Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational 2023

Understanding the Schedule K-2 Form 1065

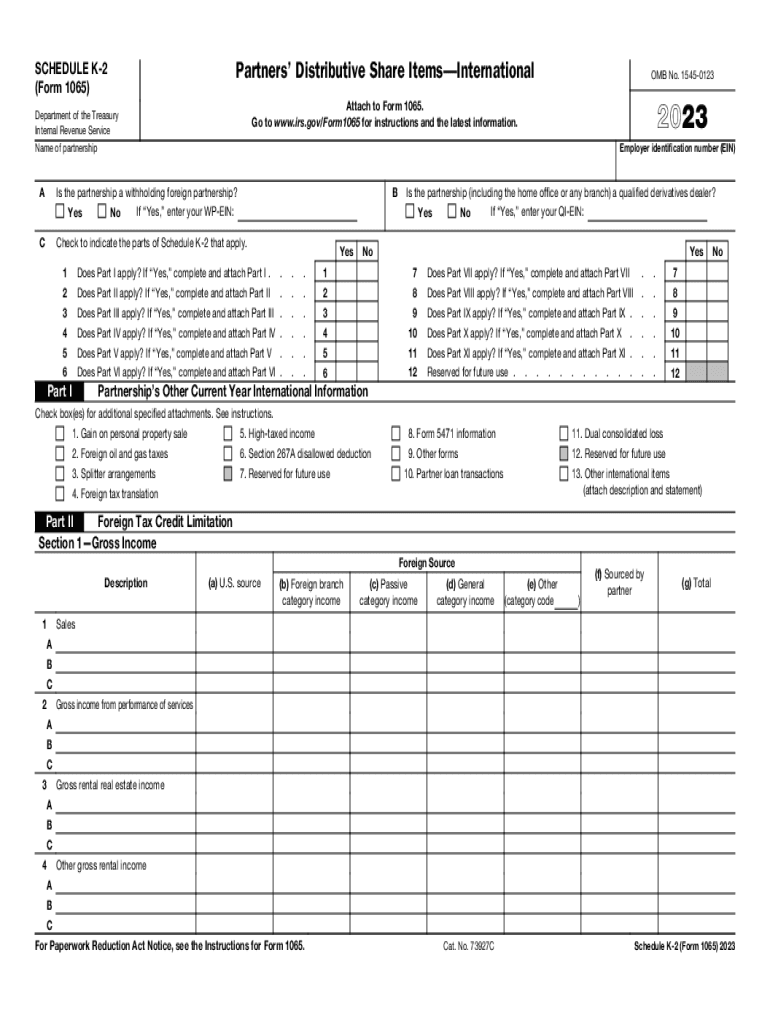

The Schedule K-2 Form 1065 is a tax document that partners in a partnership use to report their distributive share of items from the partnership. This form is essential for partnerships that have international activities, as it provides detailed information on income, deductions, and credits that partners need to report on their individual tax returns. The Schedule K-2 is designed to complement the Schedule K-1, which is issued to each partner, ensuring that all relevant information is accurately communicated to the IRS and partners.

Steps to Complete the Schedule K-2 Form 1065

Completing the Schedule K-2 Form 1065 involves several key steps:

- Gather all necessary financial documents related to the partnership's income and expenses.

- Identify the partnership's international activities, including foreign income and taxes paid.

- Fill out the form by providing the required information, ensuring accuracy in reporting income, deductions, and credits.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with the partnership's tax return to the IRS by the deadline.

Key Elements of the Schedule K-2 Form 1065

The Schedule K-2 Form 1065 includes several important sections that must be accurately filled out:

- Partner Information: Details about each partner, including their share of income and deductions.

- International Income: Specifics on foreign income earned and taxes paid to foreign governments.

- Deductions and Credits: Information on deductions and credits that partners can claim on their individual returns.

- Other Items: Any additional items that may affect a partner's tax situation, such as foreign currency transactions.

Filing Deadlines for the Schedule K-2 Form 1065

It is crucial to be aware of the filing deadlines for the Schedule K-2 Form 1065 to avoid penalties. Typically, the form must be filed with the partnership's tax return, which is due on the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. Extensions may be available, but it is essential to file the form on time to ensure compliance with IRS regulations.

Legal Use of the Schedule K-2 Form 1065

The Schedule K-2 Form 1065 is legally required for partnerships that have international operations. Failing to file this form, or providing inaccurate information, can result in penalties from the IRS. It is important for partnerships to maintain accurate records and ensure that all information reported on the Schedule K-2 is complete and truthful. This not only helps in avoiding legal issues but also ensures that partners receive the correct tax treatment for their share of the partnership's income.

Quick guide on how to complete schedule k 2 form 1065 partners distributive share itemsinternational

Complete Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational without hassle

- Find Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize essential parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 2 form 1065 partners distributive share itemsinternational

Create this form in 5 minutes!

How to create an eSignature for the schedule k 2 form 1065 partners distributive share itemsinternational

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-2 form and why is it important?

The Schedule K-2 form is a crucial tax document that provides necessary information about your partnership's income, deductions, and credits. It is important for accurately reporting income to the IRS, ensuring compliance and minimizing tax liabilities for partnerships and LLCs.

-

How can airSlate SignNow help with the Schedule K-2 form?

airSlate SignNow simplifies the process of filling out and managing your Schedule K-2 form. With our easy-to-use eSigning capabilities, users can efficiently send, sign, and store their forms securely, speeding up the overall tax preparation process.

-

Is there a cost associated with using airSlate SignNow for Schedule K-2 forms?

Yes, airSlate SignNow offers various pricing plans to suit your business needs, including options for handling Schedule K-2 forms. Our plans are cost-effective, allowing businesses to streamline their document management and eSigning processes without breaking the bank.

-

What features does airSlate SignNow offer for Schedule K-2 form management?

AirSlate SignNow offers features such as customizable templates, collaboration tools, and secure storage for your Schedule K-2 form. These features enhance user experience, making it easier to manage your documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software to manage Schedule K-2 forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications. This flexibility allows you to manage your Schedule K-2 forms within your existing workflows, increasing efficiency and accessibility.

-

What are the benefits of using airSlate SignNow for my Schedule K-2 form processing?

Using airSlate SignNow for your Schedule K-2 form processing offers numerous benefits, including faster turnaround times and improved accuracy. Our platform ensures that your forms are filled out correctly, signed electronically, and stored securely, thus streamlining your tax obligations.

-

Is airSlate SignNow user-friendly for filling out the Schedule K-2 form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for users of all experience levels to complete their Schedule K-2 forms quickly and efficiently.

Get more for Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational

Find out other Schedule K 2 Form 1065 Partners' Distributive Share ItemsInternational

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement