Form 8853 Archer MSAs and Long Term Care Insurance Contracts 2024-2026

Understanding IRS Form 8853: Archer MSAs and Long Term Care Insurance Contracts

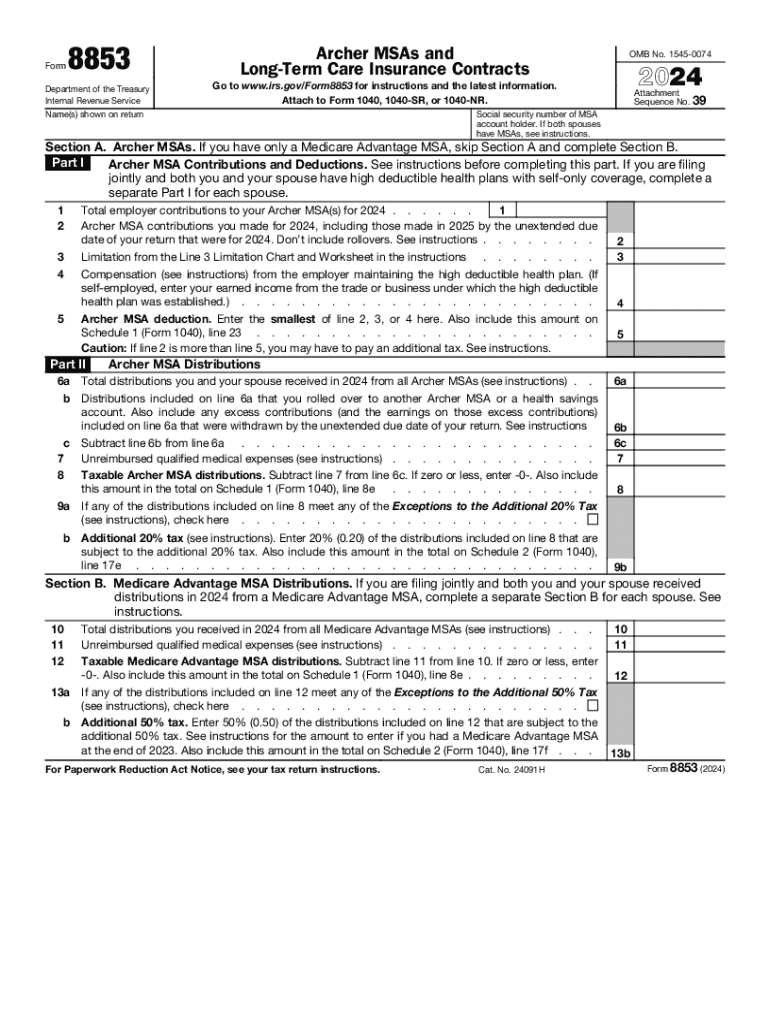

IRS Form 8853 is essential for individuals who have Archer Medical Savings Accounts (MSAs) and long-term care insurance contracts. This form allows taxpayers to report contributions to and distributions from their Archer MSAs, as well as deductions for long-term care insurance premiums. It plays a crucial role in ensuring compliance with tax regulations related to health savings and insurance. Understanding the form's purpose and requirements is vital for accurate tax reporting and maximizing potential tax benefits.

Steps to Complete IRS Form 8853

Completing Form 8853 involves several key steps:

- Gather necessary information about your Archer MSA and long-term care insurance contracts.

- Fill out Part I of the form, which details contributions to your Archer MSA.

- Complete Part II, where you report distributions from the MSA and any deductions for long-term care insurance premiums.

- Review the instructions provided by the IRS to ensure all information is accurate and complete.

- Sign and date the form before submission.

How to Obtain IRS Form 8853

You can obtain IRS Form 8853 in various ways. The most straightforward method is to download the form directly from the IRS website. It is available in PDF format, allowing for easy printing and completion. Additionally, tax preparation software often includes the form, enabling users to fill it out electronically. Ensure you have the latest version of the form to comply with current tax regulations.

Filing Deadlines for IRS Form 8853

Form 8853 must be filed along with your annual tax return. Typically, the deadline for filing individual tax returns is April 15. If you require an extension, you may file for an extension, but it is essential to submit Form 8853 by the extended deadline to avoid penalties. Keeping track of these important dates helps ensure compliance and avoids unnecessary complications.

IRS Guidelines for Form 8853

The IRS provides specific guidelines for completing and submitting Form 8853. These guidelines include detailed instructions on how to report contributions, distributions, and deductions. It is important to follow these guidelines closely to ensure accuracy and compliance with tax laws. Additionally, the IRS updates these guidelines periodically, so staying informed about the latest changes is crucial for taxpayers.

Eligibility Criteria for Using IRS Form 8853

To use IRS Form 8853, you must meet specific eligibility criteria. Primarily, you need to have an Archer MSA or long-term care insurance policy. Archer MSAs are typically available to self-employed individuals or employees of small businesses with high-deductible health plans. Additionally, you must adhere to the contribution limits and distribution rules set by the IRS. Understanding these criteria helps ensure that you are eligible to claim the associated tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct form 8853 archer msas and long term care insurance contracts

Create this form in 5 minutes!

How to create an eSignature for the form 8853 archer msas and long term care insurance contracts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8853 and why is it important?

IRS Form 8853 is used to report Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (MSAs). It is important for taxpayers who wish to claim deductions for contributions made to these accounts, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with IRS Form 8853?

airSlate SignNow simplifies the process of preparing and signing IRS Form 8853 by providing an easy-to-use platform for document management. Users can quickly fill out the form, eSign it, and securely send it to the IRS, streamlining the filing process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8853?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion and eSigning of IRS Form 8853, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for IRS Form 8853?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features enhance the user experience when completing IRS Form 8853, ensuring that all necessary information is accurately captured.

-

Can I integrate airSlate SignNow with other software for IRS Form 8853?

Yes, airSlate SignNow offers integrations with various software applications, allowing users to streamline their workflow when handling IRS Form 8853. This capability enhances productivity by connecting with tools you already use.

-

What are the benefits of using airSlate SignNow for IRS Form 8853?

Using airSlate SignNow for IRS Form 8853 provides benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled securely while simplifying the eSigning process.

-

How secure is airSlate SignNow when handling IRS Form 8853?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your IRS Form 8853 and other sensitive documents are protected throughout the signing and submission process.

Get more for Form 8853 Archer MSAs And Long Term Care Insurance Contracts

Find out other Form 8853 Archer MSAs And Long Term Care Insurance Contracts

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation