Alabama Att 1 2018

What is the Alabama ATT-1?

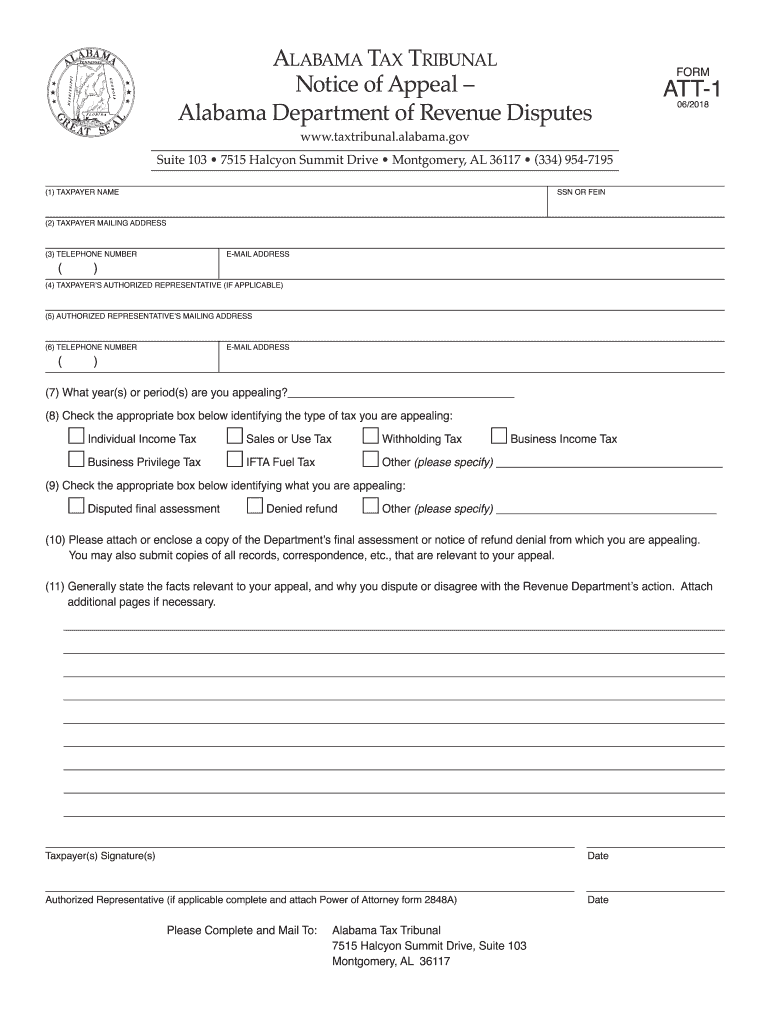

The Alabama ATT-1 form, also known as the Alabama Appeal Revenue Tax form, is a critical document used by taxpayers in Alabama to formally appeal decisions made by the Alabama Department of Revenue regarding tax assessments. This form allows individuals and businesses to contest tax liabilities they believe are incorrect. Understanding the ATT-1 is essential for anyone looking to navigate the appeals process effectively.

How to Use the Alabama ATT-1

Using the Alabama ATT-1 involves several key steps. First, ensure you have received a letter from the Alabama Department of Revenue outlining the assessment you wish to appeal. Next, complete the ATT-1 form accurately, providing all required information, including your contact details and the specifics of the tax assessment in question. Once completed, submit the form according to the instructions provided, which may include online submission, mailing, or in-person delivery to the appropriate office.

Steps to Complete the Alabama ATT-1

Completing the Alabama ATT-1 requires careful attention to detail. Follow these steps:

- Obtain the ATT-1 form from the Alabama Department of Revenue's website or your local office.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your appeal, referencing the specific assessment letter you received.

- Attach any supporting documents that substantiate your claim.

- Review the form for accuracy before submission.

Legal Use of the Alabama ATT-1

The Alabama ATT-1 form serves a legal purpose in the tax appeal process. It is recognized by the state as a formal request for reconsideration of tax assessments. When filed correctly, it initiates a review process that can lead to adjustments in tax liabilities. Taxpayers should ensure they adhere to all legal requirements, including filing within the specified deadlines, to maintain the validity of their appeal.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the Alabama ATT-1 form. Generally, taxpayers must file their appeal within 30 days of receiving the assessment notice from the Alabama Department of Revenue. Missing this deadline can result in the loss of the right to appeal. It is advisable to keep track of important dates related to your tax assessments to ensure compliance with filing requirements.

Required Documents

When submitting the Alabama ATT-1 form, it is essential to include all required documents to support your appeal. This may include:

- A copy of the assessment letter from the Alabama Department of Revenue.

- Any relevant financial documents that support your case, such as tax returns or payment records.

- Additional documentation that may clarify or substantiate your appeal.

Form Submission Methods

The Alabama ATT-1 can be submitted through various methods. Taxpayers may choose to:

- File online through the Alabama Department of Revenue's website, if available.

- Mail the completed form and supporting documents to the designated address provided in the assessment letter.

- Deliver the form in person to the local office of the Alabama Department of Revenue.

Quick guide on how to complete 10 comm office alabama tax tribunal alabamagov

Your assistance manual on how to prepare your Alabama Att 1

If you're curious about how to generate and dispatch your Alabama Att 1, here are several quick tips on how to simplify tax processing.

To commence, you only need to set up your airSlate SignNow profile to transform how you handle documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to update information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the instructions below to complete your Alabama Att 1 in no time:

- Create your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Alabama Att 1 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and amend any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting in paper form can lead to return errors and postpone reimbursements. It goes without saying, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 10 comm office alabama tax tribunal alabamagov

Create this form in 5 minutes!

How to create an eSignature for the 10 comm office alabama tax tribunal alabamagov

How to generate an eSignature for your 10 Comm Office Alabama Tax Tribunal Alabamagov in the online mode

How to create an eSignature for your 10 Comm Office Alabama Tax Tribunal Alabamagov in Chrome

How to generate an eSignature for putting it on the 10 Comm Office Alabama Tax Tribunal Alabamagov in Gmail

How to generate an eSignature for the 10 Comm Office Alabama Tax Tribunal Alabamagov straight from your mobile device

How to make an eSignature for the 10 Comm Office Alabama Tax Tribunal Alabamagov on iOS

How to generate an electronic signature for the 10 Comm Office Alabama Tax Tribunal Alabamagov on Android OS

People also ask

-

What is a letter from Alabama Department of Revenue?

A letter from Alabama Department of Revenue is an official communication that may include tax-related information, notices of audit, or other important updates regarding your tax obligations. Understanding this letter is crucial for compliance and effective communication with the department. Ensuring you have the right tools to communicate, like airSlate SignNow, can streamline your response process.

-

How can airSlate SignNow help with a letter from Alabama Department of Revenue?

airSlate SignNow allows you to electronically sign and send documents, making it easier to respond to any requests from the Alabama Department of Revenue. You can securely send your signed documents directly through the platform, ensuring that you are compliant and timely in your communications. The efficiency of airSlate SignNow can simplify handling these important letters.

-

Are there any fees associated with receiving a letter from Alabama Department of Revenue?

While there are typically no fees for receiving a letter from Alabama Department of Revenue, responding to certain requests may involve associated costs, such as potential penalties or filing fees. Using airSlate SignNow can help you manage these costs by streamlining document signing and submission, making your process efficient and straightforward.

-

What features does airSlate SignNow offer to manage letters from Alabama Department of Revenue?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure storage that are essential when dealing with letters from Alabama Department of Revenue. These tools give users the ability to sign, store, and retrieve important financial documents conveniently. Leveraging these features can signNowly enhance your management of tax-related communications.

-

Is airSlate SignNow compliant with Alabama Department of Revenue regulations?

Yes, airSlate SignNow is designed to comply with regulatory requirements, including those set forth by the Alabama Department of Revenue. This ensures that any documents signed and sent via the platform are legally binding and secure. By using airSlate SignNow, you can have peace of mind knowing that your tax-related communications meet legal standards.

-

Can I integrate airSlate SignNow with other software for managing tax documents?

Absolutely! airSlate SignNow provides integrations with various software applications, enabling you to manage tax documents related to a letter from Alabama Department of Revenue seamlessly. This integration ensures that your workflow is streamlined and efficient, allowing you to connect with accounting software or CRMs that help manage your financial documents.

-

What is the pricing structure for using airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs, making it cost-effective for managing letters from Alabama Department of Revenue. You can choose from basic to advanced plans depending on your features and volume of document handling requirements. This flexibility ensures that you can find a suitable option for your budget.

Get more for Alabama Att 1

- Planilla de registro consular r1 form

- Form g 325a biographic information visaserve com

- Power of attorney pennsylvania form

- Lifestyle analysis worksheet form

- Flcertificationboard form

- Petition for variance or waiver georgia secretary of state form

- 10500 appellate civil case information statement sierra club

- Mc 152 m notice of change index ready this form is to be completed for a change of name change of address or adding or deleting

Find out other Alabama Att 1

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document