Att 1 2024-2026

Understanding the Alabama Department of Revenue Letter

A letter from the Alabama Department of Revenue typically serves as official correspondence regarding tax assessments, compliance issues, or other financial matters. This letter may include important information about your tax obligations, deadlines, and any actions required on your part. Understanding the content of this letter is crucial to ensure compliance and avoid potential penalties.

Key Elements of the Alabama Department of Revenue Letter

An Alabama Department of Revenue letter usually contains several key elements:

- Taxpayer Information: Your name, address, and taxpayer identification number.

- Assessment Details: A summary of the tax assessment, including the tax year in question and the amount owed.

- Response Instructions: Clear directions on how to respond, including deadlines and contact information for inquiries.

- Legal References: Citations of relevant tax laws or regulations that pertain to your situation.

Steps to Respond to the Alabama Department of Revenue Letter

When you receive a letter from the Alabama Department of Revenue, follow these steps to ensure a proper response:

- Review the Letter: Carefully read the letter to understand the issues raised and the required actions.

- Gather Documentation: Collect any necessary documents that support your case or clarify your tax situation.

- Prepare a Response: Draft a response that addresses the points raised in the letter, including any supporting evidence.

- Submit Your Response: Send your response by the specified deadline, using the recommended submission method outlined in the letter.

Legal Use of the Alabama Department of Revenue Letter

The correspondence from the Alabama Department of Revenue is legally binding. It serves as formal notification of any tax-related issues and outlines your rights and responsibilities. Ignoring or failing to respond to this letter can lead to penalties, including increased fines or legal action. It is important to treat this correspondence seriously and respond appropriately.

Penalties for Non-Compliance

Failure to comply with the instructions in a letter from the Alabama Department of Revenue can result in various penalties. These may include:

- Fines: Monetary penalties for late payments or failure to respond.

- Interest Charges: Accumulation of interest on unpaid taxes.

- Legal Action: Potential legal proceedings to collect owed taxes.

Obtaining a Certified Letter from the Alabama Department of Revenue

If you require a certified letter from the Alabama Department of Revenue, it is essential to request one formally. This can usually be done by contacting their office directly. A certified letter provides proof of delivery and can be crucial for legal or tax-related matters. Ensure you provide all necessary information to facilitate the request.

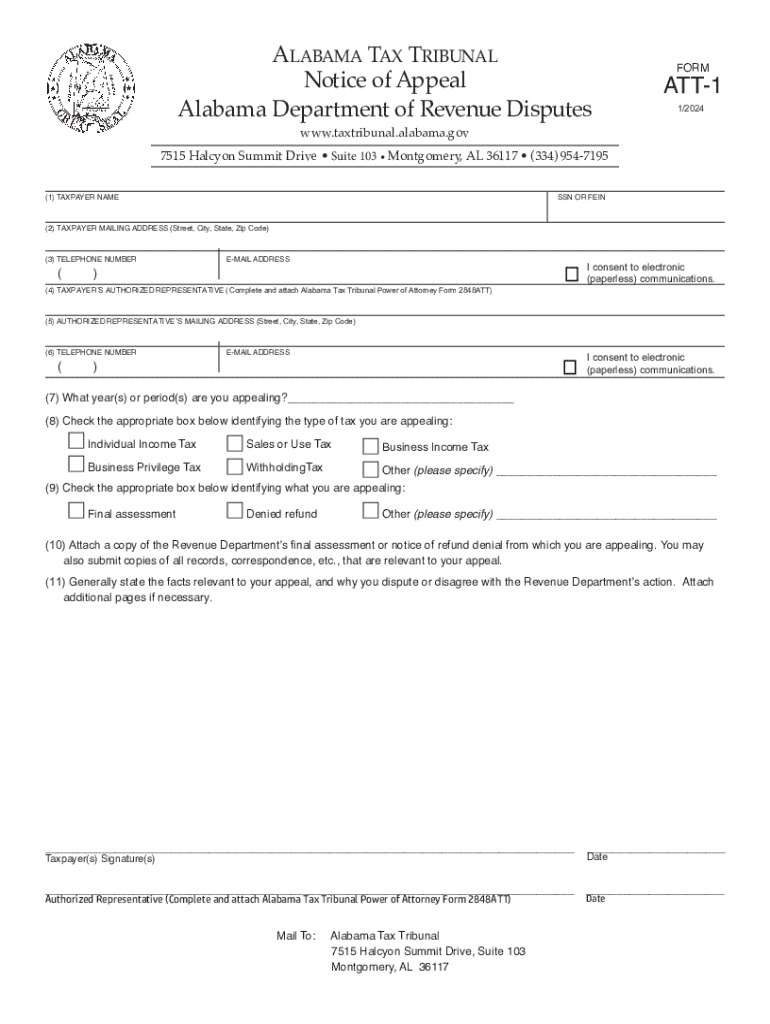

Quick guide on how to complete att 1

Manage Att 1 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without any delays. Handle Att 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Att 1 with ease

- Find Att 1 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require generating new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Att 1 and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct att 1

Create this form in 5 minutes!

How to create an eSignature for the att 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter from Alabama Department of Revenue?

A letter from Alabama Department of Revenue is an official communication regarding tax matters, including assessments, notices, or other important information. It is crucial for individuals and businesses to understand the contents of this letter to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with a letter from Alabama Department of Revenue?

airSlate SignNow provides a streamlined solution for sending and eSigning documents, including responses to a letter from Alabama Department of Revenue. This ensures that your replies are timely and legally binding, helping you manage your tax obligations efficiently.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like a letter from Alabama Department of Revenue. These features enhance productivity and ensure that all communications are organized and accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax letters?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to manage documents like a letter from Alabama Department of Revenue. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful document management tools.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to handle documents such as a letter from Alabama Department of Revenue. This integration helps streamline your workflow and ensures that all your tax-related documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including a letter from Alabama Department of Revenue, offers numerous benefits such as increased efficiency, reduced paper usage, and enhanced security. These advantages help businesses stay organized and compliant with tax regulations.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like a letter from Alabama Department of Revenue. This ensures that your information remains confidential and secure throughout the signing process.

Get more for Att 1

- Landscaping contractor package texas form

- Power attorney form 497327882

- Commercial contractor package texas form

- Declaration guardian 497327884 form

- Excavation contractor package texas form

- Texas contractor 497327886 form

- Concrete mason contractor package texas form

- Demolition contractor package texas form

Find out other Att 1

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself