Form 8082 2023-2026

What is the Form 8082

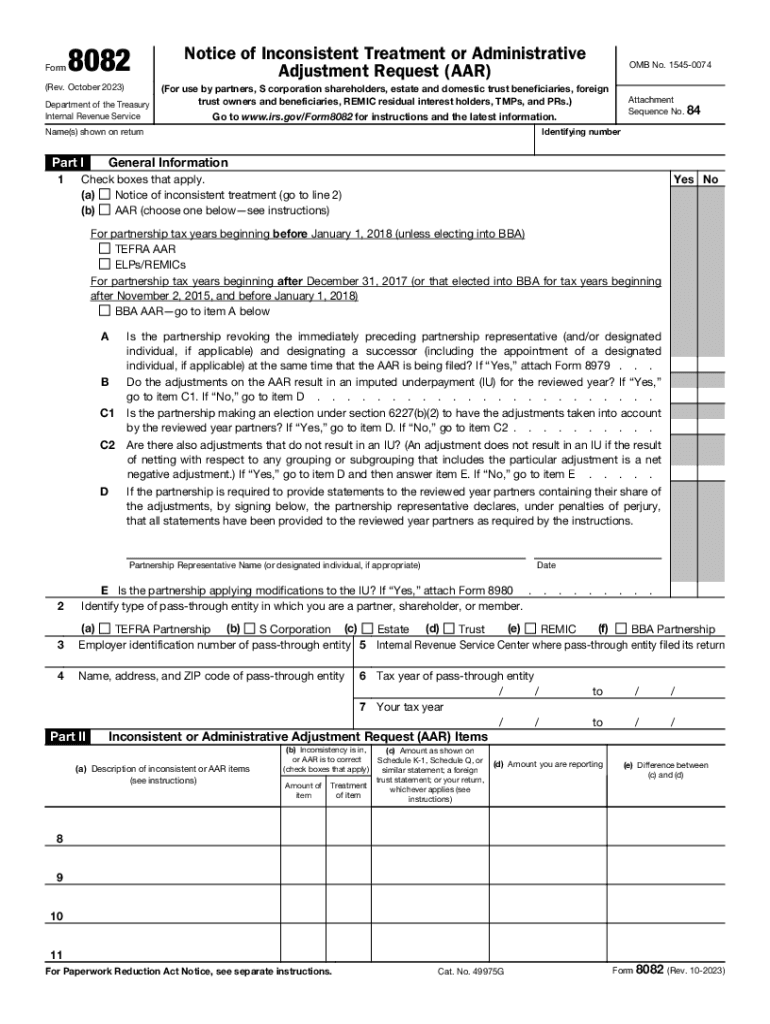

The IRS Form 8082, also known as the Administrative Adjustment Request (AAR), is a tax form used by partnerships and S corporations to request changes to previously filed tax returns. This form is essential for correcting inconsistencies in tax treatment or addressing issues identified by the IRS. It allows taxpayers to formally notify the IRS of any adjustments they wish to make to their tax filings, ensuring compliance with federal tax regulations.

How to obtain the Form 8082

The IRS Form 8082 can be easily obtained from the official IRS website. Users can download the form in PDF format, which is suitable for printing and filling out by hand. Additionally, the form may be available through tax professionals or software that offers tax preparation services. It is important to ensure that you are using the most current version of the form to comply with the latest IRS requirements.

Steps to complete the Form 8082

Completing the IRS Form 8082 involves several key steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Provide details about the tax year for which you are making the adjustment.

- Clearly state the reason for the adjustment, including any relevant facts and figures.

- Attach any supporting documentation that substantiates your request for adjustment.

- Review the completed form for accuracy before submitting it to the IRS.

Key elements of the Form 8082

When filling out the IRS Form 8082, it is important to include specific key elements:

- Taxpayer Information: Ensure all personal and business details are accurate.

- Tax Year: Clearly indicate the tax year in question.

- Adjustment Details: Provide a comprehensive explanation of the proposed adjustments.

- Supporting Documents: Include any relevant documentation that supports your request.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8082 can vary based on the specific circumstances of the adjustment request. Generally, it is advisable to submit the form as soon as discrepancies are identified. For most tax years, the form should be filed within three years from the original due date of the return. Keeping track of these deadlines is crucial to avoid penalties and ensure that your request is processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8082 can be submitted via mail, and it is important to send it to the correct address specified in the form instructions. Currently, there is no option for electronic submission of this form. Ensure that you keep a copy of the submitted form for your records. If you prefer to submit the form in person, you can visit your local IRS office, but it is recommended to check in advance for any specific requirements or procedures.

Quick guide on how to complete form 8082

Complete Form 8082 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without delays. Handle Form 8082 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Form 8082 with ease

- Locate Form 8082 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8082 and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8082

Create this form in 5 minutes!

How to create an eSignature for the form 8082

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS form 8082 instructions?

The IRS form 8082 instructions provide guidance on how to complete and submit Form 8082, which is used to notify the IRS of a treated as a partnership tax return. Understanding these instructions is crucial to ensure compliance and avoid penalties. You can find comprehensive details and step-by-step guidance in the IRS form 8082 instructions.

-

How can airSlate SignNow help with IRS form 8082?

airSlate SignNow simplifies the process of sending and electronically signing IRS form 8082. Our platform allows you to securely manage your documents, ensuring that you can follow the IRS form 8082 instructions seamlessly. With streamlined workflows, you can focus on compliance without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for IRS form 8082?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. With our cost-effective solutions, you can utilize features optimized for handling IRS form 8082 instructions and other document management tasks. We provide clear pricing tiers to help you choose the best fit for your organization.

-

What features does airSlate SignNow offer for managing IRS form 8082?

airSlate SignNow comes equipped with features like customizable templates, electronic signature capabilities, and document tracking that are beneficial for managing IRS form 8082. These tools not only streamline the compliance process but also save time and reduce errors when following the IRS form 8082 instructions.

-

Can I integrate airSlate SignNow with other software for IRS form 8082?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your workflow for managing IRS form 8082. This means you can easily link our platform with your existing tools and ensure that your teams have all the necessary resources to follow the IRS form 8082 instructions.

-

What benefits do businesses gain from using airSlate SignNow for IRS form 8082?

Businesses that choose airSlate SignNow for IRS form 8082 benefit from increased efficiency, reduced paperwork, and enhanced compliance. Our user-friendly interface and automation features allow your team to correctly follow IRS form 8082 instructions without the usual stress associated with document management.

-

How secure is my information when using airSlate SignNow for IRS form 8082?

Security is a top priority for airSlate SignNow. We use advanced encryption and compliance protocols to protect your information while preparing IRS form 8082. You can confidently manage your documents, knowing that your data is secure while following the IRS form 8082 instructions.

Get more for Form 8082

- Lesson 3 extra practice area of composite figures answer key form

- Bank islam baiti home financing form

- Bi weekly student aidwork study time sheet to neiu form

- Sba form 1010 fillable

- North carolina division of motor vehicles mvr 618 form

- 735 7282 insurers notification to dmv notice of totaled vehicle form

- Application for custom plates new york dmv ny gov form

- Renewing your licenseid mt motor vehicle division form

Find out other Form 8082

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement