Form 944SP Employer's Annual Federal Tax Return Spanish Version 2022

What is the Form 944SP Employer's Annual Federal Tax Return Spanish Version

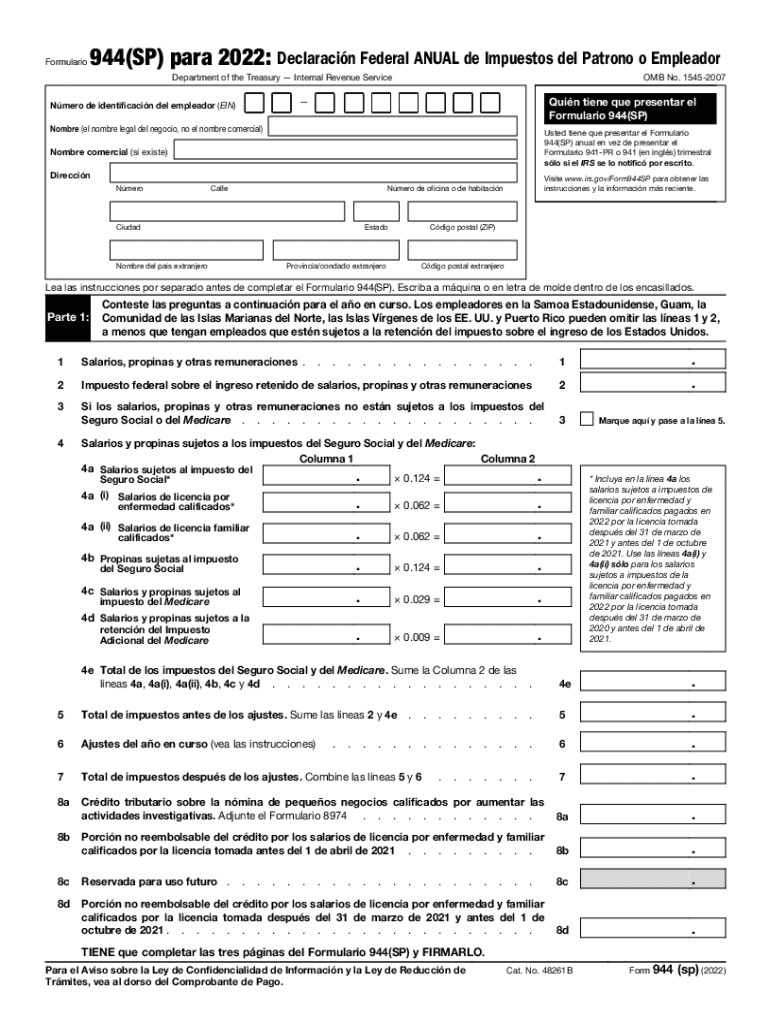

The Form 944SP, or Employer's Annual Federal Tax Return Spanish Version, is a specific tax form designed for small businesses in the United States. This form allows employers to report their annual payroll tax liability to the Internal Revenue Service (IRS). The Spanish version caters to Spanish-speaking employers who prefer to complete their tax obligations in their native language. It includes necessary information about withheld federal income taxes, Social Security, and Medicare taxes for the year.

How to use the Form 944SP Employer's Annual Federal Tax Return Spanish Version

Using the Form 944SP involves a few straightforward steps. First, employers must gather all relevant payroll records for the tax year, including total wages paid and taxes withheld. Next, they should fill out the form accurately, ensuring all sections are completed. Once the form is filled, it must be signed and dated by an authorized individual. Finally, employers should submit the completed form to the IRS by the designated deadline, ensuring they keep a copy for their records.

Steps to complete the Form 944SP Employer's Annual Federal Tax Return Spanish Version

Completing the Form 944SP involves several key steps:

- Gather all payroll records, including total wages and taxes withheld.

- Fill out the form, ensuring accuracy in all entries.

- Double-check all calculations to avoid errors.

- Sign and date the form where indicated.

- Submit the form to the IRS by the deadline, either electronically or via mail.

Filing Deadlines / Important Dates

The filing deadline for the Form 944SP is typically January 31 of the year following the tax year being reported. Employers should be aware of any changes to this date announced by the IRS. It is essential to file on time to avoid potential penalties and interest on unpaid taxes.

Legal use of the Form 944SP Employer's Annual Federal Tax Return Spanish Version

The Form 944SP is legally recognized by the IRS as the official document for reporting annual payroll taxes for small businesses. Employers must use this form to comply with federal tax regulations. Failure to use the correct form or to file it on time can result in penalties, so understanding its legal implications is crucial for employers.

Key elements of the Form 944SP Employer's Annual Federal Tax Return Spanish Version

Key elements of the Form 944SP include:

- Identification information for the employer, such as name, address, and Employer Identification Number (EIN).

- Total wages paid to employees during the year.

- Amounts of federal income tax withheld.

- Social Security and Medicare taxes owed.

- Signature and date section for the authorized representative.

Quick guide on how to complete form 944sp employers annual federal tax return spanish version

Prepare Form 944SP Employer's Annual Federal Tax Return Spanish Version effortlessly on any device

Digital document management has become popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 944SP Employer's Annual Federal Tax Return Spanish Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form 944SP Employer's Annual Federal Tax Return Spanish Version without hassle

- Obtain Form 944SP Employer's Annual Federal Tax Return Spanish Version and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers for this purpose.

- Generate your eSignature using the Sign feature, which takes just moments and carries the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign Form 944SP Employer's Annual Federal Tax Return Spanish Version to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944sp employers annual federal tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 944sp employers annual federal tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

The Form 944SP Employer's Annual Federal Tax Return Spanish Version is a tax document specifically designed for Spanish-speaking employers in the United States. It allows them to report the annual federal payroll taxes they owe to the IRS. Using this version helps ensure compliance with tax obligations while catering to the language needs of Spanish-speaking users.

-

How does airSlate SignNow simplify the process of filling out the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

airSlate SignNow simplifies the filling out of the Form 944SP Employer's Annual Federal Tax Return Spanish Version by providing an intuitive interface and easy navigation. Users can fill in the required fields electronically and avoid the complexities of paper forms. This digital approach saves time and reduces errors in tax form submission.

-

Is there a cost associated with using airSlate SignNow for the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

Yes, there is a cost to use airSlate SignNow, but it offers flexible pricing plans suitable for businesses of all sizes. The pricing is competitive and includes various features that enhance the document management experience. Investing in airSlate SignNow can lead to signNow time savings and improved workflow efficiency.

-

Can I access the Form 944SP Employer's Annual Federal Tax Return Spanish Version on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to access the Form 944SP Employer's Annual Federal Tax Return Spanish Version from their smartphones or tablets. This flexibility ensures that you can manage your documents and sign forms on the go, increasing productivity and convenience.

-

What features does airSlate SignNow offer for the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

airSlate SignNow offers features such as electronic signatures, document storage, and collaborative editing for the Form 944SP Employer's Annual Federal Tax Return Spanish Version. These functionalities enhance document management and make it easy for teams to work together efficiently. Additionally, real-time updates ensure that all stakeholders are on the same page.

-

Does airSlate SignNow integrate with other software for managing the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

Yes, airSlate SignNow offers integrations with various third-party software solutions, allowing you to streamline your workflows when managing the Form 944SP Employer's Annual Federal Tax Return Spanish Version. These integrations enable users to connect their existing accounting and HR systems with airSlate SignNow easily, enhancing productivity across platforms.

-

What benefits can businesses expect from using airSlate SignNow for the Form 944SP Employer's Annual Federal Tax Return Spanish Version?

Businesses can expect numerous benefits when using airSlate SignNow for the Form 944SP Employer's Annual Federal Tax Return Spanish Version, including increased efficiency, reduced processing times, and improved accuracy in document handling. Furthermore, the ability to eSign documents securely reduces the risk of lost paperwork and ensures compliance with regulatory requirements.

Get more for Form 944SP Employer's Annual Federal Tax Return Spanish Version

- 132 printable staff performance appraisal form templates

- Student information form for letter of recommendation boylan

- Asylum filing form

- Fl 311 child custody and visitation application attachment fl 311 child custody and visitation application attachment form

- Ccr hdfc life form

- Brokers fee agreement bfa the pennsylvania association of form

- Application for rental registration scranton pa scrantonpa form

- Crest manor apartments in willow grove pa form

Find out other Form 944SP Employer's Annual Federal Tax Return Spanish Version

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History