Application for Correction of Assessed Value NYC Gov Nyc 2012

What is the Application For Correction Of Assessed Value NYC gov NYC

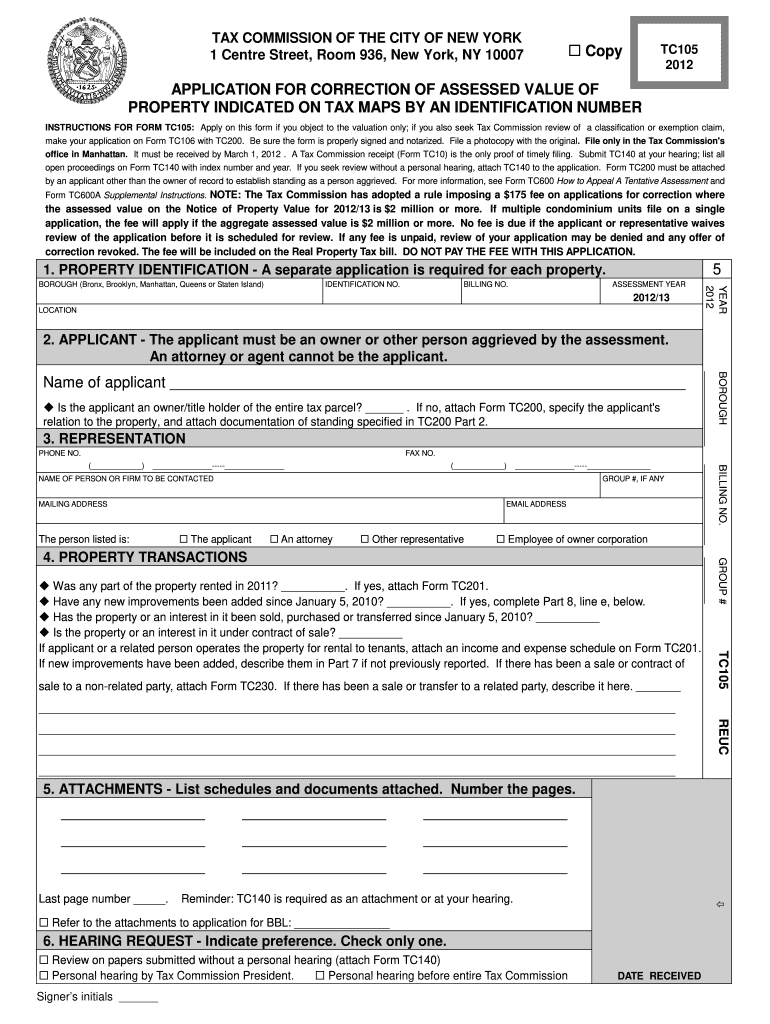

The Application For Correction Of Assessed Value is a formal request submitted to the NYC Department of Finance. This application allows property owners to challenge the assessed value of their property, which can impact property taxes. By filing this application, property owners can seek to adjust their property's assessed value if they believe it is inaccurately appraised. This process ensures that property taxes reflect the true market value of the property, promoting fairness in taxation.

How to use the Application For Correction Of Assessed Value NYC gov NYC

Using the Application For Correction Of Assessed Value involves several straightforward steps. First, property owners must gather relevant documentation that supports their claim, such as recent property appraisals or sales data for comparable properties. Next, they should fill out the application form accurately, ensuring all required information is included. Once completed, the application can be submitted electronically or by mail to the appropriate department. It is important to keep a copy of the submitted application for personal records.

Steps to complete the Application For Correction Of Assessed Value NYC gov NYC

Completing the Application For Correction Of Assessed Value requires careful attention to detail. The following steps outline the process:

- Obtain the application form from the NYC Department of Finance website.

- Gather supporting documents, such as proof of property value or recent sales data.

- Fill out the application form, ensuring all sections are completed accurately.

- Review the application for any errors or omissions.

- Submit the application either online or via mail, following the instructions provided on the form.

Eligibility Criteria

To be eligible to file the Application For Correction Of Assessed Value, property owners must meet specific criteria. The applicant must be the current owner of the property in question and must have a valid reason for disputing the assessed value. Common grounds for eligibility include discrepancies between the assessed value and the market value or errors in property details such as square footage or property type. It is essential to provide adequate documentation to support the claim.

Required Documents

When submitting the Application For Correction Of Assessed Value, certain documents are necessary to substantiate the claim. These may include:

- Recent property appraisals or market analysis reports.

- Sales data for similar properties in the area.

- Documentation of any improvements or changes made to the property.

- Previous tax bills or assessments for comparison.

Having these documents ready can significantly enhance the chances of a successful appeal.

Form Submission Methods

The Application For Correction Of Assessed Value can be submitted through various methods, ensuring convenience for property owners. The options include:

- Online submission via the NYC Department of Finance website.

- Mailing the completed form to the designated office address.

- In-person submission at specific Department of Finance locations.

Each method has its own guidelines, so it is advisable to follow the instructions carefully to avoid delays in processing.

Quick guide on how to complete application for correction of assessed value nycgov nyc

Your assistance manual on how to prepare your Application For Correction Of Assessed Value NYC gov Nyc

If you're curious about how to finalize and submit your Application For Correction Of Assessed Value NYC gov Nyc, here are a few straightforward guidelines to simplify your tax submission process.

To initiate, simply create your airSlate SignNow account to revolutionize your online document handling. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and complete your tax documents with ease. With its editor, you can navigate between text, check boxes, and eSignatures, allowing you to revise information as necessary. Enhance your tax management through advanced PDF editing, eSigning, and seamless sharing.

Follow these instructions to complete your Application For Correction Of Assessed Value NYC gov Nyc in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Application For Correction Of Assessed Value NYC gov Nyc in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and amend any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to increased return errors and delayed refunds. Additionally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct application for correction of assessed value nycgov nyc

FAQs

-

What are the chances of getting a refund for a NYC towing overcharge? I was charged the "heavy duty towing fee" of 370, even though my car is far under the weight requirement. I filled out the refund form but am worried the city will not refund me.

First realize you’re dealing with the parking dept bureaucracy. Some little worker bee has the power to approve or reject your request. Make them happy as follows:Follow their instructions. Fill out the forms legibly and completely. I even make a point of putting “N/A or None” in the blanks that don’t apply. This shows the worker bee that you completely read and respect their form.It also shows you pay attention to detail and you may be difficult and time consuming to deal with if you continue to dispute the fee.Provide supporting documentation…a photo of the vehicle, one of the gross vehicle weight/tire pressure label, maybe the weight specs from the manufacturer.Submit your application in a timely manner.Be patient. It may take weeks or months for your request to work its way through the system. Follow up every few weeks. Be sure you include the citation number, confirmation number on any correspondence.Remember, you’re only going to get the difference between the standard and heavy duty fees.It’s kind of a headache to deal with but its their game and their rules.Ive fought minor issues such as parking tickets or refunds over the years. It’s kind of fun and interesting to see how the system works and very satisfying when you win your case.

-

Do we have to separately fill out the application forms of medial institutions like AMU apart from the NEET application form for 2017?

No there's no separate exam to get into AMU , the admission will be based on your NEET score.

Create this form in 5 minutes!

How to create an eSignature for the application for correction of assessed value nycgov nyc

How to make an electronic signature for your Application For Correction Of Assessed Value Nycgov Nyc in the online mode

How to create an electronic signature for your Application For Correction Of Assessed Value Nycgov Nyc in Google Chrome

How to make an eSignature for putting it on the Application For Correction Of Assessed Value Nycgov Nyc in Gmail

How to make an eSignature for the Application For Correction Of Assessed Value Nycgov Nyc straight from your smartphone

How to generate an electronic signature for the Application For Correction Of Assessed Value Nycgov Nyc on iOS

How to create an electronic signature for the Application For Correction Of Assessed Value Nycgov Nyc on Android OS

People also ask

-

What is the Application For Correction Of Assessed Value NYC gov Nyc?

The Application For Correction Of Assessed Value NYC gov Nyc is a formal process that allows property owners to challenge their property tax assessments. By filing this application, you can potentially lower your property taxes if you believe your assessed value is too high.

-

How can airSlate SignNow help with the Application For Correction Of Assessed Value NYC gov Nyc?

airSlate SignNow streamlines the process of submitting the Application For Correction Of Assessed Value NYC gov Nyc by allowing you to easily eSign and send your documents online. This ensures that your application is submitted quickly and securely, saving you time and effort.

-

What are the costs associated with the Application For Correction Of Assessed Value NYC gov Nyc?

While the Application For Correction Of Assessed Value NYC gov Nyc itself does not have a filing fee, there may be costs associated with preparing your application. Utilizing airSlate SignNow can reduce these costs by simplifying document management and eSigning, making it a cost-effective solution.

-

Is the Application For Correction Of Assessed Value NYC gov Nyc easy to complete?

Yes, the Application For Correction Of Assessed Value NYC gov Nyc is designed to be user-friendly. With airSlate SignNow, you can follow an intuitive process to fill out and submit your application efficiently, reducing any confusion during the process.

-

What features does airSlate SignNow offer for the Application For Correction Of Assessed Value NYC gov Nyc?

airSlate SignNow offers robust features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for handling the Application For Correction Of Assessed Value NYC gov Nyc. These features enhance the overall user experience and ensure your documents are managed effectively.

-

Can I integrate airSlate SignNow with other applications for the Application For Correction Of Assessed Value NYC gov Nyc?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to connect your workflow for the Application For Correction Of Assessed Value NYC gov Nyc with other tools you may already be using. This integration helps streamline your processes even further.

-

What are the benefits of using airSlate SignNow for my property tax application?

Using airSlate SignNow for your Application For Correction Of Assessed Value NYC gov Nyc offers numerous benefits, including enhanced security, quick turnaround times, and easy document management. This ensures that your application process is efficient and stress-free.

Get more for Application For Correction Of Assessed Value NYC gov Nyc

- Self exclusion form

- Cdcr classification score sheet form

- Brazil health declaration form pdf

- Canara bank withdrawal slip pdf form

- Alverno college transcript request 12128520 form

- Confirmation of claim to refugee and protection status in new bb form

- Rent verification form keller williams realty

- Separation employee form

Find out other Application For Correction Of Assessed Value NYC gov Nyc

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement