Tax Commission of the City of New York NYC Gov 2023

Understanding the Tax Commission of the City of New York

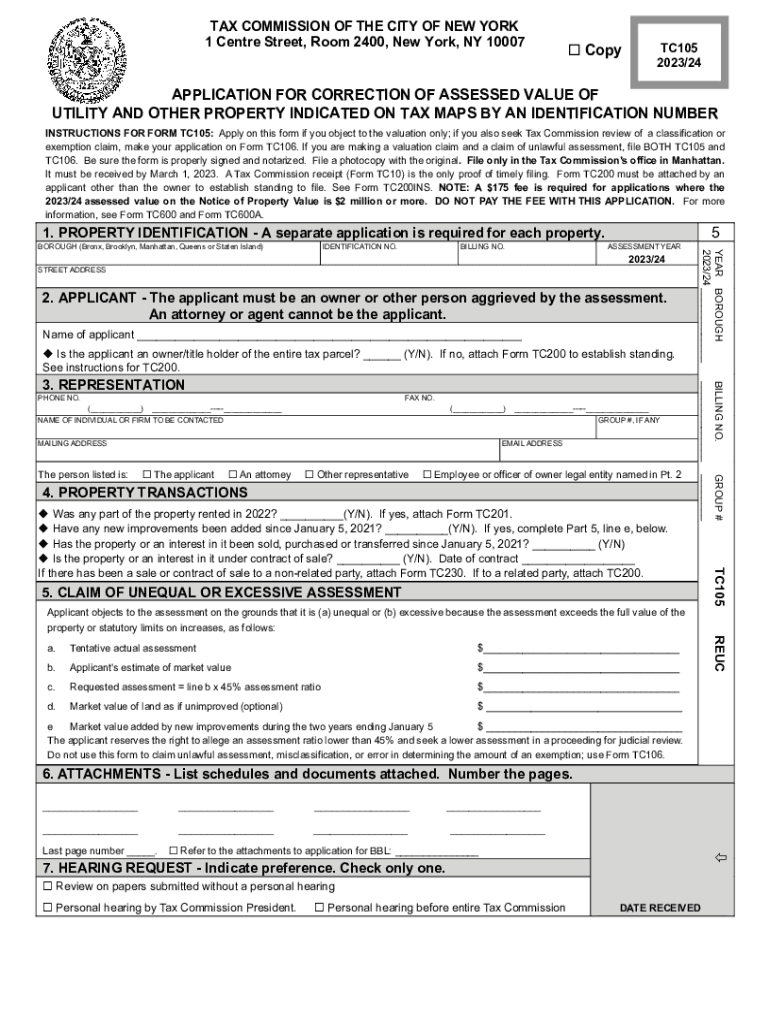

The Tax Commission of the City of New York is a vital entity responsible for overseeing property tax assessments and ensuring fair taxation practices within the city. This commission plays a crucial role in maintaining the integrity of the tax system, providing services to property owners, and addressing grievances related to property tax assessments. Its primary functions include reviewing assessment complaints, conducting hearings, and issuing decisions that affect property tax liabilities. By facilitating transparency and accountability, the commission helps ensure that property taxes are assessed equitably across New York City.

Steps to Utilize the Tax Commission of the City of New York

Using the Tax Commission involves several important steps to ensure that property owners can effectively navigate the assessment process. First, individuals should gather all relevant documentation related to their property, including the current assessment notice and any supporting evidence for their claim. Next, they can file a complaint with the commission, which typically requires completing a specific form detailing the reasons for the appeal. After submitting the complaint, property owners may need to attend a hearing where they can present their case. Following the hearing, the commission will issue a decision, which can be further appealed if necessary.

Required Documents for the Tax Commission of the City of New York

When preparing to engage with the Tax Commission, it is essential to have the correct documentation ready. Key documents typically include:

- The original assessment notice from the Department of Finance.

- Evidence supporting the claim, such as photographs, comparable property assessments, or expert appraisals.

- Any prior correspondence with the Department of Finance regarding the assessment.

- Identification and proof of ownership of the property in question.

Having these documents organized can facilitate a smoother process when addressing property tax assessments.

Form Submission Methods for the Tax Commission of the City of New York

Property owners can submit their complaints to the Tax Commission through various methods. The most common submission methods include:

- Online: Many forms can be completed and submitted electronically through the commission's official website.

- By Mail: Complaints can be sent via postal service to the commission's office, ensuring that all documents are included.

- In-Person: Property owners may also choose to visit the commission's office to submit their complaints directly and discuss their cases with staff.

Choosing the method that best suits one's needs can help streamline the process of addressing property tax assessments.

Legal Use of the Tax Commission of the City of New York

The Tax Commission operates under specific legal frameworks that govern its functions and authority. Property owners have the legal right to appeal their property tax assessments through the commission. This process is designed to ensure that all property owners can contest assessments they believe to be inaccurate or unfair. The commission's decisions are binding, and property owners must comply with any rulings made. Understanding these legal aspects is crucial for anyone looking to navigate the tax assessment process effectively.

Eligibility Criteria for Filing a Complaint

To file a complaint with the Tax Commission, property owners must meet certain eligibility criteria. Generally, the criteria include:

- The individual must be the legal owner of the property in question.

- The complaint must be filed within the designated timeframe, typically within 30 days of receiving the assessment notice.

- All required documentation must be submitted along with the complaint form.

Ensuring compliance with these criteria is essential for a successful appeal process.

Quick guide on how to complete tax commission of the city of new york nyc gov

Complete Tax Commission Of The City Of New York NYC gov effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and digitally sign your documents promptly without complications. Manage Tax Commission Of The City Of New York NYC gov on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and digitally sign Tax Commission Of The City Of New York NYC gov with ease

- Find Tax Commission Of The City Of New York NYC gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and digitally sign Tax Commission Of The City Of New York NYC gov and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax commission of the city of new york nyc gov

Create this form in 5 minutes!

How to create an eSignature for the tax commission of the city of new york nyc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Commission Of The City Of New York NYC gov. and how can it benefit me?

The Tax Commission Of The City Of New York NYC gov. is responsible for overseeing property tax assessments and providing services related to tax appeals. By understanding its operations, you can navigate the appeals process more effectively. Leveraging airSlate SignNow can simplify eSigning documents related to your tax submissions, making the whole process more efficient.

-

How does airSlate SignNow assist with tax-related documents for the Tax Commission Of The City Of New York NYC gov.?

airSlate SignNow offers a streamlined platform for sending and eSigning tax-related documents required by the Tax Commission Of The City Of New York NYC gov. Our eSignature solution ensures that your forms are securely signed and submitted electronically, saving you time and reducing paperwork.

-

Is airSlate SignNow affordable for businesses dealing with the Tax Commission Of The City Of New York NYC gov.?

Yes, airSlate SignNow is designed to be cost-effective, particularly for businesses that frequently interact with the Tax Commission Of The City Of New York NYC gov. By eliminating the need for paper documents and manual processing, our platform helps reduce costs associated with document management.

-

What features does airSlate SignNow offer for managing tax documents with the Tax Commission Of The City Of New York NYC gov.?

airSlate SignNow includes a variety of features such as templates for tax documents, automated workflows, and secure cloud storage. These tools enhance productivity when dealing with the Tax Commission Of The City Of New York NYC gov., allowing you to quickly create, send, and manage your requirements efficiently.

-

Can I integrate airSlate SignNow with other applications to assist with the Tax Commission Of The City Of New York NYC gov.?

Absolutely! airSlate SignNow seamlessly integrates with various applications including CRMs and project management tools, which can be particularly beneficial when handling tasks involving the Tax Commission Of The City Of New York NYC gov. These integrations streamline your workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning documents for the Tax Commission Of The City Of New York NYC gov.?

Using airSlate SignNow allows you to eSign documents securely and legally, ensuring compliance with the standards set by the Tax Commission Of The City Of New York NYC gov. The platform's user-friendly interface also helps you save time and reduce errors, which can be crucial during tax season.

-

How can I ensure my documents meet the requirements of the Tax Commission Of The City Of New York NYC gov.?

With airSlate SignNow, you can utilize customizable templates that align with the requirements of the Tax Commission Of The City Of New York NYC gov. By using these templates, you can ensure that your documents are complete and compliant before submission, thus reducing the chances of rejections or delays.

Get more for Tax Commission Of The City Of New York NYC gov

- Kentucky department for public health instructions for the chfs ky form

- Kyc form askari investment management limited

- I went to bed time form

- H1204 form

- Sample wedding day itinerary princess weddings and functions form

- Colorado resale certificate form

- Request for reimbursement request for reimbursement form

- Employment application form 688265199

Find out other Tax Commission Of The City Of New York NYC gov

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF