Irs 8082 Form 2018

What is the IRS 8082 Form

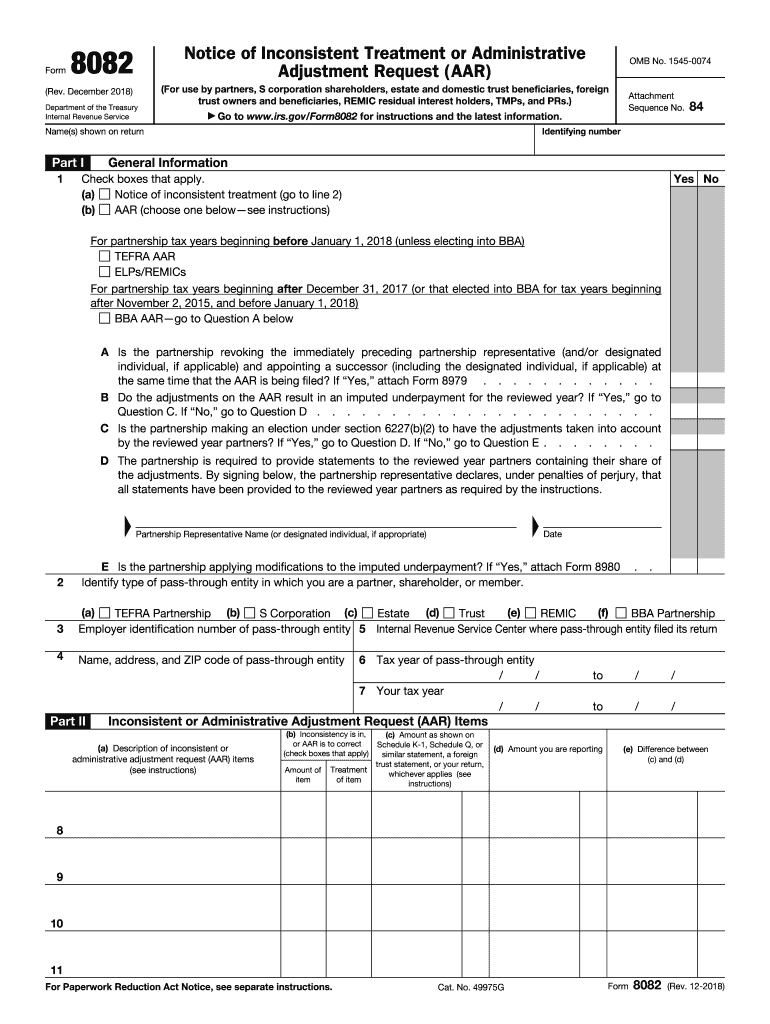

The IRS 8082 form, formally known as the Administrative Adjustment Request, is used by taxpayers to request changes to previously filed tax returns. This form is particularly relevant for partnerships and S corporations that need to adjust their income, deductions, or credits. By submitting the 8082 form, taxpayers can inform the IRS of inconsistencies or errors that may have occurred in earlier filings. This form plays a crucial role in ensuring that tax records are accurate and up to date.

How to Use the IRS 8082 Form

To effectively use the IRS 8082 form, taxpayers must first gather all relevant information regarding the tax returns they wish to adjust. This includes the original return, any supporting documentation, and details about the adjustments being requested. Once the form is completed, it should be submitted to the IRS according to the guidelines provided. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to Complete the IRS 8082 Form

Completing the IRS 8082 form involves several key steps:

- Download the IRS 8082 form from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the tax return you are adjusting, including the tax year and the nature of the adjustment.

- Clearly explain the reason for the adjustment in the designated section of the form.

- Review the form for accuracy and completeness before submitting it.

Legal Use of the IRS 8082 Form

The IRS 8082 form is legally binding when completed and submitted according to IRS regulations. It is essential for taxpayers to understand that any adjustments made through this form must comply with existing tax laws and guidelines. Failure to accurately report adjustments can lead to penalties or further scrutiny from the IRS. By using the 8082 form correctly, taxpayers can ensure their requests for changes are legally recognized.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 8082 form typically align with the deadlines for the original tax returns being adjusted. It is crucial for taxpayers to submit the form within the appropriate timeframe to ensure that their adjustments are considered. Missing deadlines can result in the IRS rejecting the request for adjustment. Taxpayers should keep abreast of any changes in IRS deadlines to avoid complications.

Required Documents

When submitting the IRS 8082 form, taxpayers should include any necessary supporting documents. These may include copies of the original tax returns, documentation that supports the requested adjustments, and any correspondence with the IRS regarding the adjustments. Providing complete documentation helps facilitate a smoother review process by the IRS.

Quick guide on how to complete irs 8082 form

Complete Irs 8082 Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Irs 8082 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Irs 8082 Form with ease

- Acquire Irs 8082 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your documentation management needs in just a few clicks from any device of your preference. Adjust and eSign Irs 8082 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8082 form

Create this form in 5 minutes!

How to create an eSignature for the irs 8082 form

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is form 8082 and how can airSlate SignNow help with it?

Form 8082 is used by taxpayers to disclose their participation in certain transactions. With airSlate SignNow, you can easily prepare, sign, and send form 8082 electronically, ensuring compliance and security. Our platform simplifies document management and streamlines the eSignature process for your convenience.

-

Is airSlate SignNow compliant with the requirements for submitting form 8082?

Yes, airSlate SignNow adheres to all necessary compliance regulations required for electronically signing and submitting form 8082. Our platform guarantees that your documents are securely stored and comply with legal standards, giving you peace of mind when handling sensitive tax documents.

-

How much does it cost to use airSlate SignNow for form 8082?

airSlate SignNow offers flexible pricing plans that cater to various needs, including features relevant to preparing and sending form 8082. Our budget-friendly subscription options provide you with access to essential tools without compromising on quality. Visit our website to explore the plans and find one that suits your business.

-

What features does airSlate SignNow provide for managing form 8082?

airSlate SignNow offers a robust set of features for managing form 8082, including templates, real-time collaboration, and electronic signatures. Our drag-and-drop interface makes it simple to customize your form and gather signatures swiftly. These features ensure that your document workflow is efficient and hassle-free.

-

Can I integrate airSlate SignNow with other software when working with form 8082?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software systems, allowing you to connect your existing tools when preparing form 8082. This integration enhances your workflow by enabling data transfer and synchronization between platforms to ensure accuracy and efficiency.

-

What are the benefits of using airSlate SignNow for form 8082?

Using airSlate SignNow for form 8082 provides numerous benefits, including improved document turnaround times, enhanced security, and increased accessibility. Our platform allows for easy tracking and management of your documents, ensuring you never miss a deadline. Experience the convenience of automated workflows designed to save you time and resources.

-

How secure is the information shared in form 8082 with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you handle form 8082, your information is protected with advanced encryption measures and secure data storage. Our commitment to safety ensures that your sensitive tax documents remain confidential and secure throughout the eSigning process.

Get more for Irs 8082 Form

Find out other Irs 8082 Form

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free