IRP Exemption to Title Ad Valorem Tax a 2019-2026

Understanding the IRP Exemption to Title Ad Valorem Tax A

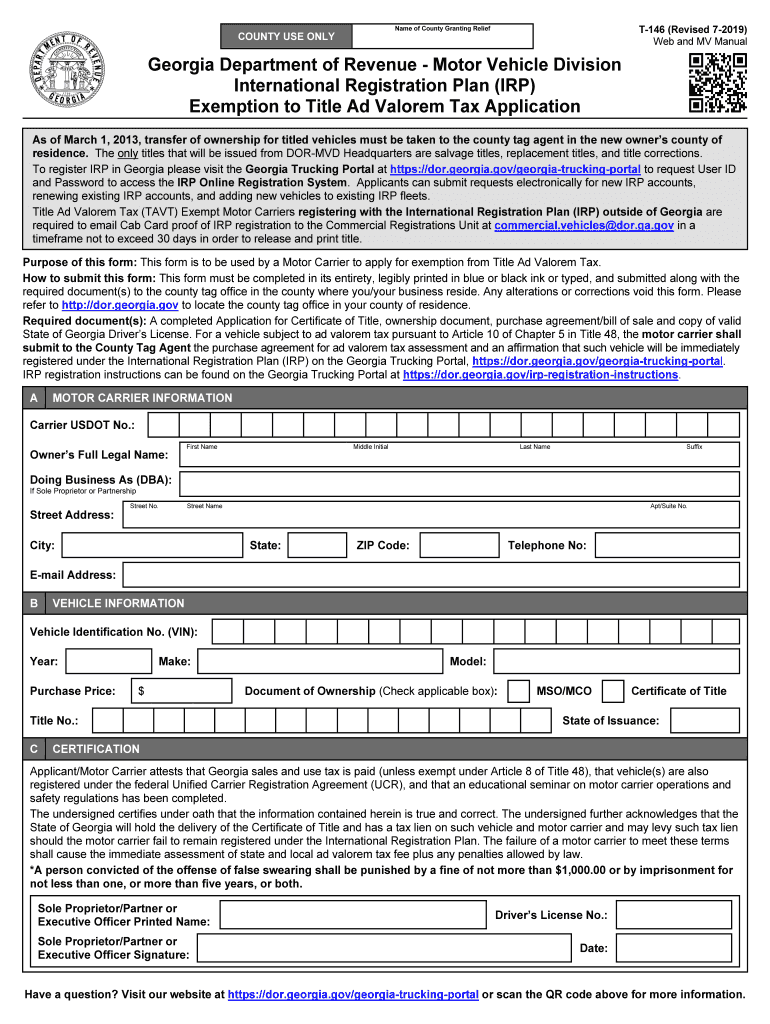

The IRP Exemption to Title Ad Valorem Tax A is a provision that allows certain vehicles to be exempt from the ad valorem tax imposed on motor vehicle titles in Georgia. This exemption is primarily applicable to vehicles registered under the International Registration Plan (IRP), which is designed for commercial vehicles that operate in multiple jurisdictions. Understanding this exemption is crucial for vehicle owners who may qualify, as it can significantly reduce their tax liabilities.

Steps to Utilize the IRP Exemption to Title Ad Valorem Tax A

To take advantage of the IRP Exemption to Title Ad Valorem Tax A, vehicle owners must follow specific steps. First, ensure that your vehicle is registered under the IRP. Next, complete the necessary application forms, including the exemption request. It is essential to provide accurate information regarding the vehicle and its use. Once the forms are completed, submit them to the appropriate state authority for review. Keeping records of all submissions and communications is advisable for future reference.

Required Documents for the IRP Exemption to Title Ad Valorem Tax A

When applying for the IRP Exemption to Title Ad Valorem Tax A, several documents are necessary to support your application. These typically include:

- Proof of IRP registration

- Completed exemption application form

- Documentation of vehicle use (e.g., logs or contracts)

- Identification and ownership proof for the vehicle

Having these documents ready can streamline the application process and help avoid delays.

