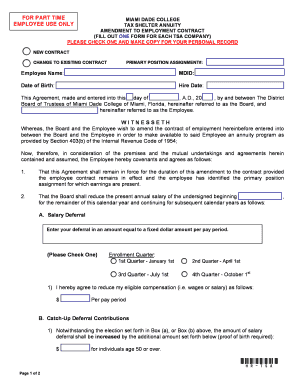

Tax Shelter Annuity Enrollment for Part Time Employees Form

What is the Tax Shelter Annuity Enrollment For Part Time Employees

The Tax Shelter Annuity Enrollment for Part Time Employees is a retirement savings program designed to help eligible part-time workers save for their future. This program allows employees to set aside a portion of their salary into a tax-deferred annuity plan. Contributions made to this plan are not subject to federal income tax until they are withdrawn, providing a valuable opportunity for employees to grow their savings without immediate tax implications.

Eligibility Criteria

To participate in the Tax Shelter Annuity Enrollment, part-time employees must meet specific eligibility criteria. Generally, eligibility is determined by the employer's policies and may include factors such as:

- Employment status as a part-time employee.

- Minimum length of service with the employer.

- Age requirements, which may vary by plan.

It is essential for employees to review their employer's specific guidelines to confirm their eligibility for enrollment in this program.

Steps to complete the Tax Shelter Annuity Enrollment For Part Time Employees

Completing the Tax Shelter Annuity Enrollment involves several straightforward steps. Employees should follow these general procedures:

- Review the eligibility criteria provided by your employer.

- Obtain the enrollment form from your human resources department or the designated plan administrator.

- Fill out the form with accurate personal information, including your name, Social Security number, and contribution amount.

- Submit the completed form to your employer or the plan administrator by the specified deadline.

Following these steps will ensure that your enrollment is processed efficiently.

Required Documents

When enrolling in the Tax Shelter Annuity program, certain documents may be required to complete the process. Commonly needed documents include:

- Your completed enrollment form.

- Proof of employment status, if necessary.

- Identification documents, such as a driver's license or Social Security card.

Be sure to check with your employer for any additional requirements specific to your organization.

Form Submission Methods

Employees can submit their Tax Shelter Annuity Enrollment forms through various methods, depending on their employer's guidelines. Common submission methods include:

- Online submission via the employer's designated portal.

- Mailing the completed form to the human resources department.

- In-person delivery to the HR office or plan administrator.

Understanding the available submission methods can help ensure your enrollment is completed on time.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding Tax Shelter Annuities, including contribution limits and tax implications. Employees should be aware of the following:

- Annual contribution limits may apply, which are subject to change each tax year.

- Withdrawals made before reaching retirement age may incur penalties.

- Tax implications for distributions must be reported on your tax return.

Consulting IRS resources or a tax professional can provide clarity on how these guidelines affect your participation in the program.

Quick guide on how to complete tax shelter annuity enrollment for part time employees

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, alter, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign [SKS] without any hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Shelter Annuity Enrollment For Part Time Employees

Create this form in 5 minutes!

How to create an eSignature for the tax shelter annuity enrollment for part time employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Shelter Annuity Enrollment for Part Time Employees?

Tax Shelter Annuity Enrollment for Part Time Employees refers to a retirement plan option that allows part-time workers to allocate a portion of their income into tax-advantaged accounts. This enrollment helps employees save for retirement while reducing their taxable income. Understanding this feature is crucial for part-time employees looking to maximize their financial future.

-

How can I enroll in a Tax Shelter Annuity program for part-time employees?

To enroll in a Tax Shelter Annuity for Part Time Employees, you typically need to consult your employer's benefits department. They will provide you with the necessary forms and guidelines for the enrollment process. It's important to review your options thoroughly to make the best decisions regarding your retirement savings.

-

What are the benefits of Tax Shelter Annuity Enrollment for Part Time Employees?

The main benefits of Tax Shelter Annuity Enrollment for Part Time Employees include tax deferral on contributions, which can lead to signNow savings over time. Additionally, these plans often offer options for investment growth, allowing employees to build a nest egg for retirement. This enrollment is a smart choice for those looking to enhance their financial security.

-

Are there costs associated with Tax Shelter Annuity Enrollment for Part Time Employees?

Typically, there are minimal fees associated with Tax Shelter Annuity Enrollment for Part Time Employees, depending on the plan provider. Some fees may include administrative costs or expense ratios on investment options. It's advisable to review the fee structure with your employer or provider to understand the costs involved.

-

What features should I look for in a Tax Shelter Annuity plan for part-time workers?

When evaluating a Tax Shelter Annuity plan for Part Time Employees, look for features such as low fees, flexible contribution options, and a variety of investment choices. Additionally, consider whether the plan offers online management tools and customer support to assist you throughout the enrollment process. These features can greatly enhance your savings experience.

-

Can I roll over an existing retirement account into a Tax Shelter Annuity?

Yes, you can often roll over funds from an existing retirement account into a Tax Shelter Annuity for Part Time Employees. This process allows you to consolidate your retirement savings and potentially benefit from different investment options. However, be sure to discuss the rollover rules and implications with your financial advisor or plan administrator.

-

How does the Tax Shelter Annuity Enrollment affect my taxes?

Tax Shelter Annuity Enrollment for Part Time Employees allows you to contribute funds on a pre-tax basis, which reduces your taxable income for the year. This means you won't pay taxes on your contributions until you withdraw them, typically during retirement when you may be in a lower tax bracket. This structure can lead to substantial tax savings over the years.

Get more for Tax Shelter Annuity Enrollment For Part Time Employees

Find out other Tax Shelter Annuity Enrollment For Part Time Employees

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy