Form 944 for Employer's ANNUAL Federal Tax Return 2023

What is the Form 944 For Employer's ANNUAL Federal Tax Return

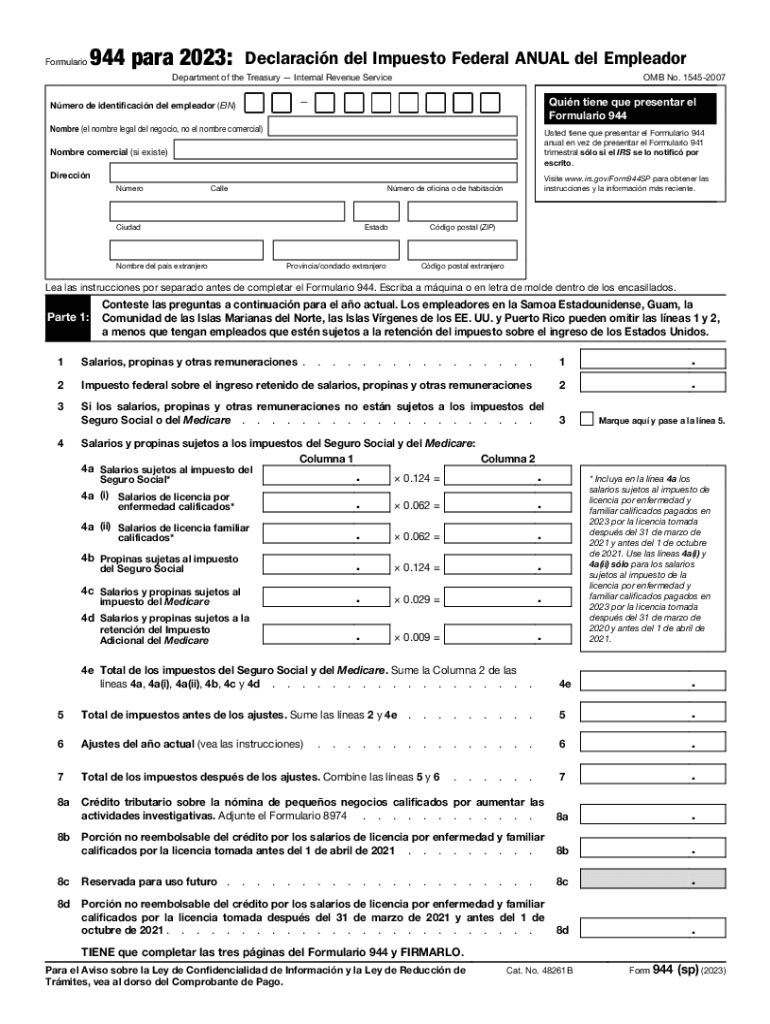

The Form 944 is the Employer's Annual Federal Tax Return, designed for small businesses that owe less than a certain amount in employment taxes each year. This form allows eligible employers to report their annual payroll tax liability to the Internal Revenue Service (IRS). Unlike the more commonly used Form 941, which is filed quarterly, Form 944 simplifies the process for smaller employers by allowing them to file just once a year. This form is crucial for ensuring compliance with federal tax obligations and helps streamline the reporting process for eligible businesses.

How to obtain the Form 944 For Employer's ANNUAL Federal Tax Return

Employers can obtain the Form 944 directly from the IRS website, where it is available for download in PDF format. Additionally, businesses may request a copy by contacting the IRS directly. It is important for employers to ensure they are eligible to use Form 944 before obtaining it, as this form is specifically for those with a lower annual tax liability. The IRS also provides guidance on how to determine eligibility, which can be helpful for new businesses or those transitioning from Form 941.

Steps to complete the Form 944 For Employer's ANNUAL Federal Tax Return

Completing the Form 944 involves several key steps:

- Gather necessary information, including total wages paid, tips received, and federal income tax withheld.

- Fill out the form accurately, ensuring all required fields are completed, such as business name, address, and Employer Identification Number (EIN).

- Calculate the total tax liability based on the information provided, including Social Security and Medicare taxes.

- Review the completed form for accuracy before submission to avoid penalties or delays.

Once the form is completed, it can be submitted to the IRS either by mail or electronically, depending on the employer's preference and eligibility.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with Form 944 to ensure timely submission. The form is typically due by January 31 of the following year for the tax year being reported. If January 31 falls on a weekend or holiday, the due date is extended to the next business day. Employers should also be mindful of any changes in deadlines announced by the IRS, as these can vary from year to year.

Key elements of the Form 944 For Employer's ANNUAL Federal Tax Return

The Form 944 contains several key elements that employers must complete:

- Employer Identification Number (EIN): A unique number assigned to the business for tax purposes.

- Wages, tips, and other compensation: Total amount paid to employees during the year.

- Federal income tax withheld: The total federal income tax withheld from employee wages.

- Social Security and Medicare taxes: Calculated based on employee wages and tips.

Completing these sections accurately is essential for proper tax reporting and compliance.

Penalties for Non-Compliance

Failure to file Form 944 on time or inaccuracies in reporting can result in penalties imposed by the IRS. These penalties may include fines for late filing, as well as additional charges for underpayment of taxes. It is crucial for employers to understand their obligations and ensure that all forms are submitted accurately and on time to avoid these financial repercussions. Regularly reviewing tax obligations and staying informed about IRS regulations can help mitigate the risk of non-compliance.

Quick guide on how to complete form 944 for employers annual federal tax return

Manage Form 944 For Employer's ANNUAL Federal Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly with ease. Handle Form 944 For Employer's ANNUAL Federal Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form 944 For Employer's ANNUAL Federal Tax Return effortlessly

- Find Form 944 For Employer's ANNUAL Federal Tax Return and click Get Form to initiate the process.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 944 For Employer's ANNUAL Federal Tax Return to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944 for employers annual federal tax return

Create this form in 5 minutes!

How to create an eSignature for the form 944 for employers annual federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 944 For Employer's ANNUAL Federal Tax Return?

Form 944 For Employer's ANNUAL Federal Tax Return is a tax document that small businesses use to report and pay their federal payroll taxes. This form is designed for employers with an annual payroll tax liability of $1,000 or less, streamlining the tax report process by allowing them to file once a year instead of quarterly.

-

How does airSlate SignNow simplify the submission of Form 944 For Employer's ANNUAL Federal Tax Return?

airSlate SignNow offers an intuitive platform that enables users to electronically sign and send documents securely, including Form 944 For Employer's ANNUAL Federal Tax Return. This eliminates the need for printing, scanning, or mailing paperwork, making the process faster and more efficient.

-

What are the pricing options for using airSlate SignNow for Form 944 For Employer's ANNUAL Federal Tax Return?

airSlate SignNow provides various pricing plans tailored to meet the needs of different businesses. These plans typically include features such as unlimited document signing, templates for Form 944 For Employer's ANNUAL Federal Tax Return, and integrations with other software, allowing for cost-effective solutions.

-

Can I integrate airSlate SignNow with my accounting software for Form 944 For Employer's ANNUAL Federal Tax Return?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll systems. This integration ensures that you can easily manage Form 944 For Employer's ANNUAL Federal Tax Return and other financial documents within your existing workflow, saving time and reducing errors.

-

What features does airSlate SignNow offer for handling Form 944 For Employer's ANNUAL Federal Tax Return?

airSlate SignNow includes features such as document templates, custom workflows, real-time tracking, and secure cloud storage. These functionalities enhance the efficiency of managing Form 944 For Employer's ANNUAL Federal Tax Return, ensuring you can handle your filings with ease and reliability.

-

Is airSlate SignNow secure for eSigning Form 944 For Employer's ANNUAL Federal Tax Return?

Absolutely, airSlate SignNow prioritizes security and compliance. The platform employs advanced encryption methods and follows industry-standard regulations, ensuring that your Form 944 For Employer's ANNUAL Federal Tax Return and other documents are securely handled.

-

How can airSlate SignNow improve my business workflow for Form 944 For Employer's ANNUAL Federal Tax Return?

airSlate SignNow streamlines document management and signing processes, which signNowly enhances your business's workflow. By reducing the time spent on paperwork, companies can focus more on their core operations, especially when dealing with Form 944 For Employer's ANNUAL Federal Tax Return.

Get more for Form 944 For Employer's ANNUAL Federal Tax Return

- Ann arbor public schools field trips consent form

- Peoria unified school district 11 field trip permission bformb bb

- Model form agreement bewteen owner and design professional fillable

- Southington dog license form

- Zabas form

- College of william and mary krissa loretto kloretto wmwikis form

- Rental fillable agreement template form

- Rental family member agreement template form

Find out other Form 944 For Employer's ANNUAL Federal Tax Return

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple