Form 944 for Employer's ANNUAL Federal Tax Return 2024-2026

What is the Form 944 For Employer's ANNUAL Federal Tax Return

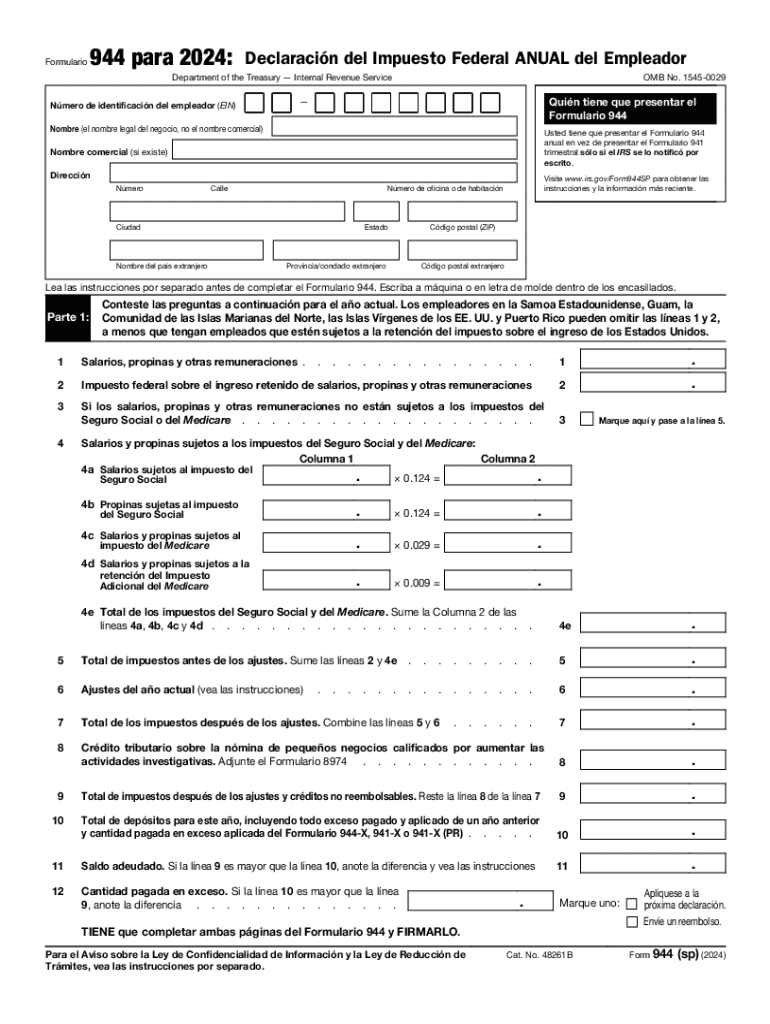

The Form 944 is a specialized tax form used by small employers to report and pay their annual federal payroll taxes. This form is designed for businesses with an annual payroll tax liability of one thousand dollars or less. By using Form 944, eligible employers can simplify their tax reporting process, as they are only required to file once a year instead of quarterly. This form covers various tax obligations, including Social Security, Medicare, and federal income tax withholding for employees.

How to obtain the Form 944 For Employer's ANNUAL Federal Tax Return

Employers can obtain Form 944 from the Internal Revenue Service (IRS) website or by contacting the IRS directly. The form is available for download in a printable format, ensuring easy access for all eligible businesses. Additionally, employers may receive the form automatically if they have previously filed it or if they qualify based on their payroll tax liability. It is essential to ensure that the correct version of the form is used, as updates may occur annually.

Steps to complete the Form 944 For Employer's ANNUAL Federal Tax Return

Completing Form 944 involves several key steps:

- Begin by entering your business information, including the employer identification number (EIN), business name, and address.

- Report the total wages paid to employees during the year, including any tips and other compensation.

- Calculate the total federal income tax withheld from employees' wages.

- Determine the amounts for Social Security and Medicare taxes based on the wages reported.

- Complete the section for any adjustments, such as overpayments or corrections from previous filings.

- Sign and date the form, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

The deadline for filing Form 944 is typically January 31 of the year following the tax year being reported. Employers must ensure that any taxes owed are paid by this date to avoid penalties. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for employers to keep track of these dates to maintain compliance with federal tax regulations.

Penalties for Non-Compliance

Failure to file Form 944 on time or to pay the associated taxes can result in significant penalties. The IRS may impose a failure-to-file penalty, which is generally five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid tax amounts. Employers are encouraged to file accurately and on time to avoid these financial repercussions.

Key elements of the Form 944 For Employer's ANNUAL Federal Tax Return

Form 944 includes several critical elements that employers must complete:

- Employer identification number (EIN)

- Total wages paid to employees

- Federal income tax withheld

- Social Security and Medicare tax calculations

- Adjustments for overpayments or corrections

- Certification by the employer

Create this form in 5 minutes or less

Find and fill out the correct form 944 for employers annual federal tax return 767975997

Create this form in 5 minutes!

How to create an eSignature for the form 944 for employers annual federal tax return 767975997

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 944 For Employer's ANNUAL Federal Tax Return?

Form 944 For Employer's ANNUAL Federal Tax Return is a simplified tax form used by eligible small businesses to report their annual payroll taxes to the IRS. This form allows employers to report their federal income tax withheld and Social Security and Medicare taxes in a single annual submission, making it easier to manage tax obligations.

-

How can airSlate SignNow help with Form 944 For Employer's ANNUAL Federal Tax Return?

airSlate SignNow streamlines the process of completing and submitting Form 944 For Employer's ANNUAL Federal Tax Return by providing an easy-to-use platform for eSigning and sending documents. With our solution, you can ensure that your tax forms are filled out accurately and submitted on time, reducing the risk of penalties.

-

What features does airSlate SignNow offer for managing Form 944?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed to assist with Form 944 For Employer's ANNUAL Federal Tax Return. These features enhance efficiency and ensure that all necessary information is captured and submitted correctly.

-

Is airSlate SignNow cost-effective for small businesses filing Form 944?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to file Form 944 For Employer's ANNUAL Federal Tax Return. Our pricing plans are designed to accommodate various business sizes, ensuring that you can access essential features without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for Form 944?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your payroll and tax documents, including Form 944 For Employer's ANNUAL Federal Tax Return. This integration helps streamline your workflow and ensures that all your financial data is synchronized.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form 944 For Employer's ANNUAL Federal Tax Return provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, making tax season less stressful.

-

How secure is airSlate SignNow when handling Form 944?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information when handling Form 944 For Employer's ANNUAL Federal Tax Return. You can trust that your data is safe with us, allowing you to focus on your business.

Get more for Form 944 For Employer's ANNUAL Federal Tax Return

- Certificate of veterinary inspection pdf form

- Ame church disciplinary questions form

- Square d panel schedule form

- Creditor matrix template form

- Diocese of rockville centre pension plan form

- Hazardous declaration form ocean

- Abcd01 117 texas sales and use tax return short form

- Lifeguard contract template form

Find out other Form 944 For Employer's ANNUAL Federal Tax Return

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template