SP Internal Revenue Service 2020

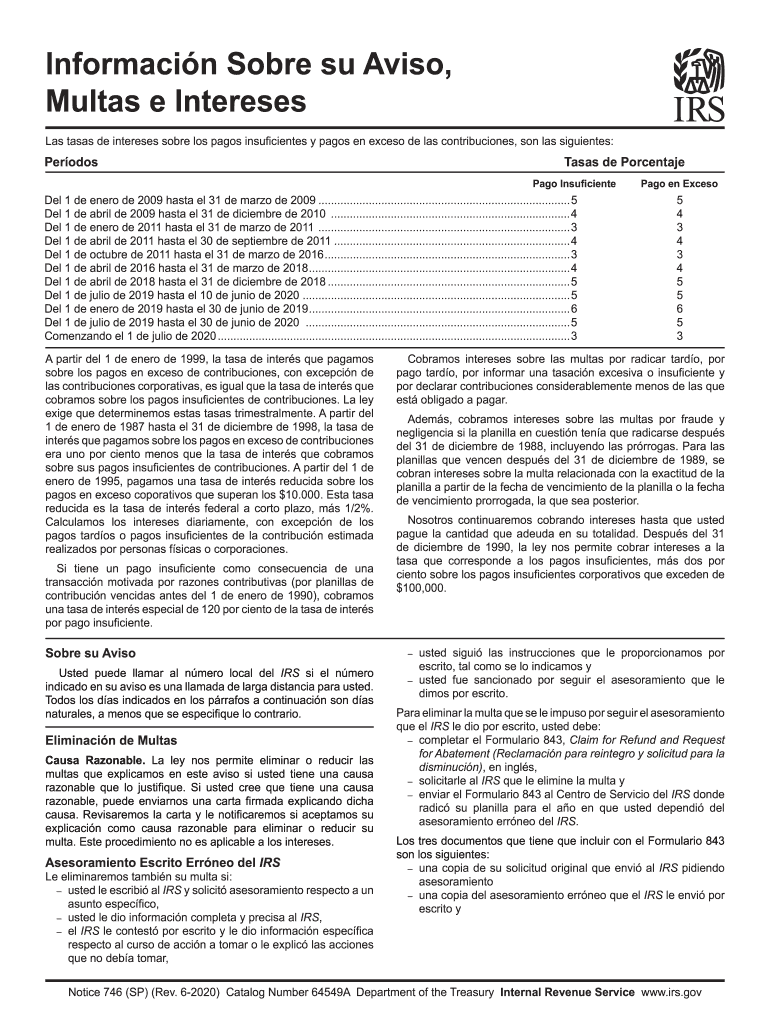

What is the SP Internal Revenue Service

The SP Internal Revenue Service form is a crucial document used within the United States tax system. It serves various purposes, primarily related to tax reporting and compliance. This form may be utilized by individuals or businesses to provide necessary information to the IRS, ensuring that all tax obligations are met accurately and timely. Understanding the specific requirements and purposes of this form can help taxpayers navigate their responsibilities effectively.

How to use the SP Internal Revenue Service

Using the SP Internal Revenue Service form involves several steps that ensure accurate completion and submission. First, gather all relevant financial documents and information required for the form. This may include income statements, deduction records, and other pertinent data. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, choose your preferred submission method, whether online, by mail, or in person, to ensure it reaches the IRS in a timely manner.

Steps to complete the SP Internal Revenue Service

Completing the SP Internal Revenue Service form involves a systematic approach:

- Gather necessary documents, including income statements and deduction records.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any mistakes or missing information.

- Choose a submission method: online, by mail, or in person.

- Submit the form and keep a copy for your records.

