8082 Form 2017

What is the 8082 Form

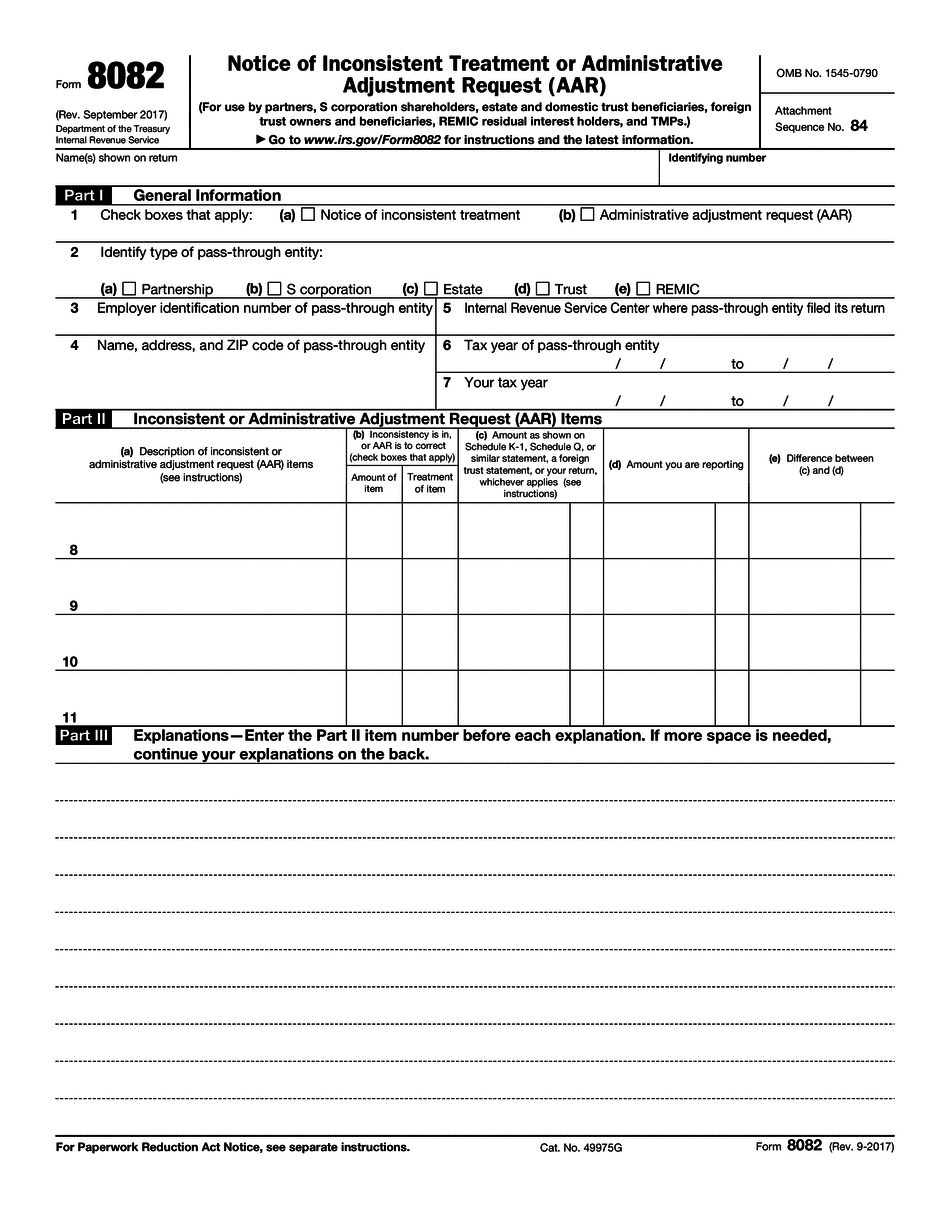

The 8082 Form is a tax document used by businesses and individuals to report certain types of income and deductions to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations, particularly for those who may have complex financial situations or specific reporting requirements. It is important to understand the purpose of the 8082 Form to accurately complete it and avoid potential penalties.

How to use the 8082 Form

Using the 8082 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the income or deductions you intend to report. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the IRS guidelines related to the 8082 Form to understand the specific requirements and instructions. Once completed, submit the form to the IRS by the designated deadline, either electronically or by mail.

Steps to complete the 8082 Form

Completing the 8082 Form requires attention to detail. Follow these steps:

- Gather all relevant financial documents, such as income statements and deduction records.

- Obtain the latest version of the 8082 Form from the IRS website or authorized sources.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form by the required deadline, either electronically or via postal mail.

Legal use of the 8082 Form

The 8082 Form is legally binding and must be completed in accordance with IRS regulations. It serves as an official record of the income and deductions reported by the taxpayer. To ensure its legal validity, it is crucial to provide accurate information and to sign the form where required. Failure to comply with the legal standards set forth by the IRS can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 8082 Form vary based on the taxpayer's situation. Generally, the form must be submitted by the tax return due date, which is typically April 15 for individual taxpayers. However, if you are filing for a business entity, the due date may differ. It is essential to be aware of these deadlines to avoid late fees or penalties.

Form Submission Methods

The 8082 Form can be submitted through various methods, including:

- Online submission through the IRS e-filing system, which is often the fastest and most efficient method.

- Mailing the completed form to the appropriate IRS address, as specified in the form instructions.

- In-person submission at designated IRS offices, although this option may require an appointment.

Examples of using the 8082 Form

The 8082 Form can be used in various scenarios, such as:

- Reporting income from freelance work or side businesses.

- Claiming deductions for business expenses incurred during the tax year.

- Documenting income from rental properties or investments.

Quick guide on how to complete 8082 2017 form

Complete 8082 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed forms, as you can acquire the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage 8082 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign 8082 Form effortlessly

- Find 8082 Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or cover sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Edit and eSign 8082 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8082 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 8082 2017 form

How to make an eSignature for the 8082 2017 Form online

How to create an eSignature for the 8082 2017 Form in Chrome

How to make an eSignature for signing the 8082 2017 Form in Gmail

How to generate an electronic signature for the 8082 2017 Form straight from your smart phone

How to make an electronic signature for the 8082 2017 Form on iOS devices

How to create an electronic signature for the 8082 2017 Form on Android OS

People also ask

-

What is the 8082 Form and how can airSlate SignNow help?

The 8082 Form is a document used in various business transactions, and airSlate SignNow makes it easy to manage and eSign this form digitally. With our platform, you can streamline the process of sending, signing, and storing the 8082 Form, ensuring efficiency and compliance in your workflows.

-

Is there a cost associated with using airSlate SignNow for the 8082 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are cost-effective, allowing you to choose the one that best suits your requirements for managing the 8082 Form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the 8082 Form?

airSlate SignNow provides a range of features for managing the 8082 Form, including customizable templates, real-time tracking, and secure cloud storage. Our platform also supports multiple signature options to enhance the signing experience, making it easier for you and your clients.

-

Can I integrate airSlate SignNow with other software for the 8082 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, such as CRM and project management tools, to enhance your workflow. This means you can easily incorporate the 8082 Form into your existing systems, improving efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for the 8082 Form?

Using airSlate SignNow for the 8082 Form offers numerous benefits, including time savings, reduced paper usage, and increased security for sensitive documents. Our user-friendly interface allows you to complete transactions faster while ensuring all signatures are legally binding.

-

How secure is the signing process for the 8082 Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption and authentication measures to protect your data and ensure that the signing process for the 8082 Form is secure, giving you peace of mind when handling important documents.

-

Can I track the status of my 8082 Form sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including the 8082 Form. You can easily monitor the status of your sent forms, ensuring you are always informed about when they are viewed, signed, or returned.

Get more for 8082 Form

- Da form 5888 1 nov 2006 armypubs army

- Peblo estimated disability compensation worksheet lra da form 5892 dec 2008 armypubs army

- Da form 5960 sep 1990 printable

- Swimming pool check list form

- Da 7432 form

- Da 7574 form

- Sniper qualification firing table vi stationary and moving known distance targets m110 day dos with the tmr and anpvs 26 da form

- M240 qualification card form

Find out other 8082 Form

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation