Business E File Supported Forms and Features

What is the Business E file Supported Forms And Features

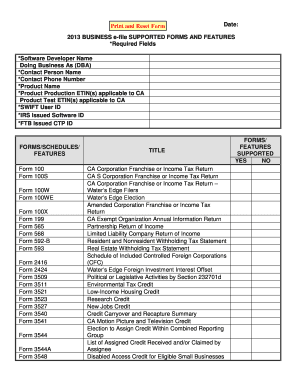

The Business E file Supported Forms and Features encompass a range of electronic forms designed for businesses to efficiently file their taxes and manage compliance. This system streamlines the submission of various tax documents, allowing businesses to handle their filings digitally. Key forms include the 1120 for corporations, the 1065 for partnerships, and the 941 for payroll taxes. Utilizing these forms not only simplifies the filing process but also enhances accuracy and reduces the risk of errors.

How to use the Business E file Supported Forms And Features

To use the Business E file Supported Forms and Features, businesses should first determine which forms are applicable based on their entity type and tax obligations. Once the necessary forms are identified, users can access them through the IRS website or authorized software platforms. After filling out the forms, businesses can submit them electronically, ensuring they meet all IRS requirements for e-filing. It is important to double-check all information for accuracy before submission to avoid penalties.

Steps to complete the Business E file Supported Forms And Features

Completing the Business E file Supported Forms involves several steps:

- Identify the correct forms based on your business structure and tax requirements.

- Gather all necessary financial documents and records needed for accurate reporting.

- Access the forms through the IRS website or compatible e-filing software.

- Fill out the forms carefully, ensuring all information is accurate and complete.

- Review the forms for any errors or omissions.

- Submit the forms electronically, following the specific submission guidelines provided by the IRS.

Legal use of the Business E file Supported Forms And Features

The Business E file Supported Forms and Features are legally recognized methods for submitting tax information to the IRS. Businesses must ensure compliance with all relevant tax laws and regulations when using these forms. This includes adhering to deadlines, maintaining accurate records, and ensuring that all information submitted is truthful and complete. Failure to comply with legal requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Business E file Supported Forms vary depending on the type of form and the business entity. Generally, corporations must file Form 1120 by the fifteenth day of the fourth month following the end of their tax year, while partnerships using Form 1065 must file by the fifteenth day of the third month after the end of their tax year. It is crucial for businesses to be aware of these deadlines to avoid late filing penalties and interest charges.

Required Documents

To complete the Business E file Supported Forms, businesses need to gather several key documents, including:

- Financial statements, including profit and loss statements and balance sheets.

- Records of income and expenses.

- Payroll records for employment tax forms.

- Previous year’s tax returns for reference.

- Any applicable schedules or additional forms required by the IRS.

Quick guide on how to complete business e file supported forms and features

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools needed to create, alter, and electronically sign your documents swiftly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS apps and streamline any document-related process today.

Effortlessly edit and digitally sign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional hand-signed signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, either by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, burdensome form searches, or errors needing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business E file Supported Forms And Features

Create this form in 5 minutes!

How to create an eSignature for the business e file supported forms and features

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key Business E file Supported Forms And Features offered by airSlate SignNow?

airSlate SignNow provides a range of Business E file Supported Forms And Features including customizable templates, bulk sending capabilities, and real-time tracking of document status. These features simplify the signing process, ensuring that documents are completed efficiently. Additionally, the platform allows for easy integration with other business tools, enhancing your workflow.

-

How does pricing work for Business E file Supported Forms And Features?

Pricing for Business E file Supported Forms And Features with airSlate SignNow is flexible, with different plans available to suit various business needs. Options include pay-as-you-go solutions and subscription plans that provide access to premium features at an affordable rate. Businesses can choose a plan based on their expected volume of eSignatures and document workflows.

-

What benefits do I gain by using airSlate SignNow for Business E file Supported Forms And Features?

Using airSlate SignNow for Business E file Supported Forms And Features allows businesses to reduce paperwork, save time, and improve efficiency. The platform streamlines the signing process, ensuring that documents are executed quickly and securely. Additionally, eSigning enhances customer satisfaction by allowing transactions to be completed from anywhere at any time.

-

Can I integrate airSlate SignNow with my existing software for Business E file Supported Forms And Features?

Yes, airSlate SignNow is designed to seamlessly integrate with many popular software applications for Business E file Supported Forms And Features. This includes CRM systems, cloud storage services, and productivity tools. These integrations ensure that your eSigning processes run smoothly within your existing workflows.

-

Are there any security measures for Business E file Supported Forms And Features?

Absolutely! airSlate SignNow prioritizes security for all Business E file Supported Forms And Features. The platform incorporates advanced encryption methods, including SSL and AES standards, to protect your documents. Additionally, it offers secure authentication options to ensure that only authorized personnel can access sensitive information.

-

What types of documents can be signed using Business E file Supported Forms And Features?

With airSlate SignNow, you can eSign a wide variety of documents using Business E file Supported Forms And Features, including contracts, agreements, and forms. The platform supports various file formats, making it easy to sign PDFs and other document types. This versatility allows businesses to digitize their document processes effectively.

-

Is there a mobile app available for accessing Business E file Supported Forms And Features?

Yes, airSlate SignNow offers a mobile app that enables users to access Business E file Supported Forms And Features on the go. This mobile solution allows you to send, sign, and manage documents from your smartphone or tablet. Having this flexibility increases productivity and helps you stay connected with your signing processes anytime, anywhere.

Get more for Business E file Supported Forms And Features

Find out other Business E file Supported Forms And Features

- Help Me With Electronic signature Rhode Island Construction Form

- Can I Electronic signature Rhode Island Construction Form

- How Can I Electronic signature Rhode Island Construction Form

- How To Electronic signature Rhode Island Construction Form

- How Do I Electronic signature Rhode Island Construction Form

- Can I Electronic signature Rhode Island Construction Form

- Help Me With Electronic signature Rhode Island Construction Form

- How Can I Electronic signature Rhode Island Construction Form

- Can I Electronic signature Rhode Island Construction Form

- How To Electronic signature Rhode Island Construction Form

- How Do I Electronic signature Rhode Island Construction Form

- How To Electronic signature Rhode Island Construction PPT

- Help Me With Electronic signature Rhode Island Construction Form

- How To Electronic signature Rhode Island Construction Form

- How Can I Electronic signature Rhode Island Construction Form

- Can I Electronic signature Rhode Island Construction Form

- How Do I Electronic signature Rhode Island Construction PPT

- How Do I Electronic signature Rhode Island Construction Form

- Help Me With Electronic signature Rhode Island Construction PPT

- How To Electronic signature Rhode Island Construction PPT