Form 4868SP Application for Automatic Extension of Time to File U S Individual Income Tax Return Spanish Version

What is the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

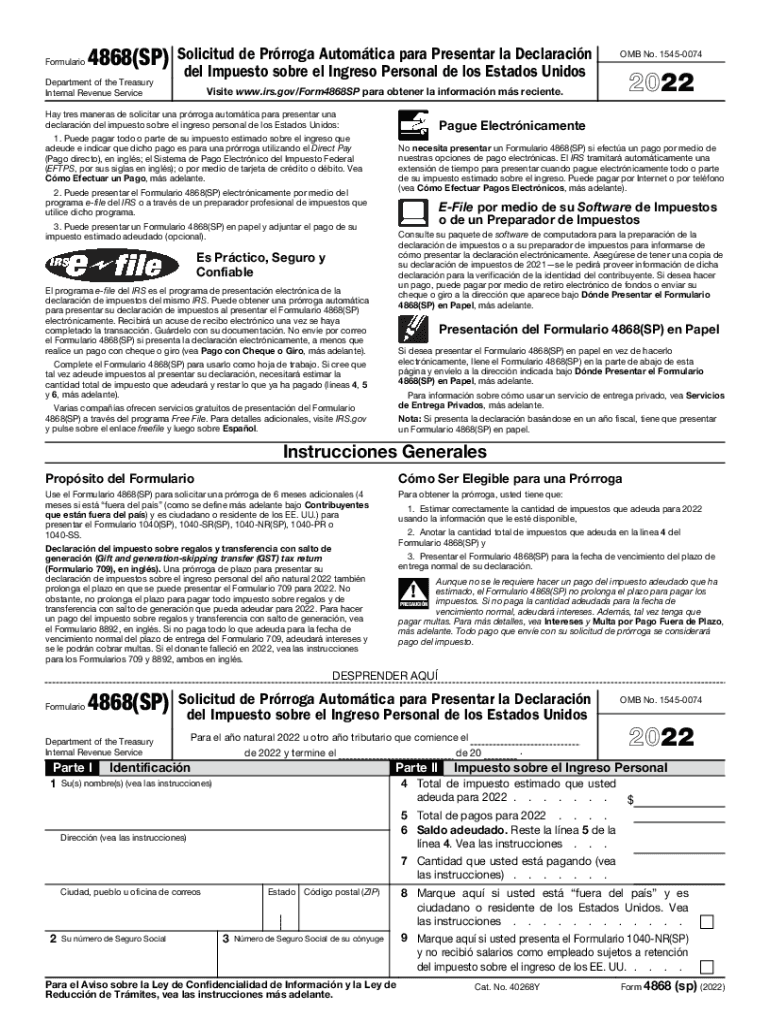

The Form 4868SP is a Spanish-language application that allows U.S. taxpayers to request an automatic extension of time to file their individual income tax returns. This form is specifically designed for Spanish-speaking individuals who need additional time to prepare their tax documents. By submitting this form, taxpayers can receive an extension of up to six months, ensuring they have ample time to gather necessary information and complete their filings accurately.

Steps to complete the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Completing the Form 4868SP involves several straightforward steps. First, gather your personal information, including your name, address, and Social Security number. Next, indicate the tax year for which you are requesting an extension. You will also need to estimate your total tax liability and any payments made. After filling out the required fields, review the form for accuracy. Finally, submit the form either electronically or by mail to the appropriate IRS address, ensuring it is sent before the tax deadline.

How to obtain the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

To obtain the Form 4868SP, you can visit the IRS website, where the form is available for download in PDF format. You may also find printed copies at local IRS offices or request them by calling the IRS directly. It is important to ensure you have the correct version of the form, as there may be updates or changes from year to year. Having the most recent version will help you avoid any issues during the filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 4868SP is crucial for compliance. Generally, the form must be submitted by the original due date of your tax return, which is typically April 15 for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to ensure your extension is valid and avoids penalties.

Legal use of the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

The Form 4868SP is legally recognized by the IRS as a valid request for an extension of time to file your tax return. However, it is essential to understand that this extension does not extend the time to pay any taxes owed. Taxpayers are still required to estimate and pay any owed taxes by the original due date to avoid interest and penalties. Using the form correctly ensures compliance with IRS regulations and provides necessary relief for taxpayers needing extra time.

Required Documents

When completing the Form 4868SP, you may need to have certain documents on hand. These include your previous year’s tax return, income statements such as W-2s or 1099s, and any documentation related to deductions or credits you plan to claim. Having these documents readily available will help you accurately estimate your tax liability and complete the form without errors.

Penalties for Non-Compliance

Failing to file your tax return by the deadline, even with an extension, can result in penalties. If you do not submit the Form 4868SP on time, you may face a failure-to-file penalty, which is typically a percentage of the unpaid taxes. Additionally, if you do not pay your estimated taxes by the due date, you may incur interest and penalties on the amount owed. It is crucial to adhere to all deadlines to avoid these financial repercussions.

Quick guide on how to complete form 4868sp application for automatic extension of time to file u s individual income tax return spanish version

Complete Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-centric procedure today.

How to modify and eSign Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version easily

- Locate Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using specialized tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form scanning, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version and maintain excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4868sp application for automatic extension of time to file u s individual income tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 4868sp application for automatic extension of time to file u s individual income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

The Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is a tax form designed for Spanish-speaking individuals to request an automatic extension for filing their U.S. individual income tax returns. This form allows taxpayers to extend their filing deadline without incurring late penalties.

-

How much does it cost to use airSlate SignNow for filing the Form 4868SP?

Using airSlate SignNow to file the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is cost-effective, with flexible pricing plans based on your needs. Our platform offers various subscription levels, ensuring you only pay for what you use while gaining access to essential e-signature features.

-

Can I eSign the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

Yes, airSlate SignNow allows you to eSign the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version easily. Our platform ensures that your e-signatures are legally binding, streamlining the submission process to the IRS.

-

What features does airSlate SignNow offer for the Form 4868SP?

airSlate SignNow provides a comprehensive suite of features for managing the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. Users can enjoy document templates, real-time collaboration, secure storage, and integration with popular apps to optimize the tax filing process.

-

How can airSlate SignNow help me with my tax filing deadlines?

airSlate SignNow simplifies the management of tax filing deadlines, including the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. Our platform sends automated reminders, ensuring you never miss an important date for your tax submissions.

-

Is the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version legally valid?

Absolutely! The Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is legally recognized by the IRS when completed correctly. airSlate SignNow ensures that all e-signatures and submissions comply with legal requirements for the filing process.

-

Can I integrate airSlate SignNow with my existing tax software to handle the Form 4868SP?

Yes, airSlate SignNow offers seamless integrations with various tax software, allowing you to efficiently manage the Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. This ensures a smoother workflow and enhances your overall tax management experience.

Get more for Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

- Groupon security code form

- De1326c 79346472 form

- I ready data analysis template after the first diagnostic class how to use the data analysis protocol form

- Exclusive license agreement template form

- Exclusive manufacturing agreement template form

- Exclusive license music agreement template form

- Exclusive marketing agreement template form

- Guarantee contract template form

Find out other Form 4868SP Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form