Irs Form 15272 Fill Out and Sign Printable PDF Template 2022-2026

Understanding Form 14446

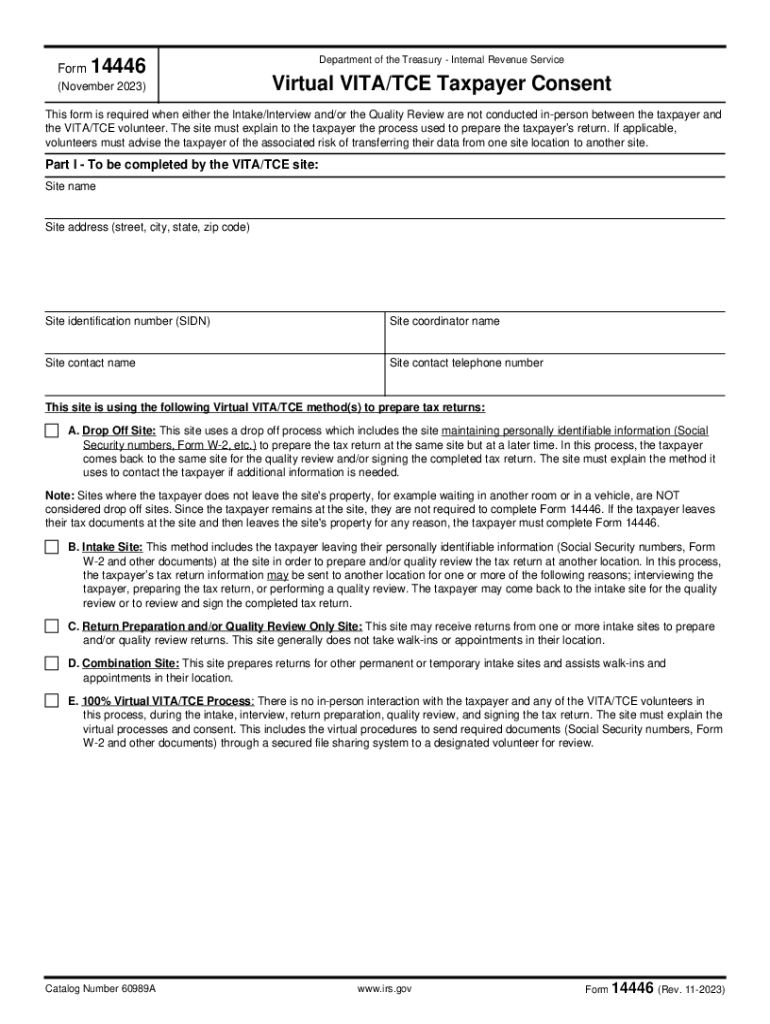

Form 14446 is a document used by taxpayers to request a waiver of penalties for failure to file or pay taxes on time. This form is particularly relevant for individuals and businesses who may have encountered extenuating circumstances that hindered their ability to meet tax obligations. Understanding the purpose and importance of this form can help taxpayers navigate their responsibilities more effectively.

Steps to Complete Form 14446

Completing Form 14446 involves several key steps:

- Gather necessary information, including your personal identification details and tax information.

- Clearly explain the reason for your request, providing any supporting documentation that validates your circumstances.

- Review the form for accuracy, ensuring all sections are filled out completely.

- Sign and date the form before submission.

Legal Use of Form 14446

Form 14446 serves a legal purpose by allowing taxpayers to formally request relief from penalties. It is essential to use the form correctly and submit it within the appropriate time frame to ensure compliance with IRS regulations. Failing to do so may result in the denial of your request.

Filing Deadlines for Form 14446

Timeliness is crucial when submitting Form 14446. Taxpayers should be aware of the filing deadlines associated with their tax returns and any penalties incurred. Generally, requests for penalty relief should be submitted as soon as the taxpayer becomes aware of the failure to file or pay, ideally within a reasonable time frame after the due date.

Required Documents for Submission

When submitting Form 14446, it is important to include any necessary supporting documents. This may include:

- Proof of extenuating circumstances, such as medical records or financial statements.

- Any previous correspondence with the IRS regarding your tax situation.

- Documentation demonstrating compliance with tax obligations in prior years.

Form Submission Methods

Form 14446 can be submitted to the IRS through various methods:

- Online submission via the IRS website if applicable.

- Mailing the completed form to the appropriate IRS address based on your location.

- In-person submission at designated IRS offices, if necessary.

Examples of Using Form 14446

Taxpayers may find themselves in situations where Form 14446 is applicable. For instance:

- A self-employed individual who faced unexpected medical expenses that impacted their ability to file taxes on time.

- A business owner who experienced natural disasters affecting their operations and financial stability.

Quick guide on how to complete irs form 15272 fill out and sign printable pdf template

Complete Irs Form 15272 Fill Out And Sign Printable PDF Template seamlessly on any device

Online document management has gained signNow popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to acquire the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Manage Irs Form 15272 Fill Out And Sign Printable PDF Template on any device using airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

How to modify and eSign Irs Form 15272 Fill Out And Sign Printable PDF Template with ease

- Locate Irs Form 15272 Fill Out And Sign Printable PDF Template and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from your preferred device. Adjust and eSign Irs Form 15272 Fill Out And Sign Printable PDF Template and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 15272 fill out and sign printable pdf template

Create this form in 5 minutes!

How to create an eSignature for the irs form 15272 fill out and sign printable pdf template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14446?

Form 14446 is a document used for certain IRS filings. It is essential for businesses to understand its requirements and applications to ensure compliance with tax laws. airSlate SignNow offers a seamless way to eSign and send form 14446 securely.

-

How can airSlate SignNow help with form 14446 signing?

With airSlate SignNow, you can efficiently eSign form 14446 within minutes. Our platform provides an easy-to-use interface, ensuring that your documents are signed promptly and securely, which is crucial for meeting filing deadlines.

-

What are the benefits of using airSlate SignNow for form 14446?

Using airSlate SignNow for form 14446 offers multiple benefits, including time savings and enhanced security. Our solution streamlines the signing process, reduces the risk of errors, and keeps your sensitive data protected.

-

Is there a cost associated with using airSlate SignNow for form 14446?

Yes, airSlate SignNow offers different pricing plans to suit various business needs. These plans include features that enable users to easily manage and eSign documents like form 14446 without breaking the bank.

-

Can airSlate SignNow integrate with other applications when handling form 14446?

Absolutely! airSlate SignNow supports integrations with a variety of applications. This capacity ensures that you can manage form 14446 alongside your other business processes seamlessly and efficiently.

-

What features does airSlate SignNow offer for form 14446 management?

airSlate SignNow provides features such as customizable templates, mobile signing, and real-time tracking for form 14446. These tools facilitate a smooth and organized document management experience, allowing you to track the status of your forms.

-

Is airSlate SignNow compliant with regulations for form 14446?

Yes, airSlate SignNow complies with industry regulations, ensuring that your use of form 14446 is secure and legitimate. Our platform is built to meet legal standards while providing an efficient eSigning solution.

Get more for Irs Form 15272 Fill Out And Sign Printable PDF Template

- Pet policy metroplains management form

- Distress assessment tool form

- Attestation statement for exclusion from pps editable form

- Vl115 claim allowance for locality allowance all staff vl115 claim allowance for locality allowance all staff form

- Credit for contributions to certified school tuition form

- Form 2220 underpayment of estimated tax by corporations

- Instructions for form 1040 nr

- Irs issues guidance on exceptions from electronic filing form

Find out other Irs Form 15272 Fill Out And Sign Printable PDF Template

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form