Legal use of the SP Internal Revenue Service

The legal use of the SP Internal Revenue Service form is governed by various regulations that ensure compliance with federal tax laws. It is essential to understand that any inaccuracies or omissions on the form can lead to penalties or legal repercussions. Therefore, using the form correctly and in accordance with IRS guidelines is vital for maintaining compliance and avoiding issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the SP Internal Revenue Service form can vary depending on the specific tax year and the taxpayer's situation. Typically, individual taxpayers must file their returns by April 15 each year, while businesses may have different deadlines based on their structure. It is important to stay informed about these dates to avoid late filing penalties and ensure timely compliance with tax obligations.

Required Documents

To complete the SP Internal Revenue Service form accurately, certain documents are typically required. These may include:

- W-2 forms from employers for income verification.

- 1099 forms for any freelance or contract work.

- Receipts and records for deductions and credits.

- Previous tax returns for reference.

Having these documents ready will streamline the process and help ensure accurate reporting.

Form Submission Methods (Online / Mail / In-Person)

The SP Internal Revenue Service form can be submitted through various methods, providing flexibility for taxpayers. Online submission is often the fastest and most efficient option, allowing for immediate processing. Alternatively, taxpayers can mail their completed forms to the appropriate IRS address or submit them in person at designated IRS offices. Each method has its own advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete sp internal revenue service

Complete SP Internal Revenue Service effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage SP Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign SP Internal Revenue Service effortlessly

- Locate SP Internal Revenue Service and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form retrieval, or errors that necessitate creating new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Edit and eSign SP Internal Revenue Service and promote clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sp internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the sp internal revenue service

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow's solution for managing documents related to the SP Internal Revenue Service?

airSlate SignNow offers a seamless platform to manage documents associated with the SP Internal Revenue Service. With our eSignature capabilities, businesses can easily send, sign, and store IRS-related documents, ensuring compliance and security. This simplifies the overall process for navigating IRS requirements, reducing administrative burden.

-

How much does airSlate SignNow cost for businesses dealing with SP Internal Revenue Service documents?

airSlate SignNow provides flexible pricing plans designed for all business sizes, especially for those handling SP Internal Revenue Service documentation. Our cost-effective solution ensures that you only pay for what you need, making it ideal for businesses seeking efficient document management. Additionally, we offer a variety of pricing tiers, including discounts for annual subscriptions.

-

What features does airSlate SignNow offer to assist with SP Internal Revenue Service compliance?

Our platform includes features that enhance compliance with SP Internal Revenue Service regulations, such as customizable templates, secure storage, and audit trails. These tools help maintain the integrity of your documents while ensuring that all signatures are legally binding. This gives businesses peace of mind when managing sensitive IRS-related information.

-

Can airSlate SignNow integrate with other tools for managing SP Internal Revenue Service documents?

Yes, airSlate SignNow integrates seamlessly with a variety of applications commonly used in managing SP Internal Revenue Service documents. This includes accounting software, CRM systems, and cloud storage solutions. Such integrations streamline workflows and enhance productivity, allowing you to handle IRS-related tasks more efficiently.

-

How does airSlate SignNow ensure the security of documents related to the SP Internal Revenue Service?

airSlate SignNow prioritizes document security, especially for those related to the SP Internal Revenue Service. Our platform employs advanced encryption, multi-factor authentication, and secure access controls to protect sensitive information. This guarantees that your IRS documents are safe while in transit and storage.

-

What benefits do businesses gain from using airSlate SignNow for SP Internal Revenue Service documentation?

By utilizing airSlate SignNow for SP Internal Revenue Service documentation, businesses can enjoy enhanced efficiency and reduced turnaround times. Our intuitive platform simplifies the signing process, which helps to expedite IRS submissions. Additionally, the cost-effective nature of our services provides signNow savings on document management.

-

Is there customer support available for users dealing with SP Internal Revenue Service documents on airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with SP Internal Revenue Service documents. Our knowledgeable team is available via multiple channels, ensuring that you receive the help needed to effectively utilize our platform for your IRS-related tasks. We also provide comprehensive resources and tutorials to guide you.

Get more for SP Internal Revenue Service

Find out other SP Internal Revenue Service

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile