About Form 8853, Archer MSAs and Long Term Care 2023

What is IRS Form 8853?

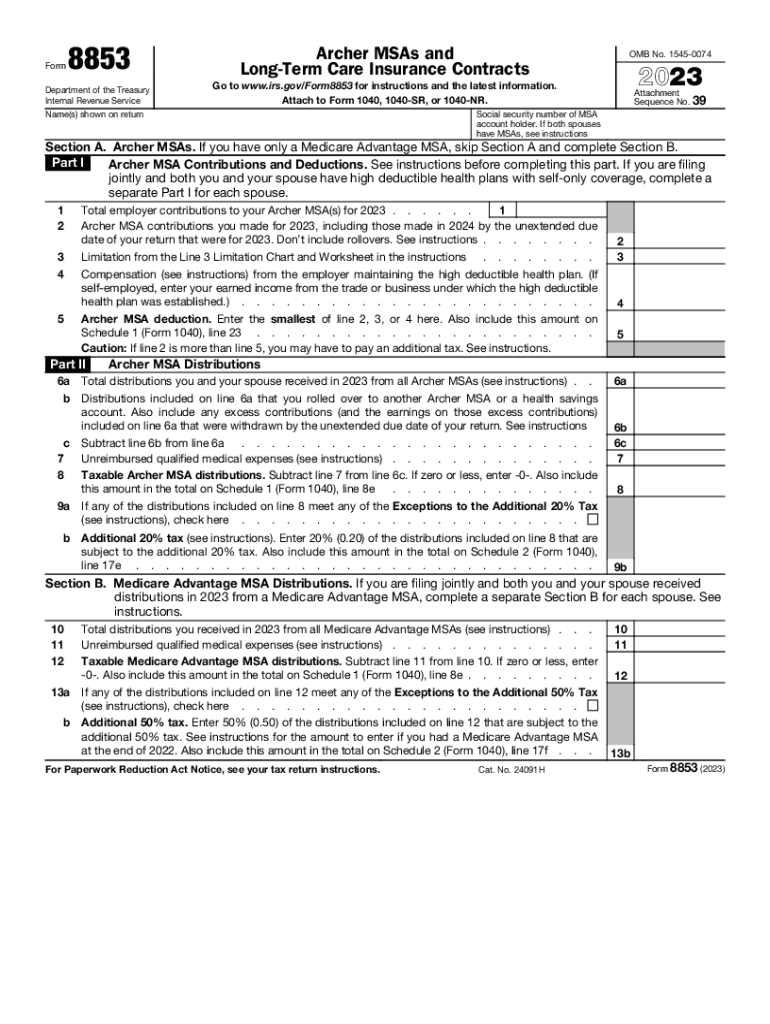

IRS Form 8853, also known as the Archer MSAs and Long-Term Care form, is used by taxpayers to report contributions to and distributions from Archer Medical Savings Accounts (MSAs) and to claim deductions for long-term care insurance premiums. This form is essential for individuals who have established an Archer MSA, which is designed to help self-employed individuals and employees of small businesses save for medical expenses. The form allows taxpayers to provide necessary details regarding their contributions and distributions, ensuring compliance with IRS regulations.

Key Elements of IRS Form 8853

The key elements of Form 8853 include sections for reporting contributions to Archer MSAs, distributions from these accounts, and deductions for long-term care insurance premiums. Taxpayers must accurately fill out each section to reflect their financial activities throughout the tax year. Important details include the total contributions made, any distributions taken, and the amount of long-term care premiums paid. Proper completion of these sections is crucial for determining tax liabilities and potential deductions.

Steps to Complete IRS Form 8853

Completing IRS Form 8853 involves several steps:

- Gather necessary documents, including records of contributions and distributions related to your Archer MSA.

- Fill out the personal information section at the top of the form, including your name, address, and Social Security number.

- Report your contributions to the Archer MSA in the designated section, ensuring accurate totals.

- Detail any distributions taken from the MSA, including the purpose of the withdrawal.

- Claim deductions for long-term care insurance premiums, providing the total amount paid during the year.

- Review the completed form for accuracy before submission.

Filing Deadlines for IRS Form 8853

IRS Form 8853 must be filed along with your federal income tax return. The typical deadline for filing your tax return is April 15 of the following year, unless an extension is granted. It is important to ensure that Form 8853 is submitted on time to avoid penalties and interest on any taxes owed. Taxpayers should keep track of any changes in filing deadlines, especially if they are affected by holidays or weekends.

Eligibility Criteria for IRS Form 8853

To be eligible to file IRS Form 8853, taxpayers must have established an Archer MSA and made contributions to it during the tax year. Additionally, individuals must be enrolled in a high-deductible health plan to qualify for contributions to an Archer MSA. Those claiming deductions for long-term care insurance must also meet specific criteria, including age and the amount of premiums paid. Understanding these eligibility requirements is essential for accurate reporting and maximizing potential deductions.

IRS Guidelines for Form 8853

The IRS provides specific guidelines for completing and filing Form 8853. Taxpayers should refer to the official IRS instructions for detailed information on how to fill out each section of the form. These guidelines include definitions of key terms, eligibility requirements, and examples of acceptable contributions and distributions. Following these guidelines helps ensure compliance and reduces the risk of errors that could lead to audits or penalties.

Quick guide on how to complete about form 8853 archer msas and long term care

Finish About Form 8853, Archer MSAs And Long Term Care effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to design, alter, and eSign your documents rapidly without interruptions. Manage About Form 8853, Archer MSAs And Long Term Care on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign About Form 8853, Archer MSAs And Long Term Care with ease

- Find About Form 8853, Archer MSAs And Long Term Care and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Alter and eSign About Form 8853, Archer MSAs And Long Term Care and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8853 archer msas and long term care

Create this form in 5 minutes!

How to create an eSignature for the about form 8853 archer msas and long term care

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 IRS Form 8853?

The 2023 IRS Form 8853 is a tax form used to report Health Savings Account (HSA) contributions and distributions. It's essential for those who want to ensure proper reporting of their HSA activities for the tax year. Completing this form correctly can prevent issues with the IRS.

-

How can airSlate SignNow assist with the 2023 IRS Form 8853?

airSlate SignNow provides a streamlined platform to securely send and sign the 2023 IRS Form 8853 electronically. This simplifies the process, making it easier to manage and submit your tax documents without hassle. Our solution ensures compliance while maintaining security and ease of use.

-

What are the benefits of using airSlate SignNow for my 2023 IRS Form 8853?

Using airSlate SignNow for your 2023 IRS Form 8853 offers convenience and speed, allowing you to eSign and send documents quickly. Our user-friendly interface enhances productivity, saving you time on administrative tasks. Additionally, our software ensures your documents are securely stored and accessible.

-

Is there a pricing plan for using airSlate SignNow for the 2023 IRS Form 8853?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, including features for managing the 2023 IRS Form 8853. You can choose from various plans based on your document volume and additional features needed. This flexibility ensures you only pay for what you use.

-

What features does airSlate SignNow offer for preparing the 2023 IRS Form 8853?

airSlate SignNow offers features such as customizable templates, electronic signature capabilities, and document tracking specifically for the 2023 IRS Form 8853. These tools help ensure that your tax documents are completed accurately and efficiently. You'll also enjoy the ability to receive notifications when documents are signed.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2023 IRS Form 8853?

Yes, airSlate SignNow seamlessly integrates with various accounting software, simplifying the process of preparing the 2023 IRS Form 8853. This integration allows for easier data transfer, reducing the risk of manual entry errors. Link your existing tools for a more efficient workflow.

-

How secure is airSlate SignNow when handling the 2023 IRS Form 8853?

Security is a top priority at airSlate SignNow. We utilize state-of-the-art encryption and comply with industry regulations to protect your sensitive information on the 2023 IRS Form 8853. Our platform ensures that your documents are safe from unauthorized access.

Get more for About Form 8853, Archer MSAs And Long Term Care

Find out other About Form 8853, Archer MSAs And Long Term Care

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast