Fillable Online Customer Credit Application Logistics Plus 2020-2026

Understanding the Customer Credit Application Form

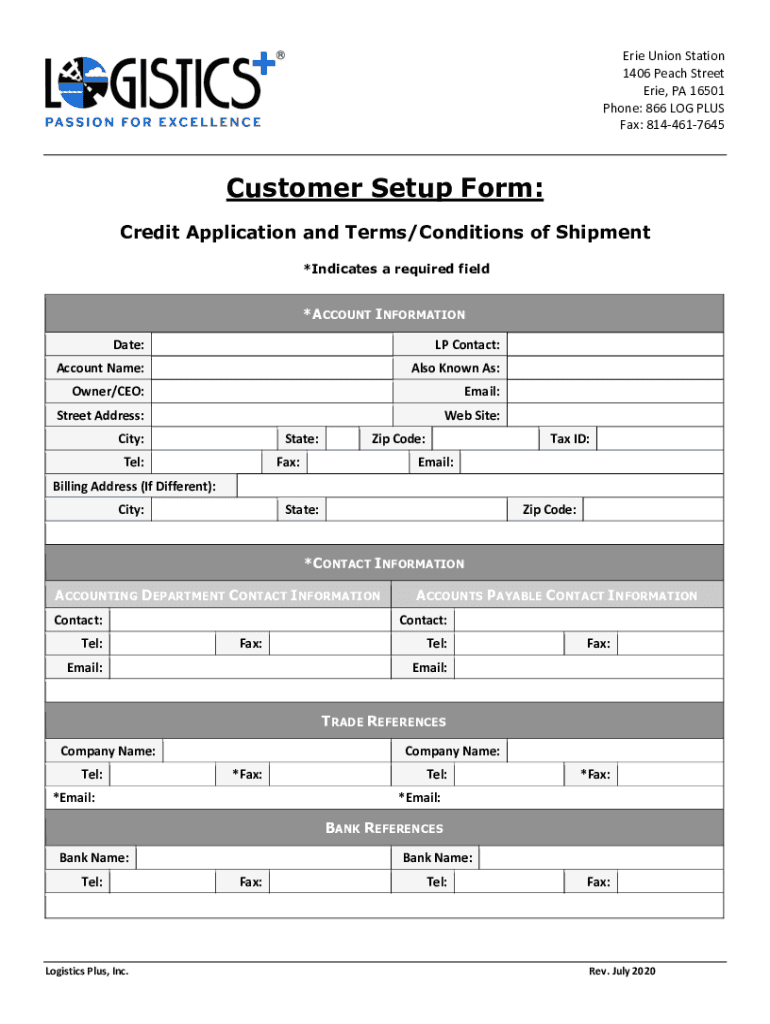

The customer credit application form is a vital document for businesses looking to assess the creditworthiness of potential clients. This form collects essential information, including the applicant's financial history, business details, and references. By evaluating this data, companies can make informed decisions about extending credit to new customers. The form typically includes sections for personal identification, business structure, and financial information, ensuring a comprehensive overview of the applicant's financial standing.

Steps to Complete the Customer Credit Application Form

Completing the customer credit application form involves several key steps to ensure accuracy and thoroughness. Begin by gathering all necessary documents, such as financial statements and identification. Next, fill out the form with accurate information regarding your business, including its legal structure, ownership details, and financial history. It is important to provide references, which may include suppliers or other creditors. Finally, review the completed form for any errors before submitting it for processing.

Required Documents for the Customer Credit Application Form

When submitting a customer credit application form, certain documents are typically required to support the application. These may include:

- Business license or registration

- Tax identification number

- Financial statements (profit and loss statements, balance sheets)

- Bank statements for the last three to six months

- Personal credit history for business owners

Having these documents ready can streamline the application process and increase the chances of approval.

Form Submission Methods

The customer credit application form can often be submitted through various methods, depending on the business's preferences. Common submission methods include:

- Online submission through a secure portal

- Mailing a printed version of the form

- In-person delivery at the business's office

Choosing the appropriate submission method can depend on the urgency of the application and the specific requirements set by the business.

Eligibility Criteria for Credit Approval

Eligibility for credit approval typically hinges on several factors outlined in the customer credit application form. Businesses will assess the applicant's credit score, financial stability, and payment history. Additionally, the length of time in business and the nature of the business operations may influence eligibility. Understanding these criteria can help applicants prepare their information accordingly and improve their chances of receiving credit.

Legal Considerations for Using the Customer Credit Application Form

When utilizing a customer credit application form, it is crucial to be aware of the legal implications involved. Businesses must ensure that they comply with federal and state regulations regarding credit reporting and consumer protection. This includes obtaining consent to check credit histories and safeguarding personal information provided by applicants. Familiarity with these legal requirements helps businesses maintain compliance and build trust with their clients.

Quick guide on how to complete fillable online customer credit application logistics plus

Effortlessly Prepare Fillable Online Customer Credit Application Logistics Plus on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Fillable Online Customer Credit Application Logistics Plus on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Fillable Online Customer Credit Application Logistics Plus with Ease

- Locate Fillable Online Customer Credit Application Logistics Plus and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Fillable Online Customer Credit Application Logistics Plus and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online customer credit application logistics plus

Create this form in 5 minutes!

How to create an eSignature for the fillable online customer credit application logistics plus

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit application form?

A credit application form is a document used by businesses to collect information from clients or customers applying for credit. This form typically includes personal information, financial data, and consent for a credit check. By using an effective credit application form, businesses can streamline their approval processes and make informed lending decisions.

-

How can airSlate SignNow help with the credit application form process?

airSlate SignNow simplifies the credit application form process by enabling businesses to create, send, and eSign forms digitally. With its user-friendly interface, you can quickly customize your credit application form to meet your specific needs. This digital solution signNowly reduces paperwork and increases efficiency in managing applications.

-

What features does airSlate SignNow offer for credit application forms?

airSlate SignNow offers features such as customizable templates, secure eSign capabilities, and real-time tracking for your credit application forms. You can also integrate the platform with various CRM systems to automate data entry. These features ensure a seamless experience for both you and your clients.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's features, including those for managing credit application forms. This trial period gives you the opportunity to test the eSigning capabilities and customization options at no cost. Experience how airSlate SignNow can benefit your business before making a commitment.

-

How secure is the credit application form with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive credit application forms. The platform uses encryption and complies with industry-standard security protocols to protect your data. You can be confident that your clients' information is safe, ensuring trust and compliance in your business processes.

-

Can I integrate airSlate SignNow with other applications for credit application forms?

Absolutely! airSlate SignNow supports integration with various applications such as CRM systems, payment processors, and document management tools. This capability allows you to automate workflows and manage your credit application forms efficiently, enhancing your overall business processes.

-

What are the costs associated with using airSlate SignNow for credit application forms?

The costs of using airSlate SignNow depend on the plan you choose, which varies based on features and the number of users. Each plan offers cost-effective solutions tailored to different business sizes, making it easy to find the right fit for managing your credit application forms. Visit our pricing page for detailed information.

Get more for Fillable Online Customer Credit Application Logistics Plus

- Run while you still can subprime demand and predatory lending in ruralhome form

- Beazer homes applauds imagine homes for winning prestigious form

- Indepthwerefromthegovernmentandwereheretohelpnot form

- South eastern distance rider association distanceriding form

- Euromillions syndicate contract template form

- Event contract template 787751606 form

- Event book contract template form

- Evaluation contract template form

Find out other Fillable Online Customer Credit Application Logistics Plus

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe