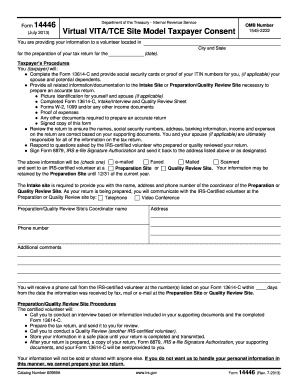

Form 14446 2013

What is the Form 14446

The IRS Form 14446 is a tax form used primarily for the purpose of claiming a refund for overpaid taxes or for specific tax credits. This form is particularly relevant for individuals who have experienced changes in their tax situations, such as receiving additional income or deductions that affect their overall tax liability. Understanding the purpose and function of Form 14446 is essential for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the Form 14446

Using IRS Form 14446 involves several key steps. Initially, gather all necessary documentation, including previous tax returns and any relevant financial records. Next, accurately fill out the form, ensuring that all required fields are completed and that the information provided aligns with your financial status. After completing the form, review it for accuracy before submission. This careful approach helps prevent delays in processing and potential issues with your tax refund.

Steps to complete the Form 14446

Completing IRS Form 14446 requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, including your Social Security number and income statements.

- Fill out the form with accurate personal and financial information.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

- Submit the form either electronically or via mail, depending on your preference.

Legal use of the Form 14446

The legal use of IRS Form 14446 is governed by specific IRS guidelines. To ensure that your submission is valid, it is essential to comply with all regulations surrounding the form. This includes providing truthful information and adhering to deadlines set by the IRS. Failure to comply with these guidelines may result in penalties or delays in processing your tax refund.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 14446 are crucial for taxpayers to observe. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Staying informed about important dates helps ensure that your form is filed on time, preventing any potential issues with your tax refund.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 14446 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Many taxpayers prefer to submit their forms electronically through the IRS website or authorized e-filing services.

- Mail: You can print the completed form and send it to the designated IRS address based on your location.

- In-Person: Some taxpayers may choose to deliver their forms directly to an IRS office for immediate processing.

Quick guide on how to complete form 14446 21158360

Effortlessly Prepare Form 14446 on Any Device

Digital document management has gained traction among businesses and individuals. It presents an ideal environmentally friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Form 14446 on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-based process today.

The Easiest Method to Edit and eSign Form 14446 with Ease

- Locate Form 14446 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 14446 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14446 21158360

Create this form in 5 minutes!

How to create an eSignature for the form 14446 21158360

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 14446, and why do I need it?

IRS Form 14446 is a tax form that establishes the taxpayer's eligibility for specific tax benefits. It is important for individuals and businesses seeking to apply for these benefits to ensure compliance with IRS regulations.

-

How does airSlate SignNow help with IRS Form 14446?

airSlate SignNow provides a streamlined platform for businesses to send and eSign IRS Form 14446 efficiently. With our electronic signature solution, you can ensure that your form is completed accurately and submitted on time, helping you avoid potential delays.

-

What are the pricing plans for airSlate SignNow regarding IRS Form 14446?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. These plans are cost-effective and designed to provide maximum value for users who regularly handle IRS Form 14446 and other important documents.

-

Are there any features specifically designed for IRS Form 14446?

Yes, airSlate SignNow includes features that enhance the signing process for IRS Form 14446, such as templating, reminders, and compliance tracking. These features help streamline the handling of important tax documents, simplifying the process for our users.

-

Can I integrate airSlate SignNow with other platforms for handling IRS Form 14446?

Absolutely! airSlate SignNow easily integrates with various platforms such as CRM systems and document management tools, allowing for a seamless workflow when managing IRS Form 14446. This integration ensures that all your documents are centralized and accessible.

-

Is it secure to send IRS Form 14446 using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your IRS Form 14446 and other sensitive documents are transmitted securely, providing peace of mind for our users.

-

What benefits does using airSlate SignNow provide for IRS Form 14446?

Using airSlate SignNow for IRS Form 14446 offers several benefits, including enhanced efficiency, accuracy, and compliance. Our solution empowers businesses to manage their tax documents better, ultimately saving time and resources while ensuring compliance with IRS guidelines.

Get more for Form 14446

- Record no 18 1524 in the united states court of form

- Wv code 14 west virginia legislature form

- You are instructed that the driver of an automobile owes pedestrians while walking along form

- Proving and pricing subcontractor delay claims cmaa com form

- The court instructs the jury that you are to return a verdict in favor of the plaintiff form

- Trial law notebook 060314 department of public advocacy form

- Avoiding the impact of a no damages for delay clause in form

- You are instructed that surety ship is not insurance and that a surety is entitled to seek form

Find out other Form 14446

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document