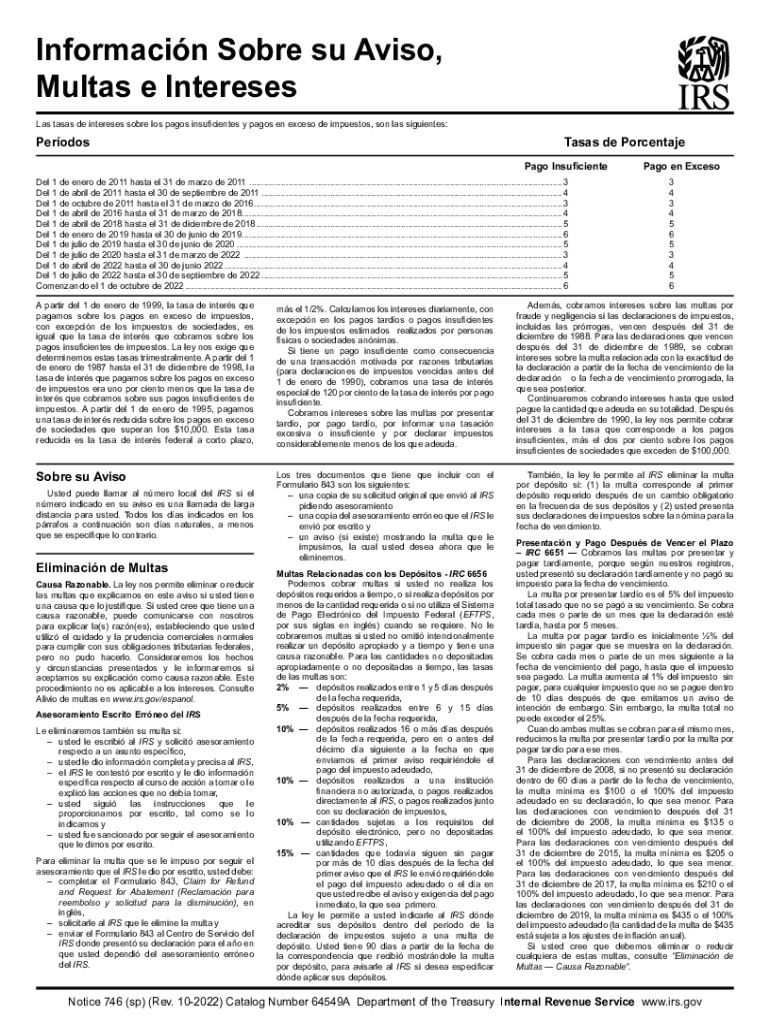

InteresesInternal Revenue Service IRS Tax Forms 2022

Understanding 2022 Multas

The term "2022 multas" refers to fines or penalties that may be imposed for various infractions, including traffic violations or tax-related issues, during the year 2022. These fines can vary significantly based on the nature of the violation and the jurisdiction in which they are issued. Understanding the specifics of these multas is crucial for individuals and businesses to ensure compliance with local laws and regulations.

How to Address 2022 Multas

Addressing 2022 multas typically involves several steps. First, it is essential to review the citation or notice received to understand the violation and the associated penalty. Next, individuals should determine if they wish to contest the fine or pay it. If contesting, gathering evidence or documentation to support the case is vital. Payment options often include online payment portals, mail, or in-person visits to designated offices. Each jurisdiction may have specific procedures, so checking local regulations is advisable.

Penalties for Non-Compliance with 2022 Multas

Failing to comply with 2022 multas can lead to additional penalties. These may include increased fines, late fees, or even legal action. In some cases, unresolved multas can affect driving records or lead to license suspensions. It is important to address these fines promptly to avoid further complications.

State-Specific Rules for 2022 Multas

Each state in the U.S. has its own rules and regulations regarding multas. These may include different fine amounts, payment deadlines, and options for contesting fines. Understanding the specific laws in your state can help individuals navigate the process more effectively. Consulting state or local government websites can provide detailed information about the applicable rules.

Examples of Common 2022 Multas

Common examples of 2022 multas include traffic violations such as speeding, running a red light, or parking in prohibited areas. Additionally, tax-related fines may arise from late filings or underreporting income. Each of these violations carries its own set of penalties, making it essential for individuals to be aware of potential fines they may face.

Required Documentation for Contesting 2022 Multas

When contesting a multa, specific documentation may be required. This can include a copy of the citation, evidence supporting the case (such as photographs or witness statements), and any relevant correspondence. Having a complete set of documents can strengthen the case and improve the chances of a favorable outcome.

Filing Deadlines for 2022 Multas

Filing deadlines for addressing 2022 multas can vary by jurisdiction. It is crucial to be aware of these deadlines to avoid additional penalties. Most jurisdictions will specify a timeframe within which fines must be paid or contested, and missing these deadlines can result in more severe consequences.

Quick guide on how to complete interesesinternal revenue service irs tax forms

Effortlessly Prepare InteresesInternal Revenue Service IRS Tax Forms on Any Device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without any delay. Manage InteresesInternal Revenue Service IRS Tax Forms on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign InteresesInternal Revenue Service IRS Tax Forms with Ease

- Obtain InteresesInternal Revenue Service IRS Tax Forms and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign InteresesInternal Revenue Service IRS Tax Forms to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct interesesinternal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What are '2022 multas' and how do they relate to airSlate SignNow?

2022 multas refer to the fines and penalties imposed in the year 2022. With airSlate SignNow, you can efficiently manage documentation related to these fines by sending, signing, and storing important documents securely online.

-

How can airSlate SignNow help businesses manage 2022 multas?

airSlate SignNow offers a streamlined process to send and eSign documents related to 2022 multas. Our platform allows businesses to create templates for common documents, ensuring compliance while saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for 2022 multas documentation?

We offer flexible pricing plans to accommodate various business needs for handling 2022 multas. Our plans include a free trial and competitive monthly subscriptions, allowing you to choose the option that best fits your budget.

-

Does airSlate SignNow integrate with other software for managing 2022 multas?

Yes, airSlate SignNow integrates seamlessly with popular applications like Google Workspace, Salesforce, and many more. This makes it easier to manage workflows related to 2022 multas and ensures that all documentation is easily accessible.

-

What features does airSlate SignNow offer to assist with 2022 multas?

airSlate SignNow includes features such as document tracking, customizable templates, and secure cloud storage specifically designed to help manage 2022 multas effectively. These tools enhance efficiency and ensure legal compliance without the hassle.

-

Is airSlate SignNow secure for handling sensitive information related to 2022 multas?

Absolutely! airSlate SignNow employs top-notch security measures to protect sensitive information, including that related to 2022 multas. Our platform is compliant with industry standards, ensuring that your data is safe and secure.

-

Can airSlate SignNow assist individuals as well as businesses with 2022 multas?

Yes, airSlate SignNow caters to both individuals and businesses dealing with 2022 multas. Our user-friendly interface makes it simple for anyone to send and sign necessary documents, making compliance accessible to all.

Get more for InteresesInternal Revenue Service IRS Tax Forms

- Framing contractor package new mexico form

- Foundation contractor package new mexico form

- Plumbing contractor package new mexico form

- Brick mason contractor package new mexico form

- Roofing contractor package new mexico form

- Electrical contractor package new mexico form

- Sheetrock drywall contractor package new mexico form

- Flooring contractor package new mexico form

Find out other InteresesInternal Revenue Service IRS Tax Forms

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online