Form 8853 Fill Out and Sign Printable PDF TemplatesignNow 2022

What is the Form 8853?

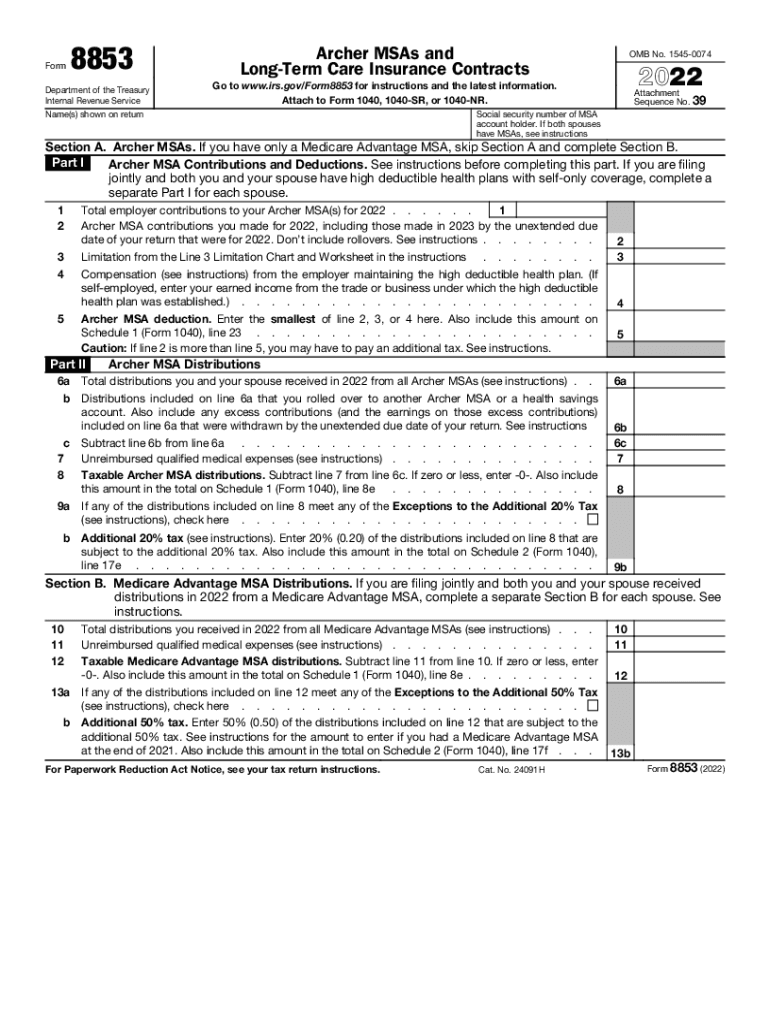

The Form 8853 is a tax form used by individuals to report contributions to Archer Medical Savings Accounts (MSAs) and to calculate the deduction for contributions made to these accounts. This form is essential for taxpayers who have established an Archer MSA, allowing them to claim tax benefits associated with their contributions. Understanding the purpose of this form helps individuals ensure compliance with IRS regulations and maximize their tax advantages.

Steps to Complete the Form 8853

Completing the Form 8853 involves several key steps:

- Gather necessary information, including details about your Archer MSA contributions and any distributions made during the tax year.

- Fill out the identification section, providing your name, Social Security number, and other relevant personal information.

- Report contributions to your Archer MSA in the appropriate section, ensuring accuracy to avoid potential penalties.

- Calculate any deductions you are eligible for based on your contributions and complete the relevant sections of the form.

- Review your completed form for accuracy and ensure all required fields are filled before submission.

Legal Use of the Form 8853

The Form 8853 is legally recognized by the IRS as a valid document for reporting contributions to Archer MSAs. To ensure its legal standing, it must be completed accurately and submitted by the designated filing deadline. Adhering to IRS guidelines is crucial, as incorrect or incomplete forms may lead to penalties or denial of tax benefits. Utilizing a reliable e-signature solution can further enhance the legal validity of the form by ensuring compliance with eSignature laws.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8853, which include instructions on eligibility, contribution limits, and filing requirements. Taxpayers must familiarize themselves with these guidelines to ensure proper completion and submission. The IRS updates these guidelines periodically, so staying informed about any changes is essential for compliance and maximizing tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8853 typically align with the general tax filing deadlines. Taxpayers must submit the form by April 15 of the year following the tax year for which the form is being filed. If additional time is needed, taxpayers may request an extension, but it is crucial to ensure that the form is submitted by the extended deadline to avoid penalties.

Required Documents

To complete the Form 8853, several documents may be required, including:

- Records of contributions made to your Archer MSA, including dates and amounts.

- Documentation of any distributions taken from the account during the tax year.

- Previous tax returns, if applicable, to reference prior contributions and deductions.

Form Submission Methods

The Form 8853 can be submitted through various methods, including:

- Filing electronically through tax software that supports IRS forms.

- Mailing a printed copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete form 8853 fill out and sign printable pdf templatesignnow

Finish Form 8853 Fill Out And Sign Printable PDF TemplatesignNow effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without complications. Manage Form 8853 Fill Out And Sign Printable PDF TemplatesignNow on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 8853 Fill Out And Sign Printable PDF TemplatesignNow without hassle

- Locate Form 8853 Fill Out And Sign Printable PDF TemplatesignNow and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 8853 Fill Out And Sign Printable PDF TemplatesignNow and maintain excellent communication at any step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8853 fill out and sign printable pdf templatesignnow

Create this form in 5 minutes!

People also ask

-

What is form 8853 and who needs it?

Form 8853 is a tax form used by individuals who are claiming a Health Savings Account (HSA) or a Medical Savings Account (MSA). If you have made contributions to or withdrawals from these accounts, you will need to fill out form 8853 when filing your taxes. Understanding its requirements is essential for compliance and to avoid potential penalties.

-

How can airSlate SignNow help with completing form 8853?

airSlate SignNow streamlines the process of filling out form 8853 by providing an intuitive platform for document creation and eSigning. Users can easily attach necessary documents and share them securely for signatures, thus simplifying tax preparation. Our service ensures that your form 8853 is accurately completed and submitted on time.

-

Is there a cost to use airSlate SignNow for form 8853?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for electronically signing documents, including form 8853. Users can choose from flexible subscription options based on their business needs. This allows everyone to access essential features without breaking the bank.

-

What features does airSlate SignNow offer for form 8853 management?

With airSlate SignNow, you can create, edit, and manage form 8853 efficiently. Our platform offers templates, real-time updates, and comprehensive tracking of document statuses. These features help you stay organized and ensure you never miss a deadline.

-

Can I integrate airSlate SignNow with other software for form 8853 handling?

Yes, airSlate SignNow supports integrations with various software platforms, making it easy to include form 8853 in your workflow. You can connect it with accounting software, CRMs, and other tools, allowing for seamless data transfer and improved efficiency. This enhances your overall document management process.

-

How secure is the information submitted through form 8853 on airSlate SignNow?

Security is a top priority at airSlate SignNow, and we employ robust encryption protocols to protect all information submitted through form 8853. Your data is safeguarded against unauthorized access, ensuring compliance with all relevant regulations. This provides you with peace of mind when handling sensitive information.

-

What benefits does airSlate SignNow offer for businesses dealing with form 8853?

Using airSlate SignNow for form 8853 helps businesses enhance efficiency, reduce errors, and save time. The user-friendly platform allows quick document preparation and eliminates the delays associated with traditional paperwork. As a result, businesses can focus more on their core activities while ensuring accurate tax reporting.

Get more for Form 8853 Fill Out And Sign Printable PDF TemplatesignNow

- New york mechanics form

- Ny lien form

- Storage business package new york form

- Child care services package new york form

- Special or limited power of attorney for real estate sales transaction by seller new york form

- Special or limited power of attorney for real estate purchase transaction by purchaser new york form

- Limited power of attorney where you specify powers with sample powers included new york form

- Limited power of attorney for stock transactions and corporate powers new york form

Find out other Form 8853 Fill Out And Sign Printable PDF TemplatesignNow

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement