RP 3002 Fill in New York State Department of Taxation and Form

What is the RP 3002 Fill in New York State Department Of Taxation And

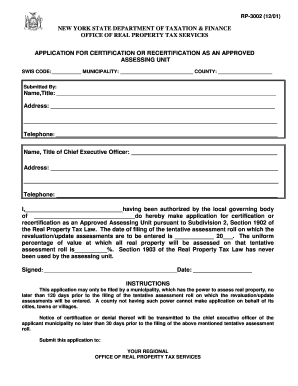

The RP 3002 is a form issued by the New York State Department of Taxation and Finance. It is primarily used for property tax purposes, specifically for the application of certain exemptions related to property ownership. This form allows property owners to claim exemptions that can significantly reduce their tax liabilities, making it an important document for those eligible for such benefits.

How to use the RP 3002 Fill in New York State Department Of Taxation And

To effectively use the RP 3002, property owners must complete the form accurately, providing all required information. This includes details about the property, the owner's status, and any applicable exemptions being claimed. Once filled out, the form must be submitted to the appropriate local tax authority. It is essential to ensure that all information is correct to avoid delays or issues with the exemption process.

Steps to complete the RP 3002 Fill in New York State Department Of Taxation And

Completing the RP 3002 involves several key steps:

- Gather necessary documentation, including proof of ownership and any relevant identification.

- Fill out the form, ensuring all sections are completed, including personal information and property details.

- Review the form for accuracy and completeness.

- Submit the form to the local tax authority by the specified deadline.

Required Documents

When filing the RP 3002, certain documents are typically required to support the application. These may include:

- Proof of property ownership, such as a deed.

- Identification documentation, such as a driver's license or social security number.

- Any prior exemption documentation, if applicable.

Form Submission Methods

The RP 3002 can be submitted through various methods, depending on the local tax authority's guidelines. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at the local tax office.

Eligibility Criteria

Eligibility for the exemptions claimed through the RP 3002 varies based on specific criteria set by the New York State Department of Taxation and Finance. Generally, property owners must meet certain conditions, such as:

- Ownership of the property for which the exemption is being claimed.

- Meeting income limits, if applicable.

- Residency requirements, depending on the type of exemption sought.

Quick guide on how to complete rp 3002 fill in new york state department of taxation and

Complete [SKS] seamlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, amend, and electronically sign your documents swiftly without holdups. Handle [SKS] on any platform with the airSlate SignNow mobile applications for Android or iOS and enhance any document-driven process today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure effective communication throughout the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RP 3002 Fill in New York State Department Of Taxation And

Create this form in 5 minutes!

How to create an eSignature for the rp 3002 fill in new york state department of taxation and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RP 3002 Fill in New York State Department Of Taxation And?

The RP 3002 Fill in New York State Department Of Taxation And is a form used for property tax exemption in New York State. This form allows property owners to apply for various tax benefits and exemptions, which can lead to signNow savings on their taxes.

-

How can airSlate SignNow help with the RP 3002 Fill in New York State Department Of Taxation And?

airSlate SignNow simplifies the process of completing the RP 3002 Fill in New York State Department Of Taxation And form by providing an easy-to-use digital platform. Users can fill out, sign, and send the form securely, ensuring compliance with submission requirements.

-

What are the pricing options for using airSlate SignNow with the RP 3002 Fill in New York State Department Of Taxation And?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs, making it affordable to handle forms like the RP 3002 Fill in New York State Department Of Taxation And. Users can choose from monthly or annual subscriptions, ensuring cost-effectiveness for all users.

-

Are there any features specifically designed for completing the RP 3002 Fill in New York State Department Of Taxation And?

Yes, airSlate SignNow offers features such as templates and form fields that streamline the completion of the RP 3002 Fill in New York State Department Of Taxation And. Users can also access secure signing options to make the form submission process reputable and efficient.

-

What benefits does using airSlate SignNow provide for the RP 3002 Fill in New York State Department Of Taxation And?

Using airSlate SignNow for the RP 3002 Fill in New York State Department Of Taxation And provides various benefits, including time savings and increased efficiency. The platform ensures that users can submit their forms accurately and quickly, helping to avoid potential delays with the tax department.

-

How does airSlate SignNow ensure compliance with RP 3002 Fill in New York State Department Of Taxation And?

airSlate SignNow ensures compliance with the RP 3002 Fill in New York State Department Of Taxation And by adhering to the latest regulations governing electronic signatures and document submissions. This commitment helps users stay compliant while processing their property tax exemption applications.

-

Can I integrate airSlate SignNow with other software for handling the RP 3002 Fill in New York State Department Of Taxation And?

Yes, airSlate SignNow offers various integrations with other software solutions that can help manage the RP 3002 Fill in New York State Department Of Taxation And. These integrations enhance workflow efficiencies and enable seamless data transfer between platforms.

Get more for RP 3002 Fill in New York State Department Of Taxation And

- Acknowledgement of hand washing form

- Senarai semak pengesahan pelantikan form

- A rounding exercise form

- Citizenship in the world workbook form

- List of proposed witnesses form

- Alabama migratory bird stamp form

- Tauhara north grants form

- Operating and maintenance manual of the tracklaying vehicle snow form

Find out other RP 3002 Fill in New York State Department Of Taxation And

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form