Partner's Instructions for Schedule K 1 Form 1065 2024-2026

Understanding Schedule K-2

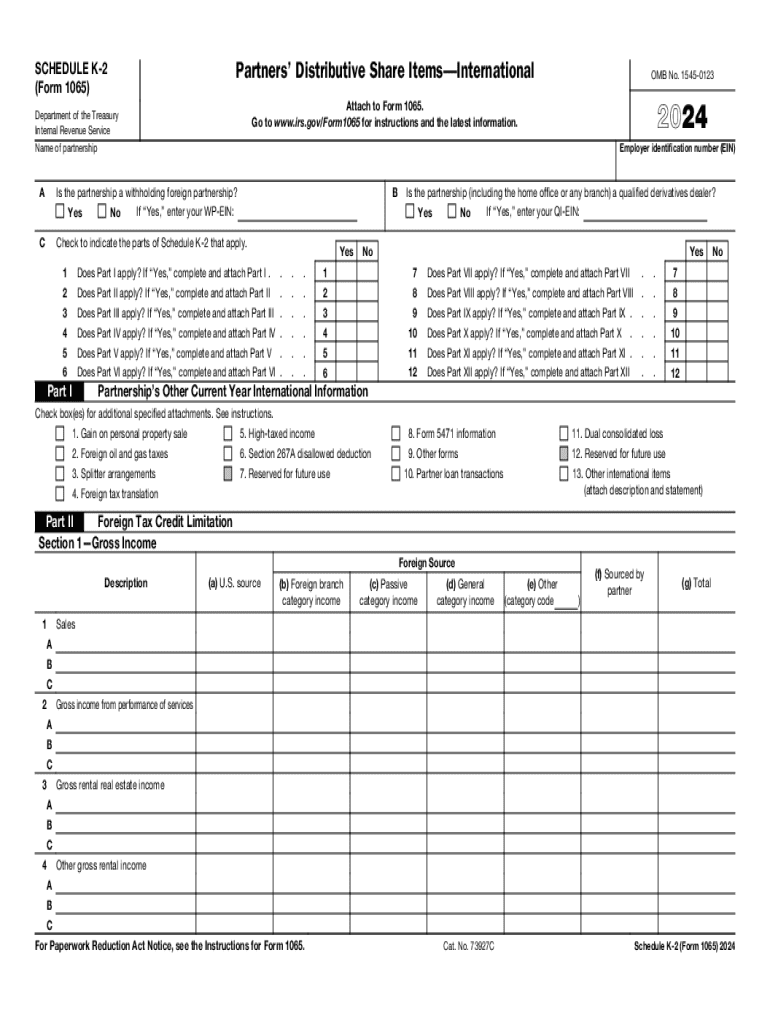

Schedule K-2 is a tax form used by partnerships to report their income, deductions, and credits. It provides detailed information about each partner's share of the partnership's income, which is essential for accurate tax reporting. This form is an extension of Schedule K-1 and is specifically designed to provide more comprehensive data for international activities and other complex transactions. Understanding the components of Schedule K-2 is crucial for ensuring compliance with IRS regulations.

Steps to Complete Schedule K-2

Completing Schedule K-2 involves several key steps:

- Gather necessary information: Collect all relevant financial data, including income statements, balance sheets, and details of any foreign transactions.

- Fill out the form: Enter the partnership's income, deductions, and credits in the appropriate sections. Ensure that all figures are accurate and reflect the partnership's financial activities.

- Review for accuracy: Double-check all entries for errors or omissions. Accurate reporting is essential to avoid penalties.

- Submit the form: File Schedule K-2 with the partnership's tax return by the due date.

IRS Guidelines for Schedule K-2

The IRS provides specific guidelines for completing and submitting Schedule K-2. These guidelines include instructions on how to report various types of income, deductions, and credits. It is important to refer to the latest IRS publications to ensure compliance with current tax laws. Additionally, partnerships must be aware of any changes in reporting requirements that may affect their filings.

Filing Deadlines for Schedule K-2

Partnerships must adhere to strict filing deadlines for Schedule K-2. Typically, the deadline aligns with the partnership's tax return due date, which is usually March 15 for calendar-year partnerships. If an extension is filed, the deadline may be extended to September 15. Timely submission is critical to avoid late fees and penalties.

Required Documents for Schedule K-2

To complete Schedule K-2 accurately, partnerships need to gather several key documents:

- Financial statements, including income statements and balance sheets.

- Records of all income and expenses related to the partnership.

- Documentation for any foreign transactions or activities.

- Previous year’s tax returns for reference.

Common Penalties for Non-Compliance

Failing to file Schedule K-2 accurately or on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect reporting can lead to audits or further scrutiny of the partnership's tax filings. It is essential for partnerships to ensure compliance to avoid these potential issues.

Create this form in 5 minutes or less

Find and fill out the correct partners instructions for schedule k 1 form 1065

Create this form in 5 minutes!

How to create an eSignature for the partners instructions for schedule k 1 form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-2 and how does it relate to airSlate SignNow?

A Schedule K-2 is a tax form used to report income, deductions, and credits from partnerships and S corporations. With airSlate SignNow, you can easily eSign and send Schedule K-2 documents securely, ensuring compliance and accuracy in your tax reporting.

-

How can airSlate SignNow help me manage my Schedule K-2 documents?

airSlate SignNow provides a user-friendly platform to manage your Schedule K-2 documents efficiently. You can create, edit, and eSign these forms, streamlining your workflow and reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for Schedule K-2?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that facilitate the eSigning and management of Schedule K-2 documents, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for Schedule K-2 processing?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage for your Schedule K-2 documents. These tools enhance efficiency and ensure that your documents are always accessible and organized.

-

Can I integrate airSlate SignNow with other software for Schedule K-2 management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage your Schedule K-2 documents alongside your other financial tools. This integration simplifies your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for Schedule K-2 eSigning?

Using airSlate SignNow for Schedule K-2 eSigning offers numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. This not only saves you time but also contributes to a more sustainable business practice.

-

How secure is airSlate SignNow for handling Schedule K-2 documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Schedule K-2 documents. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for Partner's Instructions For Schedule K 1 Form 1065

Find out other Partner's Instructions For Schedule K 1 Form 1065

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document