Form 15111 Rev 3 2023

What is the Form 15111?

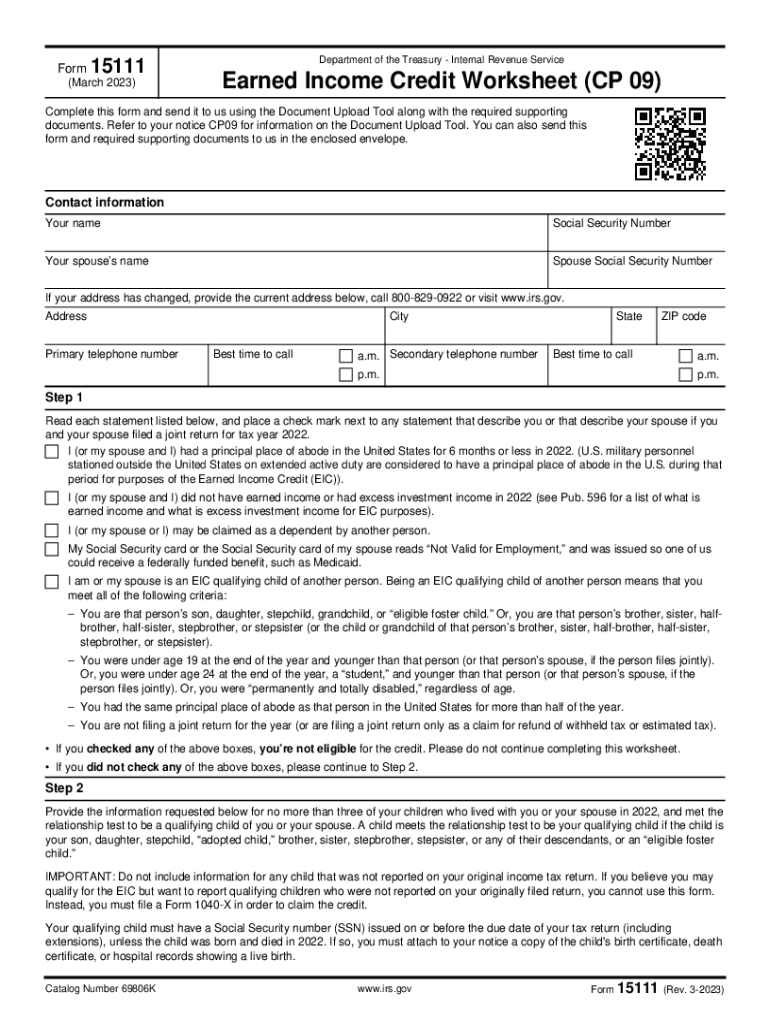

The IRS Form 15111, also known as the Earned Income Credit (EIC) Worksheet, is a document used by taxpayers to determine their eligibility for the Earned Income Credit. This credit is designed to assist low to moderate-income workers, providing them with a financial boost through tax refunds. The form helps taxpayers calculate their credit based on their income and family size, ensuring they receive the appropriate amount if eligible.

How to Use the Form 15111

Using the Form 15111 involves several steps to ensure accurate completion. Taxpayers should start by gathering necessary documentation, including income statements and information about dependents. Next, follow the instructions on the form to input relevant data, such as total earned income and filing status. After completing the calculations, taxpayers can determine their eligibility for the Earned Income Credit based on the results. It's crucial to review the form for accuracy before submission to avoid delays in processing.

Steps to Complete the Form 15111

Completing the Form 15111 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents, including W-2s and 1099s.

- Identify your filing status and the number of qualifying children, if any.

- Fill in your total earned income and adjusted gross income as instructed.

- Use the provided tables on the form to determine your potential credit amount.

- Review all entries for accuracy and ensure all required signatures are included.

Legal Use of the Form 15111

The Form 15111 is legally binding when completed and submitted according to IRS guidelines. To ensure compliance, taxpayers must adhere to the instructions provided by the IRS and ensure that all information is accurate and truthful. Misrepresentation or errors on the form can lead to penalties or disqualification from receiving the Earned Income Credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15111 typically align with the general tax filing deadlines in the United States. Taxpayers should be aware of the annual deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to ensure timely submission of the form.

Eligibility Criteria

To qualify for the Earned Income Credit using the Form 15111, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and the number of qualifying children.

- Filing a tax return, even if no tax is owed.

- Being a U.S. citizen or resident alien for the entire tax year.

Quick guide on how to complete form 15111 rev 3 2023

Handle Form 15111 Rev 3 effortlessly on any device

Virtual document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Form 15111 Rev 3 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Form 15111 Rev 3 without hassle

- Find Form 15111 Rev 3 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure private information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors requiring printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 15111 Rev 3 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 15111 rev 3 2023

Create this form in 5 minutes!

How to create an eSignature for the form 15111 rev 3 2023

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 15111 used for?

The IRS Form 15111 is utilized for individuals to request a waiver of the estimated tax penalty. This form allows taxpayers to explain their circumstances to the IRS and seek relief from penalties, which can be especially helpful if you had unexpected financial difficulties.

-

How can I fill out the IRS Form 15111 using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the IRS Form 15111 electronically. Our platform provides an intuitive interface that allows you to input your information, sign the document, and send it securely, ensuring all necessary fields are completed accurately.

-

Is there a cost associated with using airSlate SignNow for IRS Form 15111?

Yes, airSlate SignNow offers affordable pricing plans to access our document signing solutions, including the preparation of IRS Form 15111. We provide different tiers based on your needs, so you can choose a plan that fits your budget while benefiting from our user-friendly eSignature features.

-

Can I track the status of my IRS Form 15111 submission?

Absolutely! With airSlate SignNow, you can track the status of your IRS Form 15111 once it’s sent out for signature. Our platform includes real-time updates, so you can see when the form is opened, signed, and completed, giving you peace of mind throughout the process.

-

What features does airSlate SignNow offer for IRS Form 15111?

airSlate SignNow provides a variety of features to enhance your experience with IRS Form 15111, including electronic signatures, document templates, and secure storage. You can also collaborate with team members in real-time and automate reminder emails to ensure timely submissions.

-

Which integrations does airSlate SignNow support for handling IRS Form 15111?

airSlate SignNow easily integrates with numerous applications, allowing you to streamline your workflow while handling IRS Form 15111. Whether you use Google Drive, Dropbox, or various CRM solutions, our seamless integration capabilities ensure that you can manage your documents efficiently.

-

What benefits does airSlate SignNow provide for submitting IRS Form 15111?

Using airSlate SignNow for submitting IRS Form 15111 offers several benefits, including time savings, enhanced security, and accessibility. You can fill out and submit your form from anywhere at any time, ensuring that your submission is timely and compliant with IRS requirements.

Get more for Form 15111 Rev 3

Find out other Form 15111 Rev 3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors