-

Can I integrate airSlate SignNow with other applications for my Al Form Declaration?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when managing Al Form Declarations. Whether you use CRM systems, cloud storage, or other tools, our integrations help streamline your document management process.

-

What security features does airSlate SignNow provide for the Al Form Declaration?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Al Form Declaration. Our platform employs advanced encryption, secure data storage, and compliance with global security standards to ensure your information remains confidential and protected.

-

How can I track the status of my Al Form Declaration sent through airSlate SignNow?

Tracking the status of your Al Form Declaration is easy with airSlate SignNow. Our platform provides real-time notifications and a dashboard that allows you to monitor when your document is viewed, signed, or completed. This feature helps you stay organized and informed throughout the signing process.

Get more for Al Form Declaration

- Anatomic pathology request form 452322124

- Migrationsverket 240011 form

- Edm60812pdf form

- Fillable va form 8454t

- Community advisory committee quarterlyannual visitation report ncdhhs form

- Alameda alliance form

- Certificate of completion pdf janiuay iloilo form

- Employee relocation agreement template form

Find out other Al Form Declaration

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed