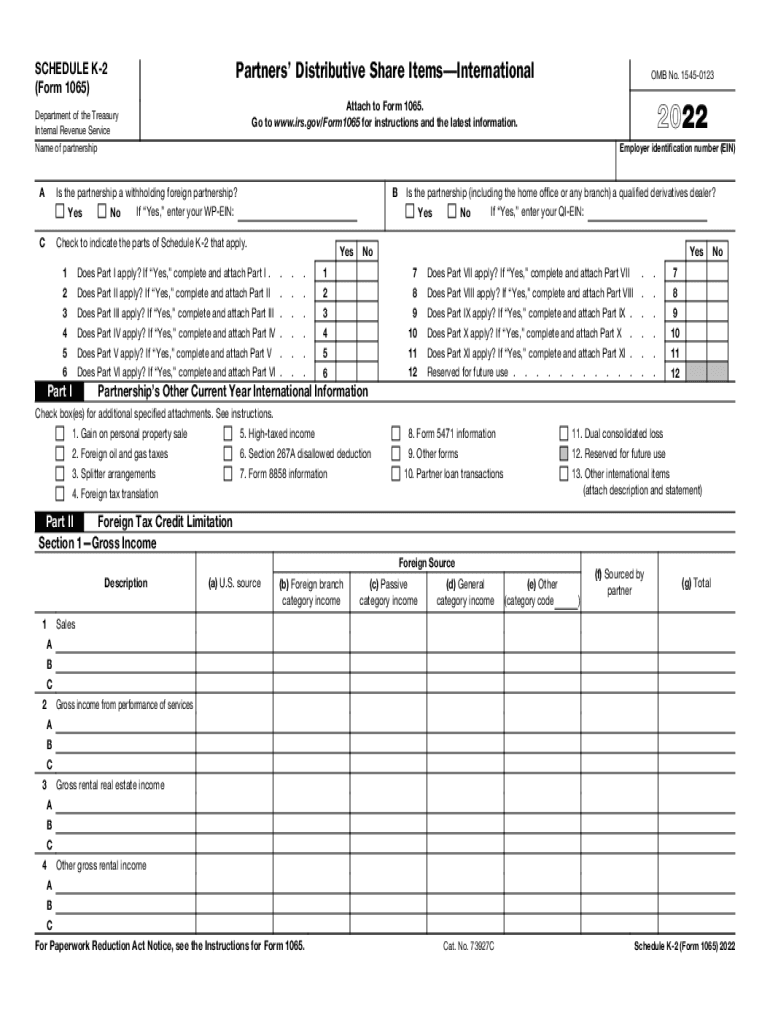

Partners Distributive Share ItemsInternational IRS Tax Forms 2022

Understanding the Schedule K-2 Form

The Schedule K-2 form is a crucial document used by partnerships to report their international tax items to the IRS. This form provides detailed information about the partners' distributive share items, which include income, deductions, and credits from foreign sources. Understanding the components of the Schedule K-2 is essential for accurate tax reporting and compliance. The form is designed to ensure that all partners receive the necessary information to report their share of international tax items correctly on their individual tax returns.

Steps to Complete the Schedule K-2 Form

Filling out the Schedule K-2 form involves several key steps:

- Gather necessary information about the partnership's international activities.

- Complete the identifying information section, including the partnership's name, address, and EIN.

- Detail each partner’s share of international income, deductions, and credits in the appropriate sections.

- Ensure all calculations are accurate and reflect the partnership’s financial activities.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Schedule K-2 Form

The Schedule K-2 form must be used in accordance with IRS regulations. It is legally binding when completed accurately and submitted on time. Failure to provide the correct information can lead to penalties and compliance issues. Partnerships are responsible for ensuring that all partners receive their respective K-2 forms, which are necessary for their individual tax filings. Compliance with tax laws is critical for maintaining the partnership's standing and avoiding legal repercussions.

Filing Deadlines for the Schedule K-2 Form

The Schedule K-2 form must be filed with the IRS by the partnership’s tax return due date, which is typically March 15 for calendar year partnerships. If an extension is filed, the deadline may be extended to September 15. It is important for partnerships to adhere to these deadlines to avoid late filing penalties and ensure that all partners can accurately report their income and deductions in a timely manner.

Required Documents for Completing the Schedule K-2 Form

To complete the Schedule K-2 form accurately, partnerships should gather the following documents:

- Partnership agreement outlining the profit and loss sharing ratios.

- Financial statements reflecting international income and expenses.

- Documentation of foreign tax credits and deductions.

- Any relevant IRS publications or guidelines related to international taxation.

Examples of Using the Schedule K-2 Form

Partnerships engaged in international business activities often utilize the Schedule K-2 form to report various types of income, such as:

- Foreign dividends received from international investments.

- Income from foreign partnerships or joint ventures.

- Foreign tax credits that can offset U.S. tax liabilities.

These examples illustrate how the Schedule K-2 form plays a vital role in ensuring that partners accurately report their international earnings and comply with U.S. tax laws.

Quick guide on how to complete partners distributive share itemsinternational irs tax forms

Prepare Partners Distributive Share ItemsInternational IRS Tax Forms easily on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Partners Distributive Share ItemsInternational IRS Tax Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Partners Distributive Share ItemsInternational IRS Tax Forms effortlessly

- Obtain Partners Distributive Share ItemsInternational IRS Tax Forms and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this task.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Recheck the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Partners Distributive Share ItemsInternational IRS Tax Forms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partners distributive share itemsinternational irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the Schedule K-2 form used for?

The Schedule K-2 form is used by partnerships and S corporations to report income, deductions, and credits. It helps streamline the reporting process for partners and shareholders by providing essential tax information, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the Schedule K-2 form?

With airSlate SignNow, you can easily eSign and manage your Schedule K-2 form electronically. Our platform simplifies the document workflow, allowing you to gather signatures quickly and securely, which can save time and enhance efficiency during tax season.

-

Is there a cost associated with using airSlate SignNow for the Schedule K-2 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost varies based on features and the number of users, providing flexibility for handling multiple Schedule K-2 forms while ensuring you only pay for what you need.

-

Are there any features specifically designed for Schedule K-2 form management?

Yes, airSlate SignNow includes features like customizable templates for the Schedule K-2 form, easy document sharing, and real-time tracking of signatures. These tools help ensure that your documents are managed efficiently and securely.

-

Can airSlate SignNow integrate with other accounting software for Schedule K-2 forms?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to import data directly into your Schedule K-2 form. This integration simplifies the process, reducing manual entry errors and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Schedule K-2 forms?

Using airSlate SignNow for your Schedule K-2 forms provides numerous benefits, including faster processing times and enhanced security features. Additionally, our platform ensures compliance with tax regulations, giving you peace of mind as you manage your documents.

-

How secure is eSigning the Schedule K-2 form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication protocols to secure your Schedule K-2 form and personal information, ensuring that your data remains private and protected throughout the signing process.

Get more for Partners Distributive Share ItemsInternational IRS Tax Forms

- Name change notification form idaho

- Commercial building or space lease idaho form

- Idaho relative caretaker legal documents package idaho form

- Idaho standby temporary guardian legal documents package idaho form

- Complaint divorce with children form

- Idaho divorce file form

- Idaho bankruptcy guide and forms package for chapters 7 or 13 idaho

- Bill of sale with warranty by individual seller idaho form

Find out other Partners Distributive Share ItemsInternational IRS Tax Forms

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free