How Long Does it Take to Process Form 15111 Fill Out & Sign 2023-2026

Understanding the Earned Income Credit Worksheet

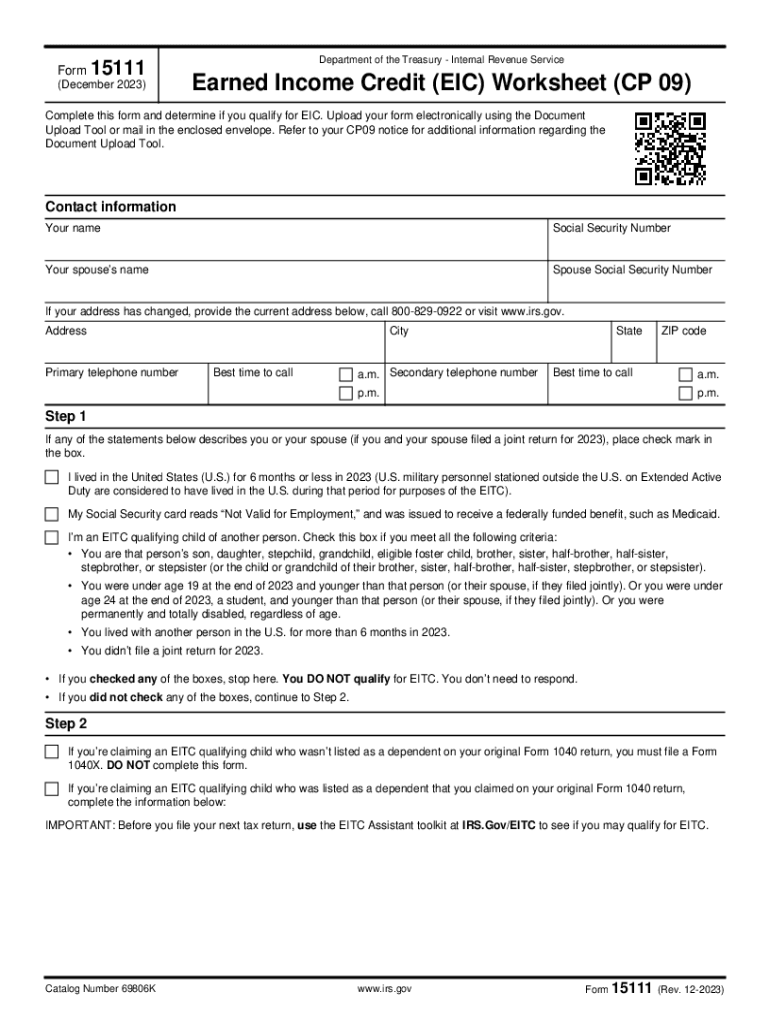

The earned income credit worksheet is a crucial tool for individuals and families seeking to claim the earned income tax credit (EITC) on their tax returns. This credit, administered by the Internal Revenue Service (IRS), is designed to assist low to moderate-income workers by reducing their tax liability and potentially providing a refund. To utilize the worksheet effectively, taxpayers must meet specific eligibility criteria, including income limits and filing status. The worksheet helps calculate the amount of credit one may qualify for based on the number of qualifying children and earned income.

Key Elements of the Earned Income Credit Worksheet

When filling out the earned income credit worksheet, several key elements must be considered:

- Filing Status: Taxpayers must identify their filing status, which can affect eligibility and credit amount.

- Qualifying Children: The worksheet includes sections to list qualifying children, which can significantly increase the credit amount.

- Earned Income: Accurate reporting of earned income is essential, as this figure directly impacts the credit calculation.

- Investment Income: Taxpayers must report any investment income, as exceeding a certain threshold can disqualify them from the credit.

Steps to Complete the Earned Income Credit Worksheet

Completing the earned income credit worksheet involves several steps to ensure accuracy:

- Gather necessary documents, including W-2 forms and any other income statements.

- Determine your filing status and whether you have any qualifying children.

- Calculate your total earned income using the relevant figures from your documents.

- Fill out the worksheet, following the instructions carefully to report all required information.

- Review your calculations to ensure accuracy before submitting your tax return.

Eligibility Criteria for the Earned Income Credit

To qualify for the earned income credit, taxpayers must meet specific eligibility criteria set by the IRS. These include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and number of qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Filing a tax return, even if no tax is owed.

Form Submission Methods

Taxpayers can submit the earned income credit worksheet through various methods:

- Online Filing: Many tax preparation software programs allow for electronic filing, making submission quick and efficient.

- Mail: Taxpayers can print their completed forms and mail them to the appropriate IRS address.

- In-Person: Some individuals may choose to file in person at designated IRS offices or through certified tax preparers.

IRS Guidelines for the Earned Income Credit

The IRS provides specific guidelines regarding the earned income credit, including updates on eligibility requirements and filing procedures. It is essential for taxpayers to stay informed about any changes that may affect their ability to claim the credit. The IRS also offers resources to assist with common questions and concerns related to the earned income credit, ensuring that taxpayers can navigate the process with confidence.

Quick guide on how to complete how long does it take to process form 15111 fill out ampamp sign

Complete How Long Does It Take To Process Form 15111 Fill Out & Sign effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage How Long Does It Take To Process Form 15111 Fill Out & Sign on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign How Long Does It Take To Process Form 15111 Fill Out & Sign without any hassle

- Locate How Long Does It Take To Process Form 15111 Fill Out & Sign and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign How Long Does It Take To Process Form 15111 Fill Out & Sign and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how long does it take to process form 15111 fill out ampamp sign

Create this form in 5 minutes!

How to create an eSignature for the how long does it take to process form 15111 fill out ampamp sign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 15111 and how is it used?

Form 15111 is a document used by businesses for specific administrative needs. With airSlate SignNow, you can efficiently send and eSign form 15111, streamlining your workflow and ensuring all necessary parties can sign it quickly.

-

How much does it cost to use airSlate SignNow for form 15111?

airSlate SignNow offers various pricing plans that are cost-effective, making it accessible for businesses of all sizes. For form 15111, you can select a plan that meets your needs and maximize your document management efficiency.

-

What features does airSlate SignNow offer for form 15111?

airSlate SignNow includes features such as electronic signatures, document templates, and workflow automation specifically tailored for handling form 15111. These tools help simplify the process, ensuring fast and secure document transactions.

-

Can I integrate airSlate SignNow with other applications when using form 15111?

Yes, airSlate SignNow offers seamless integrations with various applications to manage form 15111 efficiently. This allows you to combine your existing tools with our eSigning solution for enhanced productivity.

-

What are the benefits of using airSlate SignNow for form 15111?

Using airSlate SignNow for form 15111 provides numerous benefits, including reduced turnaround times, increased security, and enhanced collaboration. It allows stakeholders to sign from anywhere, improving efficiency and reducing paperwork.

-

Is the signing process for form 15111 secure with airSlate SignNow?

Absolutely! airSlate SignNow ensures that the signing process for form 15111 is secure, utilizing industry-standard encryption and compliance measures. Your sensitive information remains protected throughout the entire transaction.

-

How can I learn to use airSlate SignNow for form 15111?

Getting started with airSlate SignNow for form 15111 is easy! We offer comprehensive tutorials and customer support resources, helping you navigate the platform and utilize its features effectively for your business needs.

Get more for How Long Does It Take To Process Form 15111 Fill Out & Sign

Find out other How Long Does It Take To Process Form 15111 Fill Out & Sign

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online