Form 14446 2016

What is the Form 14446

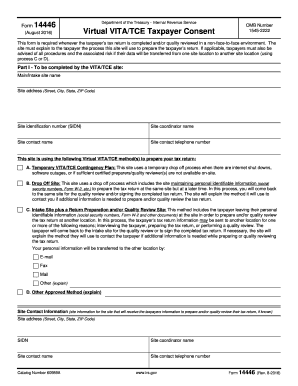

The Form 14446, also known as the VITA Virtual Consent Form, is a document used primarily by taxpayers participating in the Volunteer Income Tax Assistance (VITA) program. This form allows taxpayers to consent to the electronic preparation and filing of their tax returns. It is essential for ensuring that all parties involved understand the scope of the services provided and the confidentiality of the information shared.

How to use the Form 14446

To use the Form 14446, taxpayers must first fill out the required fields, which typically include personal information such as name, address, and Social Security number. After completing the form, it should be signed electronically or physically, depending on the submission method chosen. This consent is crucial for the VITA program to proceed with the tax preparation process on behalf of the taxpayer.

Steps to complete the Form 14446

Completing the Form 14446 involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and contact details.

- Access the form, either online or in a printable format.

- Fill out the required fields accurately, ensuring all information is current.

- Review the completed form for any errors or omissions.

- Sign the form electronically or print it for a physical signature.

- Submit the form according to the instructions provided, either online or by mail.

Legal use of the Form 14446

The legal use of the Form 14446 is governed by several regulations that ensure the confidentiality and security of taxpayer information. By signing this form, taxpayers grant permission for their data to be used in the preparation of their tax returns. The form must be completed accurately and submitted in compliance with IRS guidelines to maintain its validity.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the Form 14446. Typically, the form should be submitted before the tax return filing deadline, which is usually April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances or extensions granted by the IRS. Keeping track of these dates helps ensure compliance and avoids potential penalties.

Form Submission Methods

The Form 14446 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the VITA program. Common submission methods include:

- Online submission through secure portals provided by the VITA program.

- Mailing a printed copy of the form to the designated VITA site.

- In-person submission at a local VITA site, where assistance may be available.

Quick guide on how to complete form 14446

Easily Prepare Form 14446 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly replacement for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and eSign your documents without any delays. Handle Form 14446 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Simplest Way to Modify and eSign Form 14446 Effortlessly

- Acquire Form 14446 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools designed specifically for that by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 14446 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14446

Create this form in 5 minutes!

How to create an eSignature for the form 14446

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14446?

Form 14446 is a document used by businesses to ensure compliance with federal regulations when submitting electronic records. This form is essential for operations that involve electronic signatures and can streamline various processes. Utilizing airSlate SignNow, you can easily eSign and submit the form 14446, saving time and reducing errors.

-

How does airSlate SignNow simplify the process of completing form 14446?

airSlate SignNow offers an intuitive interface that guides users through the process of completing form 14446. With features like drag-and-drop fields and customizable templates, you can quickly fill out and eSign the form. This streamlined approach minimizes paperwork and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for form 14446?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who frequently use form 14446. The pricing is competitive and reflects the value of features such as unlimited eSignatures and integrations. You can choose a plan that aligns with your business requirements and budget.

-

Can I integrate form 14446 with other applications using airSlate SignNow?

Absolutely! airSlate SignNow provides integrations with several popular applications, allowing you to seamlessly work with form 14446 alongside your existing tools. Whether you need to integrate with CRM systems or document management software, airSlate SignNow can help streamline your workflows signNowly.

-

What benefits does airSlate SignNow provide for submitting form 14446?

Using airSlate SignNow for submitting form 14446 can improve the speed and accuracy of your submissions. The platform ensures compliance and provides an audit trail, helping you maintain accountability. Additionally, its cost-effective solution makes it a smart choice for businesses looking to enhance efficiency.

-

How secure is my data when using airSlate SignNow for form 14446?

airSlate SignNow prioritizes data security with advanced encryption and secure cloud storage for all documents, including form 14446. You can confidently manage sensitive information knowing that robust security measures are in place. This commitment to security helps protect your business and its clients.

-

What features does airSlate SignNow offer that are beneficial for managing form 14446?

airSlate SignNow offers features such as templates, customizable fields, and real-time tracking, all of which are beneficial when managing form 14446. These features allow you to create efficient workflows and ensure that all necessary information is captured correctly. This enhances the speed and accuracy of processing your form.

Get more for Form 14446

Find out other Form 14446

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form