Eligibility Criteria for the IRP Exemption to Title Ad Valorem Tax A

Eligibility for the IRP Exemption to Title Ad Valorem Tax A is generally limited to vehicles that meet specific criteria. These criteria often include being registered under the IRP and primarily used for commercial purposes. Additionally, the vehicle must not be used for personal use or in a manner that would disqualify it from the exemption. It is important to review the specific eligibility requirements set forth by Georgia state authorities to ensure compliance.

Filing Deadlines for the IRP Exemption to Title Ad Valorem Tax A

Filing deadlines for the IRP Exemption to Title Ad Valorem Tax A can vary based on the vehicle's registration and the specific tax year. Typically, applications should be submitted before the end of the tax year to ensure that the exemption is applied to that year's tax assessment. It is advisable to check with the Georgia Department of Revenue for the most current deadlines and any changes that may affect your application.

Penalties for Non-Compliance with the IRP Exemption to Title Ad Valorem Tax A

Failing to comply with the requirements associated with the IRP Exemption to Title Ad Valorem Tax A can result in penalties. These may include back taxes owed, interest on unpaid amounts, and potential fines. Understanding the implications of non-compliance is essential for vehicle owners to avoid unexpected financial burdens. Regularly reviewing compliance requirements and maintaining accurate records can help mitigate these risks.

Quick guide on how to complete irp exemption to title ad valorem tax a

Effortlessly Prepare IRP Exemption To Title Ad Valorem Tax A on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage IRP Exemption To Title Ad Valorem Tax A on any device utilizing the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Most Efficient Way to Edit and Electronically Sign IRP Exemption To Title Ad Valorem Tax A with Ease

- Locate IRP Exemption To Title Ad Valorem Tax A and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRP Exemption To Title Ad Valorem Tax A and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irp exemption to title ad valorem tax a

Create this form in 5 minutes!

How to create an eSignature for the irp exemption to title ad valorem tax a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GA tax form?

The GA tax form is used by residents and businesses in Georgia to report income and calculate their state tax obligations. It is essential for ensuring compliance with state tax laws, and airSlate SignNow simplifies the process of completing and submitting this form digitally.

-

How can airSlate SignNow help me with the GA tax form?

airSlate SignNow offers an intuitive platform to easily create, sign, and share GA tax forms electronically. With our solution, you can streamline the workflow, reduce errors, and ensure timely submission of your state tax documents.

-

Is there a cost to use airSlate SignNow for GA tax forms?

Yes, airSlate SignNow provides affordable pricing plans that cater to businesses of all sizes. For GA tax forms, you can choose a plan that best fits your needs and budget while enjoying the benefits of secure eSigning and document management.

-

What features does airSlate SignNow offer for GA tax forms?

Key features of airSlate SignNow for GA tax forms include customizable templates, secure electronic signatures, and real-time tracking of document status. These features make it easier to manage your tax documents efficiently and visit any updates or changes made.

-

Can I integrate airSlate SignNow with other tools for GA tax forms?

Yes, airSlate SignNow supports integration with various tools and applications that you may already use for managing GA tax forms. This includes popular accounting software, CRM systems, and cloud storage services to enhance workflow and productivity.

-

How does eSigning GA tax forms with airSlate SignNow work?

eSigning GA tax forms using airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures, and send it out for signing. Recipients can eSign from anywhere, streamlining the process and reducing paperwork.

-

What are the benefits of using airSlate SignNow for GA tax forms?

Using airSlate SignNow for GA tax forms offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for your sensitive tax data. The platform ensures that your documents are signed and stored securely, helping you meet your compliance requirements effortlessly.

Get more for IRP Exemption To Title Ad Valorem Tax A

Find out other IRP Exemption To Title Ad Valorem Tax A

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document