InteresesInternal Revenue Service 2023-2026

What is the IRS SP Multas?

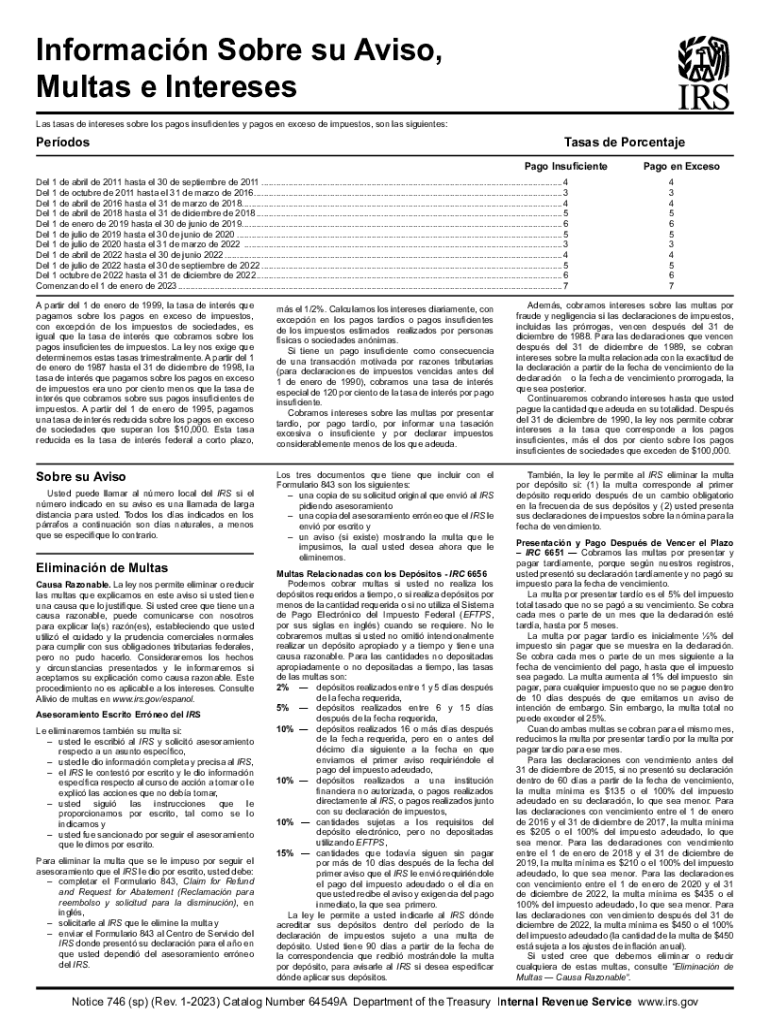

The IRS SP multas refers to penalties assessed by the Internal Revenue Service (IRS) for various types of non-compliance with tax regulations. These penalties can arise from late filings, underpayment of taxes, or failure to meet specific reporting requirements. Understanding these penalties is crucial for taxpayers to avoid unnecessary financial burdens and ensure compliance with tax laws.

Key Elements of IRS SP Multas

Several key elements characterize the IRS SP multas, including:

- Types of Penalties: These may include failure-to-file penalties, failure-to-pay penalties, and accuracy-related penalties.

- Calculation Methods: Penalties are typically calculated based on the amount owed and the duration of the non-compliance.

- Notification Process: Taxpayers usually receive a notice, such as Notice 746, detailing the penalties incurred and the reasons for them.

Steps to Complete IRS SP Multas

To address IRS SP multas effectively, taxpayers should follow these steps:

- Review Notices: Carefully read any notices received from the IRS regarding penalties.

- Gather Documentation: Collect all relevant tax documents, including prior filings and payment records.

- Calculate Amounts: Determine the total amount of penalties and interest accrued.

- Respond Timely: Submit any required responses or payments by the deadlines specified in the notices.

Penalties for Non-Compliance

Failing to comply with IRS regulations can lead to significant penalties. These may include:

- Monetary Fines: Fines can accumulate quickly, especially for late filings or payments.

- Interest Charges: Interest may accrue on unpaid penalties, further increasing the total amount owed.

- Legal Consequences: In severe cases, non-compliance can lead to legal action or additional scrutiny from the IRS.

IRS Guidelines for SP Multas

The IRS provides specific guidelines regarding the assessment and management of penalties. Key points include:

- Eligibility for Abatement: Taxpayers may qualify for penalty abatement under certain conditions, such as first-time compliance.

- Payment Plans: The IRS offers options for setting up payment plans for taxpayers unable to pay penalties in full.

- Appeal Process: Taxpayers have the right to appeal penalties they believe are unjustified.

Required Documents for IRS SP Multas

When addressing IRS SP multas, certain documents are essential:

- Tax Returns: Copies of relevant tax returns for the years in question.

- Payment Receipts: Documentation of any payments made towards taxes owed.

- Correspondence: Any communication received from the IRS regarding penalties.

Quick guide on how to complete interesesinternal revenue service

Complete InteresesInternal Revenue Service effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage InteresesInternal Revenue Service on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign InteresesInternal Revenue Service seamlessly

- Locate InteresesInternal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select how you'd like to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and eSign InteresesInternal Revenue Service to ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct interesesinternal revenue service

Create this form in 5 minutes!

How to create an eSignature for the interesesinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 'irs sp multas' and how do they relate to airSlate SignNow?

'irs sp multas' refers to IRS penalties that can impact businesses. airSlate SignNow simplifies the process of managing and signing documents related to these penalties, ensuring you remain compliant and avoid unnecessary fines.

-

How does airSlate SignNow help in minimizing 'irs sp multas'?

By automating document workflows and ensuring timely eSigning, airSlate SignNow helps businesses stay on top of IRS requirements. This proactive approach reduces the risk of missing deadlines that could lead to 'irs sp multas'.

-

What features does airSlate SignNow offer to address 'irs sp multas'?

airSlate SignNow offers features like customizable templates, real-time tracking, and secure cloud storage. These capabilities enable users to manage IRS-related documents efficiently, thereby minimizing the chance of incurring 'irs sp multas'.

-

Is airSlate SignNow cost-effective for handling 'irs sp multas'?

Yes, airSlate SignNow provides a cost-effective solution for document management, especially for compliance-related documents. By reducing administrative overhead and the risk of 'irs sp multas', it proves to be a wise financial choice for businesses.

-

Can airSlate SignNow integrate with accounting tools to manage 'irs sp multas'?

Absolutely! airSlate SignNow can be integrated with popular accounting software, making it easier to track and manage IRS penalties like 'irs sp multas'. This integration streamlines your workflow and ensures all your documents are in one place.

-

What are the benefits of using airSlate SignNow for IRS documentation?

Using airSlate SignNow enhances efficiency by allowing fast and secure eSigning of IRS-related documents. This quick turnaround helps prevent issues that could lead to 'irs sp multas' and ensures compliance with tax obligations.

-

How secure is airSlate SignNow for handling sensitive IRS documents?

airSlate SignNow employs top-notch security measures such as encryption and secure servers to protect sensitive IRS documents. This focus on security helps prevent data bsignNowes that could potentially lead to 'irs sp multas'.

Find out other InteresesInternal Revenue Service

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy