763 S Virginia Special Nonresident Claim Form

What is the 763 S Virginia Special Nonresident Claim Form

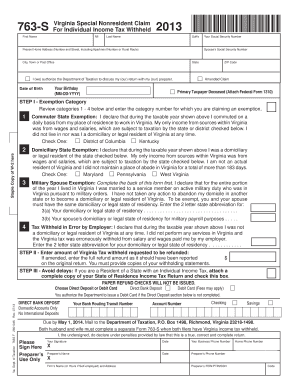

The 763 S Virginia Special Nonresident Claim Form is a specific document used by nonresident individuals to claim a refund of Virginia income tax withheld. This form is essential for those who have earned income in Virginia but do not reside in the state. By completing this form, individuals can ensure they receive any overpaid taxes back from the state, adhering to the regulations set forth by the Virginia Department of Taxation.

How to use the 763 S Virginia Special Nonresident Claim Form

Using the 763 S Virginia Special Nonresident Claim Form involves several straightforward steps. First, gather all necessary information, including your Virginia tax withholding details and personal identification. Next, accurately fill out the form, ensuring all sections are completed to avoid delays. After filling out the form, review it for accuracy and completeness before submission. This careful approach helps ensure a smooth processing experience.

Steps to complete the 763 S Virginia Special Nonresident Claim Form

Completing the 763 S Virginia Special Nonresident Claim Form requires a methodical approach. Follow these steps:

- Obtain the form from the Virginia Department of Taxation website or a reliable source.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details of your income earned in Virginia and the amount of tax withheld.

- Calculate the refund amount you are claiming based on the information provided.

- Sign and date the form to validate your claim.

- Submit the completed form either online, by mail, or in person, depending on your preference.

Key elements of the 763 S Virginia Special Nonresident Claim Form

The 763 S Virginia Special Nonresident Claim Form includes several key elements that are crucial for proper completion. These elements comprise:

- Personal Information: Your name, address, and Social Security number.

- Income Details: Information on the income earned in Virginia and the corresponding tax withheld.

- Refund Calculation: A section to calculate the total refund amount based on your tax withholding.

- Signature: A space for your signature, confirming the accuracy of the information provided.

Eligibility Criteria

To be eligible to use the 763 S Virginia Special Nonresident Claim Form, individuals must meet specific criteria. Primarily, you must be a nonresident who has earned income in Virginia and had state income tax withheld from that income. Additionally, you should not be a resident of Virginia for tax purposes during the tax year in question. Understanding these criteria is essential to ensure that your claim is valid and can be processed efficiently.

Form Submission Methods

The 763 S Virginia Special Nonresident Claim Form can be submitted through various methods, providing flexibility for users. You can choose to submit the form online via the Virginia Department of Taxation's e-filing system, which offers a quick and efficient way to process your claim. Alternatively, you may opt to mail the completed form to the appropriate address provided by the Department of Taxation. In-person submission is also possible at designated locations, allowing for direct interaction if needed.

Quick guide on how to complete 763 s virginia special nonresident claim form

Complete 763 S Virginia Special Nonresident Claim Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage 763 S Virginia Special Nonresident Claim Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 763 S Virginia Special Nonresident Claim Form with ease

- Find 763 S Virginia Special Nonresident Claim Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes a matter of seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign 763 S Virginia Special Nonresident Claim Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 763 s virginia special nonresident claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 763 S Virginia Special Nonresident Claim Form?

The 763 S Virginia Special Nonresident Claim Form is a tax form used by nonresident individuals to claim refunds for Virginia income tax withheld. This form is essential for those who have had Virginia taxes deducted but are not residents of the state. Understanding how to fill out and submit the 763 S Virginia Special Nonresident Claim Form can help ensure you receive your rightful refund.

-

How can I effectively complete the 763 S Virginia Special Nonresident Claim Form?

To effectively complete the 763 S Virginia Special Nonresident Claim Form, gather all necessary documentation, including your income statements and proof of Virginia taxes withheld. Make sure to follow the guidelines provided by the Virginia Department of Taxation to fill it out correctly. Using airSlate SignNow can simplify this process with electronic signatures and document management.

-

What are the benefits of using airSlate SignNow for the 763 S Virginia Special Nonresident Claim Form?

Using airSlate SignNow for the 763 S Virginia Special Nonresident Claim Form allows you to eSign your documents securely and quickly. It streamlines the process, saving you time and reducing the likelihood of errors. Moreover, the platform ensures that your documents are safely stored and easily accessible for future reference.

-

Is there a cost associated with filing the 763 S Virginia Special Nonresident Claim Form via airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, the cost for using their services can be very affordable compared to traditional mailing and signing methods. This cost-effective solution not only covers the eSigning process but also offers features like templates and cloud storage. You can select a plan that best fits your needs for handling the 763 S Virginia Special Nonresident Claim Form.

-

Can I integrate airSlate SignNow with other tools to manage the 763 S Virginia Special Nonresident Claim Form?

Yes, airSlate SignNow can integrate with various tools and platforms to manage the 763 S Virginia Special Nonresident Claim Form and other documents. This integration can streamline your workflow and enhance productivity. Connecting with your preferred software can provide more convenience and efficiency in handling your tax documents.

-

How long does it take to process the 763 S Virginia Special Nonresident Claim Form?

The processing time for the 763 S Virginia Special Nonresident Claim Form can vary based on several factors, including the volume of claims being processed by the Virginia Department of Taxation. Generally, you can expect processing to take anywhere from 6 to 8 weeks. Using airSlate SignNow can help accelerate your preparation time so you can submit your form as soon as possible.

-

What should I do if my 763 S Virginia Special Nonresident Claim Form is denied?

If your 763 S Virginia Special Nonresident Claim Form is denied, you should review the rejection notice to understand the reasons. Common issues may include missing information or incorrect calculations. You can then correct the errors and resubmit your claim, potentially using airSlate SignNow to ensure that your new submission is accurate and well-documented.

Get more for 763 S Virginia Special Nonresident Claim Form

- Applicantattorney name state bar number and address original to file copies to applicant county counsel reporters for court use form

- Notification to court of baddressb on conservatorship guardianship form

- Subsequent document form

- Ex parte notice form

- Arrest warrant application non support connecticut bar examining committee additional response page form 2s jud ct

- Jd cv 115 connecticut judicial branch jud ct form

- Jd cv 122 form

- Application for case referral land use litigation jud ct form

Find out other 763 S Virginia Special Nonresident Claim Form

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer