Form 433 a OIC Sp Rev 4 Collection Information Statement for Wage Earners and

What is the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

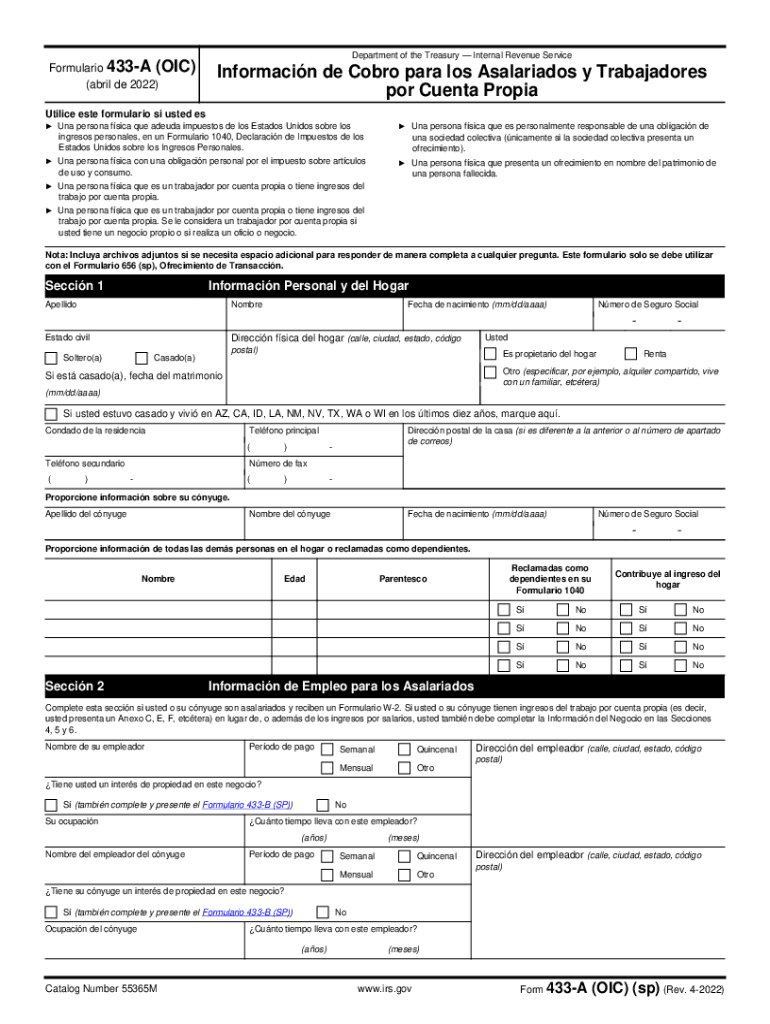

The Form 433 A OIC sp Rev 4, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a crucial document used by the Internal Revenue Service (IRS) to assess an individual's financial situation. This form is primarily utilized by taxpayers who are seeking to settle their tax liabilities through an Offer in Compromise (OIC). It provides the IRS with a comprehensive overview of the taxpayer's income, expenses, assets, and liabilities, allowing them to determine the taxpayer's ability to pay their tax debt.

How to use the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Using the Form 433 A OIC sp Rev 4 involves several key steps. First, gather all necessary financial information, including pay stubs, bank statements, and documentation of monthly expenses. Next, accurately fill out the form, ensuring that all sections are completed, including personal information, income details, and asset disclosures. Once completed, the form should be submitted to the IRS along with the Offer in Compromise application. It is essential to ensure that all information is truthful and complete to avoid delays or rejections in the application process.

Steps to complete the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

Completing the Form 433 A OIC sp Rev 4 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Document your income sources, such as wages, bonuses, and any other earnings.

- List your monthly expenses, including housing costs, utilities, food, and transportation.

- Detail your assets, including bank accounts, vehicles, and real estate.

- Provide information about your liabilities, such as loans and credit card debts.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To use the Form 433 A OIC sp Rev 4, taxpayers must meet specific eligibility criteria. Primarily, they should have a tax liability that they are unable to pay in full. Additionally, individuals must not be in an open bankruptcy proceeding and should have filed all required tax returns. The IRS evaluates the taxpayer's financial situation to determine if an Offer in Compromise is a viable option based on their ability to pay.

Required Documents

When submitting the Form 433 A OIC sp Rev 4, it is essential to include supporting documents that verify the information provided. Required documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for all accounts.

- Documentation of monthly expenses, such as bills and receipts.

- Proof of assets, including titles for vehicles and property deeds.

Form Submission Methods

The Form 433 A OIC sp Rev 4 can be submitted to the IRS through various methods. Taxpayers may choose to file the form online through the IRS website, mail it to the appropriate IRS address, or deliver it in person at a local IRS office. It is important to follow the specific submission guidelines provided by the IRS to ensure proper processing of the form.

Quick guide on how to complete form 433 a oic sp rev 4 collection information statement for wage earners and 577617884

Complete Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And effortlessly

- Obtain Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And and ensure efficient communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic sp rev 4 collection information statement for wage earners and 577617884

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic sp rev 4 collection information statement for wage earners and 577617884

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

The Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And is designed to collect detailed financial information from wage earners applying for an Offer in Compromise (OIC) with the IRS. It helps the IRS assess your ability to pay and determines if you qualify for a reduced tax liability. Using this form accurately is crucial for a successful OIC application.

-

How can airSlate SignNow help me complete the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

airSlate SignNow provides templates and tools to efficiently complete your Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. Our platform guides you step-by-step through the process to ensure all necessary information is gathered. You can also easily eSign and share the completed forms with relevant parties.

-

Is there a cost associated with using airSlate SignNow for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Yes, there is a subscription fee for using airSlate SignNow, which offers a cost-effective solution for document eSigning and management. Pricing varies based on the plan you choose, but it typically includes features that streamline the process of handling forms like the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. You can explore our pricing page for specific details.

-

What features does airSlate SignNow offer that benefit the completion of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

airSlate SignNow offers features such as customizable templates, easy eSignature capabilities, and secure document storage that enhance the completion of the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And. Moreover, our platform allows for real-time collaboration and tracking of signatures to ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for submitting the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Absolutely! airSlate SignNow integrates with various applications like Google Workspace, Microsoft Office, and popular CRM tools. This integration allows you to manage your documents seamlessly, making it easier to complete and submit the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And directly from your preferred applications.

-

Is airSlate SignNow secure for handling the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Yes, airSlate SignNow prioritizes security, offering features such as encrypted document storage, secure sign-in practices, and compliance with data protection regulations. This ensures that your personal and financial information included in the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And is kept confidential and protected.

-

What are the benefits of using airSlate SignNow for the Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And?

Using airSlate SignNow for your Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And provides numerous benefits, including increased efficiency in form completion, reduced paper clutter, and enhanced tracking of signatures. Additionally, our platform simplifies communication between you and the IRS, leading to a smoother filing process.

Get more for Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

- Vca payment form 22334576

- Metlife change request form fillable

- Itemized statement example 1579812 form

- Hillingdon gov form

- Gopeo form

- Playday entry form sundays dripping springs ranch park

- Stowohio orgbuilding permit application pdfcommericalindustrialmulti family zoning certificate form

- Form it 203 gr group return for nonresident partners tax year 772079652

Find out other Form 433 A OIC sp Rev 4 Collection Information Statement For Wage Earners And

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement