Who Must Complete Form 5405 Repayment of First Time 2022

What is Form 5405: Repayment of First-Time Homebuyer Credit?

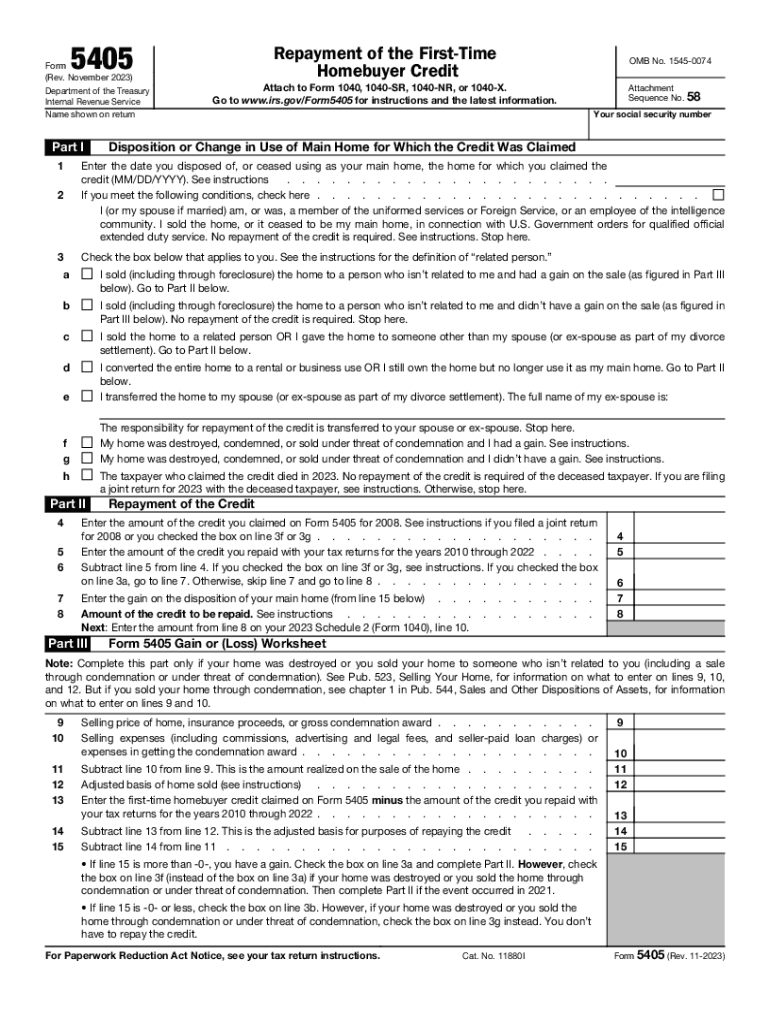

Form 5405 is used by individuals who received the First-Time Homebuyer Credit and need to report the repayment of that credit. This credit was available to eligible taxpayers who purchased a home between 2008 and 2010. If you claimed this credit and later sold or otherwise disposed of the home, you may be required to repay some or all of the credit. Understanding the purpose of this form is essential for compliance with IRS regulations.

Eligibility Criteria for Completing Form 5405

To determine if you must complete Form 5405, consider your eligibility based on the following criteria:

- You received the First-Time Homebuyer Credit when purchasing your home.

- You sold, exchanged, or otherwise disposed of the home before the end of the credit period.

- Your home was not your main home for any part of the year you sold it.

If any of these conditions apply, you are required to complete the form to report the repayment of the credit.

Steps to Complete Form 5405

Completing Form 5405 involves several key steps:

- Gather necessary documentation, including the original Form 5405 and any related tax returns.

- Fill out the form with accurate information regarding the sale or disposal of the home.

- Calculate the amount of credit that must be repaid based on the specifics of your situation.

- Submit the completed form with your tax return for the year in which the repayment is due.

Following these steps ensures that you accurately report the repayment to the IRS.

Required Documents for Form 5405

When completing Form 5405, you will need to have certain documents on hand to ensure accurate reporting. These documents may include:

- Your original Form 5405, if applicable.

- Tax returns from the year you claimed the First-Time Homebuyer Credit.

- Documentation related to the sale or disposal of the home, such as a closing statement.

Having these documents ready will facilitate a smoother completion process.

Filing Deadlines for Form 5405

It is important to be aware of the filing deadlines associated with Form 5405. Generally, the form must be submitted with your tax return for the year in which you sold or disposed of the home. The standard tax return filing deadline is April 15 of the following year, unless an extension is granted. Missing this deadline may result in penalties or interest charges.

Penalties for Non-Compliance with Form 5405

Failure to file Form 5405 when required can lead to significant penalties. The IRS may impose a penalty for underpayment of taxes due to the failure to report the repayment of the First-Time Homebuyer Credit. Additionally, interest may accrue on any unpaid amounts. It is crucial to comply with the requirements to avoid these financial consequences.

Quick guide on how to complete who must complete form 5405 repayment of first time

Complete Who Must Complete Form 5405 Repayment Of First time effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage Who Must Complete Form 5405 Repayment Of First time on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Who Must Complete Form 5405 Repayment Of First time with ease

- Locate Who Must Complete Form 5405 Repayment Of First time and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Who Must Complete Form 5405 Repayment Of First time to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct who must complete form 5405 repayment of first time

Create this form in 5 minutes!

How to create an eSignature for the who must complete form 5405 repayment of first time

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who must complete Form 5405 Repayment Of First Time Homebuyer Credit?

Individuals who received a First Time Homebuyer Credit after April 9, 2008, must complete Form 5405 Repayment Of First Time. This includes those who sold their home or no longer use it as their primary residence. It helps the IRS track repayments of the credit.

-

How does airSlate SignNow help in completing Form 5405?

airSlate SignNow simplifies the completion of Form 5405 Repayment Of First Time by providing an intuitive eSigning platform. Users can easily fill out the form and securely send it for signatures, ensuring compliance and accuracy with IRS requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features such as templates, cloud storage, and integration with popular applications. These features enhance your ability to manage forms like Form 5405 Repayment Of First Time effectively, saving time and increasing productivity.

-

Is there a cost associated with using airSlate SignNow to process Form 5405?

Yes, airSlate SignNow has various pricing plans that cater to different business needs. However, considering the powerful features and ease of use, many users find it a cost-effective solution for managing forms, including Form 5405 Repayment Of First Time.

-

What are the benefits of using airSlate SignNow for Form 5405?

Using airSlate SignNow for Form 5405 Repayment Of First Time provides benefits such as enhanced security, speed, and convenience. eSigning ensures that your forms are processed quickly and reduces the risk of errors, making tax compliance stress-free.

-

Can I integrate airSlate SignNow with other applications for Form 5405?

Yes, airSlate SignNow allows seamless integration with various applications like Google Drive, Salesforce, and Microsoft Office. This makes it easy to manage Form 5405 Repayment Of First Time alongside other documents in your workflow.

-

What types of businesses can benefit from airSlate SignNow when completing Form 5405?

All types of businesses—real estate agencies, tax professionals, and small businesses—can benefit from using airSlate SignNow. It streamlines the paperwork process for Form 5405 Repayment Of First Time, improving efficiency regardless of industry.

Get more for Who Must Complete Form 5405 Repayment Of First time

- Penfed bank statement template 24683099 form

- Jphn application form

- Amniocentesis procedure education literature and consent form

- Physiotherapy questionnaire form

- Forwardhealth personal care addendum f11136 forwardhealth personal care addendum dhs wisconsin form

- Cat surrender form humane society of charlotte humanesocietyofcharlotte

- Exterior paint contract template form

- Gw 2 uniform water well completion reportabandonment form final072916 docx

Find out other Who Must Complete Form 5405 Repayment Of First time

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation