Com Provides a Wide Range of IRS Tax Publications and Tax Information

Understanding IRS Tax Publications and Information

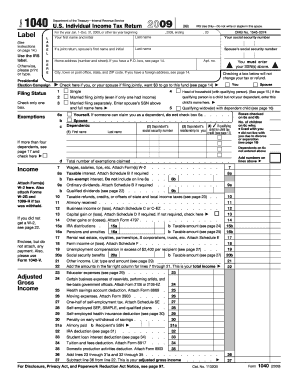

The IRS provides a comprehensive array of tax publications and information to assist taxpayers in understanding their obligations and rights. These publications cover various topics, including income tax, deductions, credits, and specific situations like self-employment. Each publication is designed to clarify complex tax issues, making it easier for individuals and businesses to comply with federal tax laws.

How to Access IRS Tax Publications

Accessing IRS tax publications is straightforward. You can visit the official IRS website, where a dedicated section lists all available publications. Users can search by keyword or browse through categories. Additionally, many publications can be downloaded in PDF format for easy reference. For those who prefer physical copies, the IRS also offers options to order publications by mail.

Steps to Utilize IRS Tax Publications Effectively

To make the most of IRS tax publications, follow these steps:

- Identify the specific tax issue or question you need assistance with.

- Search for the relevant publication using the IRS website’s search feature.

- Read the publication thoroughly, noting any important details related to your situation.

- Keep the publication handy while preparing your tax forms to ensure compliance.

Key Elements of IRS Tax Publications

IRS tax publications typically include essential elements such as:

- Definitions of key terms related to tax topics.

- Step-by-step instructions for completing forms.

- Examples that illustrate common scenarios.

- Important deadlines and filing requirements.

IRS Guidelines for Tax Compliance

The IRS outlines specific guidelines to help taxpayers navigate their responsibilities. These guidelines include information on filing requirements, acceptable deductions, and credits. Staying informed about these guidelines is crucial for avoiding penalties and ensuring accurate tax filings.

Filing Deadlines and Important Dates

Taxpayers must be aware of critical filing deadlines to avoid late fees and penalties. The IRS typically sets the annual tax filing deadline for April 15, unless it falls on a weekend or holiday. Additionally, there are deadlines for estimated tax payments and extensions. Keeping track of these dates is essential for timely compliance.

Quick guide on how to complete com provides a wide range of irs tax publications and tax information

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered operation today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure outstanding communication at every phase of the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Com Provides A Wide Range Of IRS Tax Publications And Tax Information

Create this form in 5 minutes!

How to create an eSignature for the com provides a wide range of irs tax publications and tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of IRS tax publications can I access through airSlate SignNow?

airSlate SignNow Com Provides A Wide Range Of IRS Tax Publications And Tax Information, including forms, instructions, and guidelines necessary for tax preparation. Users can easily find and access the specific publications they need to ensure compliance and accuracy in their tax filings.

-

How does airSlate SignNow help with tax document management?

With airSlate SignNow, businesses can efficiently manage their tax documents by utilizing features that allow for easy eSigning and document sharing. This platform Com Provides A Wide Range Of IRS Tax Publications And Tax Information, making it simple to keep all necessary documents organized and accessible.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that Com Provides A Wide Range Of IRS Tax Publications And Tax Information, ensuring that users can find the right solution for their budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software. This capability ensures that users can easily access the IRS tax publications and information they need, as airSlate SignNow Com Provides A Wide Range Of IRS Tax Publications And Tax Information to streamline their workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. The platform Com Provides A Wide Range Of IRS Tax Publications And Tax Information, allowing users to efficiently manage their tax documentation and ensure compliance.

-

How can I ensure my tax documents are secure with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage solutions. By using this platform, you can trust that your sensitive tax information is protected while still having access to the IRS tax publications and information that Com Provides A Wide Range Of IRS Tax Publications And Tax Information.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed to be user-friendly, even for those who are new to eSigning. The intuitive interface and helpful resources ensure that users can easily navigate the platform and access the IRS tax publications and information that Com Provides A Wide Range Of IRS Tax Publications And Tax Information.

Get more for Com Provides A Wide Range Of IRS Tax Publications And Tax Information

- Cape form 33028503

- Pellissippi transcript request form

- Christian brothers university certificate of financial support memphis tennessee 38104 u cbu form

- Liberty dental referral form

- Home loan application form for individual sole bdo unibank inc

- Dhs 1273c form

- Kane county illinois raffle license form

- Englisch hilfen de learning english online form

Find out other Com Provides A Wide Range Of IRS Tax Publications And Tax Information

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter