Oklahoma Form 511nr Instructions Fill Out & Sign Online

Understanding the Oklahoma Form 511NR

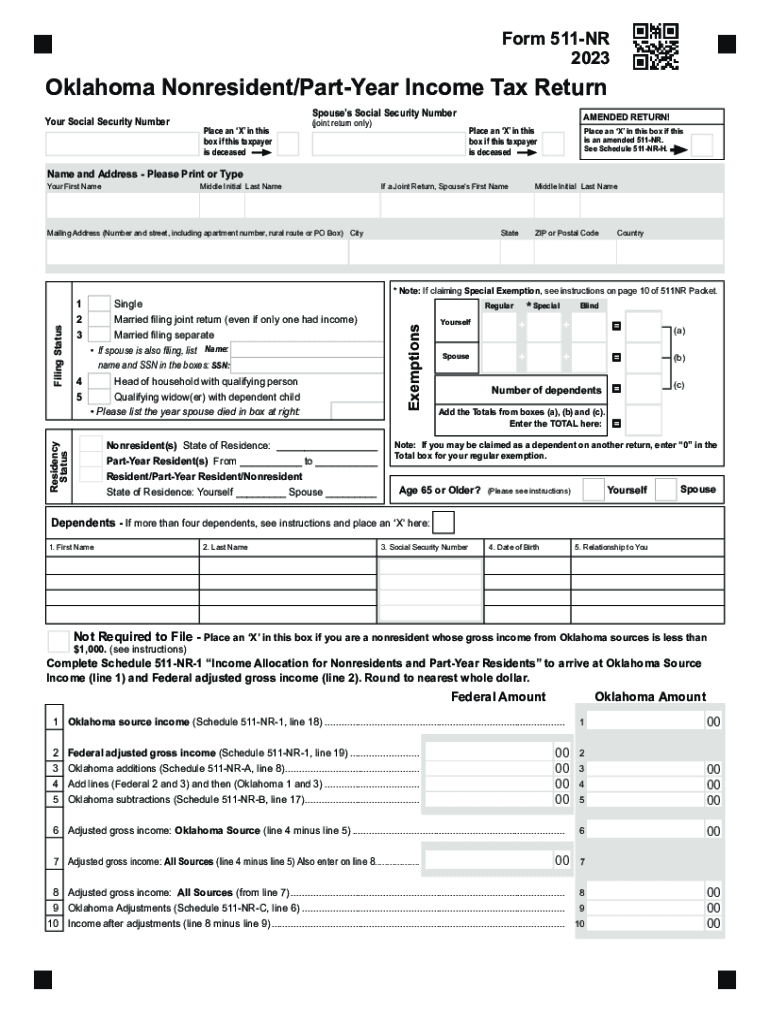

The Oklahoma Form 511NR is a state income tax form specifically designed for non-residents who earn income in Oklahoma. This form allows individuals to report their Oklahoma-source income and calculate their tax liability. Non-residents must use this form to ensure compliance with state tax laws while accurately reporting their earnings. Understanding the purpose of this form is crucial for anyone who has worked or earned income in Oklahoma but resides in another state.

Steps to Complete the Oklahoma Form 511NR

Filling out the Oklahoma Form 511NR involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Income: Enter the total income earned in Oklahoma on the appropriate lines, ensuring accuracy to avoid issues.

- Calculate Tax Liability: Use the tax tables provided in the form instructions to determine your tax amount based on your reported income.

- Claim Deductions: If eligible, claim any deductions or credits that apply to your situation, as outlined in the instructions.

- Sign and Date: Ensure to sign and date the form before submission, as unsigned forms may be rejected.

Required Documents for Filing

To successfully file the Oklahoma Form 511NR, certain documents are essential:

- W-2 forms from employers for income earned in Oklahoma.

- 1099 forms for any freelance or contract work completed in the state.

- Documentation of any deductions or credits you plan to claim.

- Identification documents, such as your Social Security number or ITIN.

Form Submission Methods

The Oklahoma Form 511NR can be submitted through various methods:

- Online Submission: Complete the form digitally and submit it through the Oklahoma Tax Commission's online portal.

- Mail Submission: Print the completed form and send it to the appropriate address listed in the form instructions.

- In-Person Submission: Visit a local Oklahoma Tax Commission office to submit your form in person.

Filing Deadlines for the Oklahoma Form 511NR

It is important to be aware of the filing deadlines to avoid penalties:

- The standard deadline for filing the Oklahoma Form 511NR is April fifteenth of each year.

- If you are unable to file by the deadline, consider applying for an extension, which can provide additional time.

Legal Use of the Oklahoma Form 511NR

The Oklahoma Form 511NR is legally recognized for reporting income earned by non-residents in the state. It is essential to use this form correctly to comply with Oklahoma tax laws. Failure to file accurately can result in penalties or legal repercussions, emphasizing the importance of understanding the form's requirements and ensuring all information is truthful and complete.

Quick guide on how to complete oklahoma form 511nr instructions fill out ampamp sign online

Accomplish [SKS] effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow offers you all the resources needed to create, adjust, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-intensive task today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Oklahoma Form 511nr Instructions Fill Out & Sign Online

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 511nr instructions fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Oklahoma Form 511nr Instructions Fill Out & Sign Online?

The Oklahoma Form 511nr Instructions Fill Out & Sign Online provides guidance for completing the non-resident personal income tax form. This ensures users accurately report their income and claim any relevant deductions, making tax filing easier and more efficient.

-

How can I access the Oklahoma Form 511nr Instructions Fill Out & Sign Online?

You can easily access the Oklahoma Form 511nr Instructions Fill Out & Sign Online through the airSlate SignNow platform. Simply visit our website, navigate to the relevant section, and follow the prompts to fill out and sign the document digitally.

-

What features does airSlate SignNow offer for filling out the Oklahoma Form 511nr?

airSlate SignNow provides numerous features for filling out the Oklahoma Form 511nr, including an intuitive interface, real-time collaboration tools, and secure document storage. This allows users to efficiently complete their forms and maintain confidentiality.

-

Is the Oklahoma Form 511nr Instructions Fill Out & Sign Online secure?

Yes, the Oklahoma Form 511nr Instructions Fill Out & Sign Online on airSlate SignNow is highly secure. We use advanced encryption technologies to protect your personal information and ensure your documents remain confidential and safe.

-

Can I sign the Oklahoma Form 511nr electronically?

Absolutely! The airSlate SignNow platform allows you to sign the Oklahoma Form 511nr electronically. This feature ensures a quick and efficient signing process, eliminating the need for printing and scanning the document.

-

What are the pricing options for using airSlate SignNow for the Oklahoma Form 511nr?

airSlate SignNow offers various pricing plans suitable for different user needs, including a free trial period. Our cost-effective solutions ensure that you can fill out and sign the Oklahoma Form 511nr without overspending.

-

Does airSlate SignNow integrate with other software for filling out forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, helping you enhance your workflow while filling out the Oklahoma Form 511nr Instructions Fill Out & Sign Online. This compatibility ensures you can streamline your processes efficiently with your favorite tools.

Get more for Oklahoma Form 511nr Instructions Fill Out & Sign Online

- Wound care orders example form

- Vehicle usage log 224002657 form

- Sheffield high school library pass student name mcsk12 form

- State of illinois eye exam form

- Osca malabon form

- Swimming permission form re advised 1 columbianacountyjfs

- Renew or replacing your dl or id while you are out of state form

- Zip codet form

Find out other Oklahoma Form 511nr Instructions Fill Out & Sign Online

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation