Tax Year Prices Per Form for Tax Preparation, in US Dollars

Understanding Tax Year Prices Per Form For Tax Preparation

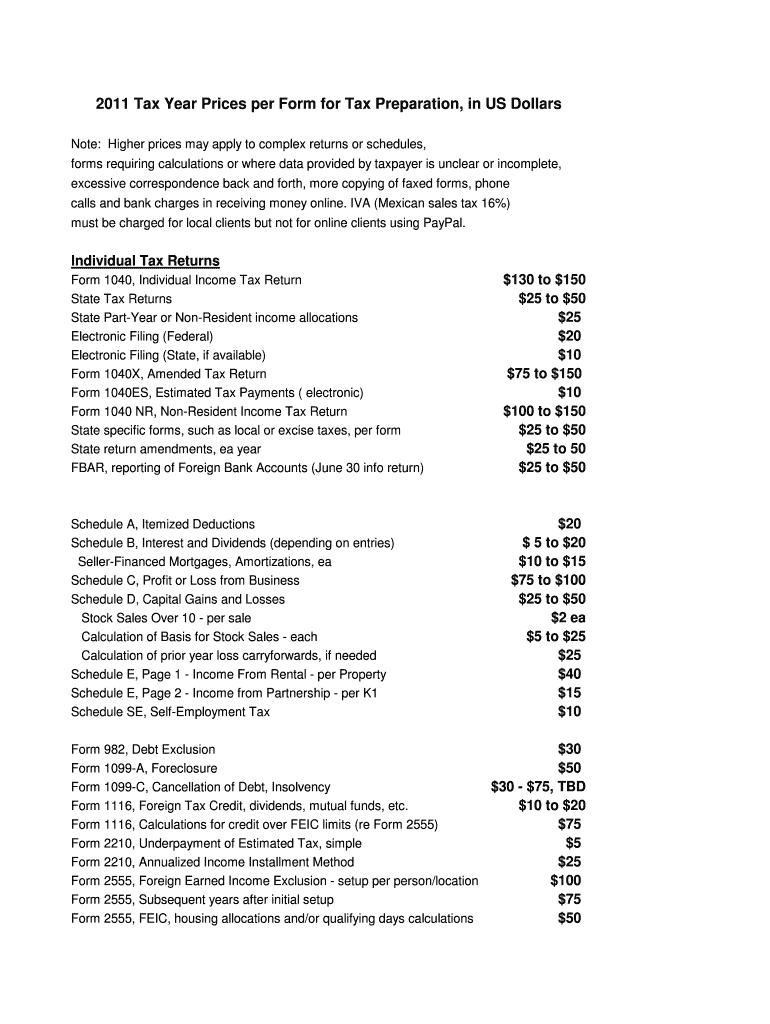

The Tax Year Prices Per Form For Tax Preparation, In US Dollars, refers to the costs associated with preparing various tax forms for filing with the Internal Revenue Service (IRS). These prices can vary based on the complexity of the form, the type of tax return being filed, and the specific services offered by tax professionals or software. Common forms include the 1040 for individual income tax, W-2 for wage and tax statement, and 1099 for miscellaneous income. Understanding these costs is essential for taxpayers to budget effectively for tax preparation services.

How to Use the Tax Year Prices Per Form For Tax Preparation

To effectively utilize the Tax Year Prices Per Form For Tax Preparation, individuals should first identify the specific forms they need based on their financial situation. Once the necessary forms are determined, taxpayers can research the associated costs for preparing each form. This can involve comparing prices from different tax preparation services or software options. It is also advisable to consider the level of support provided, as some services may offer additional guidance or resources that can justify higher costs.

Steps to Complete the Tax Year Prices Per Form For Tax Preparation

Completing the Tax Year Prices Per Form For Tax Preparation involves several key steps:

- Identify the forms required for your tax situation.

- Research the prices associated with each form through various tax preparation services.

- Gather necessary financial documents, such as W-2s and 1099s.

- Choose a tax preparation method, whether through software or a professional.

- Complete the forms accurately, ensuring all information is correct.

- Submit the forms by the appropriate deadlines to avoid penalties.

IRS Guidelines for Tax Year Prices Per Form For Tax Preparation

The IRS provides guidelines regarding the preparation and submission of tax forms, which can impact the prices associated with these services. Taxpayers should familiarize themselves with the IRS requirements for each form, including any changes that may occur from year to year. This includes understanding what documentation is needed, how to report income, and the deadlines for submission. Adhering to these guidelines can help ensure compliance and potentially reduce the risk of penalties.

Filing Deadlines and Important Dates

Filing deadlines for tax forms are crucial for taxpayers to observe. Typically, individual tax returns must be filed by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of other important dates, such as the deadlines for estimated tax payments and extensions. Keeping track of these dates is essential to avoid late fees and penalties.

Required Documents for Tax Year Prices Per Form For Tax Preparation

To accurately complete tax forms, certain documents are required. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements for interest income

- Records of any investments or asset sales

Having these documents organized and readily available can streamline the tax preparation process and ensure that all necessary information is included on the forms.

Quick guide on how to complete tax year prices per form for tax preparation in us dollars

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Year Prices Per Form For Tax Preparation, In US Dollars

Create this form in 5 minutes!

How to create an eSignature for the tax year prices per form for tax preparation in us dollars

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Tax Year Prices Per Form For Tax Preparation, In US Dollars?

The Tax Year Prices Per Form For Tax Preparation, In US Dollars vary based on the specific forms you need. airSlate SignNow offers competitive pricing that helps you manage costs while ensuring compliance. You can find detailed pricing information directly on our website.

-

How does airSlate SignNow enhance the tax preparation process?

airSlate SignNow streamlines tax preparation by allowing users to easily eSign and send documents securely. This reduces the time spent on paperwork and helps you focus on your financial tasks. With our solution, you can ensure that your forms are filled out accurately and submitted on time.

-

Are there any hidden fees associated with the Tax Year Prices Per Form For Tax Preparation, In US Dollars?

No, there are no hidden fees with airSlate SignNow. The Tax Year Prices Per Form For Tax Preparation, In US Dollars are transparent, and we provide a full breakdown of our pricing structure. Users can expect straightforward pricing without surprise charges.

-

Can airSlate SignNow integrate with my tax software?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software. This integration enhances your workflow by allowing you to easily send and eSign documents required for tax filing. Make sure to check compatibility with your existing platforms to maximize efficiency.

-

What features does airSlate SignNow offer for tax professionals?

airSlate SignNow offers features such as reusable templates, advanced eSignature capabilities, and document tracking. These features align well with the needs of tax professionals looking to improve accuracy and reduce turnaround time. You can manage the Tax Year Prices Per Form For Tax Preparation, In US Dollars effectively from one platform.

-

Is there customer support available for questions about Tax Year Prices Per Form For Tax Preparation, In US Dollars?

Absolutely! Our customer support team is readily available to assist you with any inquiries regarding Tax Year Prices Per Form For Tax Preparation, In US Dollars. You can signNow out via chat, email, or phone, and we are here to provide guidance to make your experience smooth.

-

How does using airSlate SignNow save money on tax preparations?

By utilizing airSlate SignNow's efficient eSigning and document management, you can save time and reduce labor costs associated with tax preparation. This can lead to signNow savings, particularly when considering the Tax Year Prices Per Form For Tax Preparation, In US Dollars. Our affordable pricing structure is designed to help you keep your expenses low.

Get more for Tax Year Prices Per Form For Tax Preparation, In US Dollars

Find out other Tax Year Prices Per Form For Tax Preparation, In US Dollars

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online