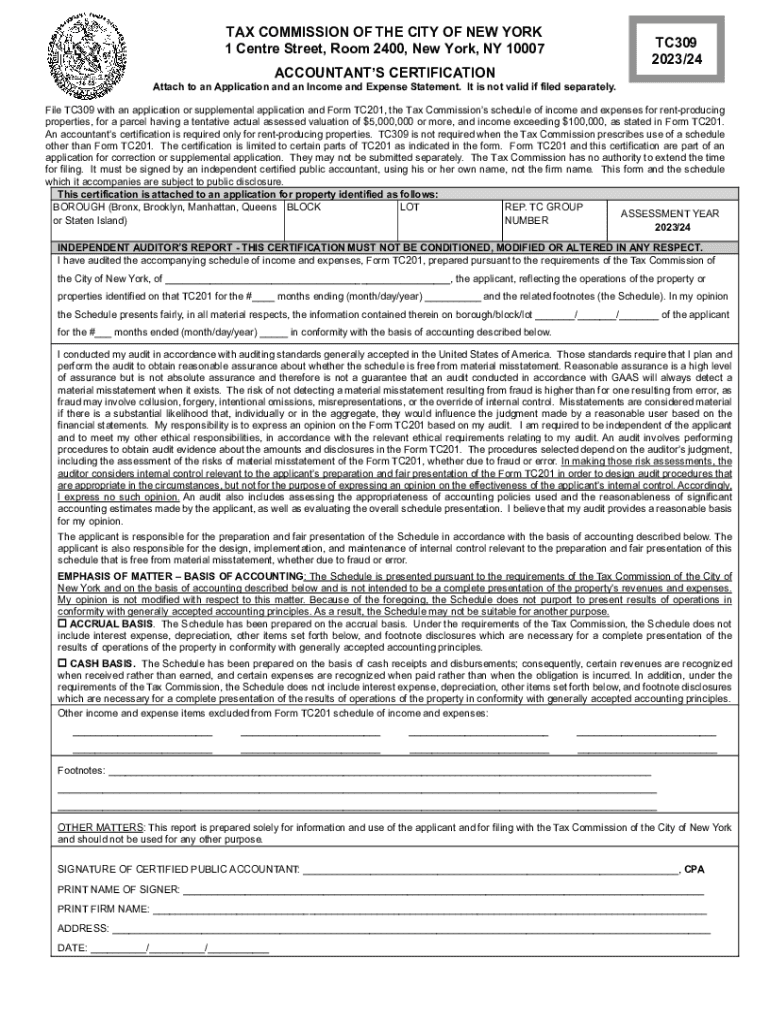

Accountant's Certification Attach to TC201 2023

Filing Deadlines and Important Dates

Understanding the filing deadlines for the TC 309 form is crucial for compliance and avoiding penalties. The due date for submitting the TC 309 typically aligns with the tax filing deadlines set by the IRS. For the 2024 tax year, the standard due date for most taxpayers is April 15, 2024. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to verify specific deadlines based on your filing status and any applicable extensions.

Steps to Complete the Accountant's Certification Attach To TC 201

Completing the Accountant's Certification Attach To TC 201 involves several key steps. First, ensure you have all necessary documentation, including financial statements and tax returns. Next, fill out the TC 201 form accurately, providing all required information. After completing the form, attach the Accountant's Certification, ensuring it is signed and dated by the accountant. Finally, review the entire submission for accuracy before sending it to the appropriate IRS office.

Required Documents

When preparing to submit the TC 309 form, several documents are essential. These include:

- Completed TC 309 form

- Accountant's Certification, if applicable

- Supporting financial documents, such as balance sheets and income statements

- Previous tax returns for reference

Having these documents ready will streamline the filing process and help ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the TC 309 form. It is important to follow these guidelines closely to avoid delays or rejections. Key points include ensuring all information is accurate, using the correct form version, and submitting the form by the established deadlines. Additionally, taxpayers should be aware of any updates to IRS policies that may affect their filing process.

Penalties for Non-Compliance

Failing to comply with the TC 309 due date can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, non-compliance may lead to interest charges on any unpaid taxes. It is essential to stay informed about deadlines and ensure timely submissions to avoid these financial repercussions.

Who Issues the Form

The TC 309 form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. Understanding the role of the IRS in the form submission process is important for ensuring compliance and addressing any potential issues that may arise during the filing process.

Eligibility Criteria

To file the TC 309 form, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of the United States and having a valid Social Security number or Employer Identification Number. Additionally, taxpayers must ensure that their financial situation aligns with the requirements outlined by the IRS for the TC 309 form. It is advisable to review these criteria carefully before proceeding with the filing.

Quick guide on how to complete accountants certification attach to tc201

Complete Accountant's Certification Attach To TC201 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Accountant's Certification Attach To TC201 on any system using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to alter and eSign Accountant's Certification Attach To TC201 effortlessly

- Find Accountant's Certification Attach To TC201 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Accountant's Certification Attach To TC201 and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct accountants certification attach to tc201

Create this form in 5 minutes!

How to create an eSignature for the accountants certification attach to tc201

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tc 309 due date?

The tc 309 due date refers to the deadline for submitting certain tax documents and forms, including those related to business operations. It's essential for businesses to keep track of this date to avoid penalties and ensure compliance with tax regulations.

-

How can airSlate SignNow assist with managing the tc 309 due date?

airSlate SignNow simplifies the process of sending and signing documents related to the tc 309 due date. With our platform, you can create, send, and obtain eSignatures on essential tax documents in a timely manner, ensuring you meet all deadlines.

-

What features does airSlate SignNow offer to help with tax document management?

airSlate SignNow includes features like customizable templates, automated reminders, and secure storage, which are invaluable for managing the tc 309 due date. These tools help businesses streamline their document processes and avoid missing important deadlines.

-

Is there a pricing plan that suits small businesses trying to stay on top of the tc 309 due date?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses looking to manage the tc 309 due date efficiently. Our cost-effective solutions provide access to essential features without breaking the bank, making it easy to stay compliant.

-

Can airSlate SignNow integrate with other accounting software for tc 309 due date reminders?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, providing automatic reminders for the tc 309 due date. This integration ensures that all your document management and tax-related tasks are streamlined in one platform.

-

What benefits does using airSlate SignNow offer for handling the tc 309 due date?

Using airSlate SignNow for the tc 309 due date management enhances efficiency and reduces the risk of missed deadlines. Our platform ensures secure electronic signatures and easy document tracking, allowing businesses to focus on their core operations instead of paperwork.

-

How can I ensure that my documents related to the tc 309 due date are secure?

airSlate SignNow prioritizes document security with features like encryption and secure access controls. This means that all documents associated with the tc 309 due date are protected against unauthorized access, ensuring your sensitive tax information is kept confidential.

Get more for Accountant's Certification Attach To TC201

- Edexcel epq project proposal form example

- Participants must sign and submit a waiver before barclays center form

- Walgreenshealthcom registration and order form

- Improper evidence of ownership procedure form

- Form 3cefa 30504485

- Virginia 529 intent to enroll form 44198549

- Barber application form

- Weights amp measures device registration application form

Find out other Accountant's Certification Attach To TC201

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple