Form it 203 GR Group Return for Nonresident Partners Tax Year 2024-2026

What is the Form IT 203 GR Group Return For Nonresident Partners Tax Year

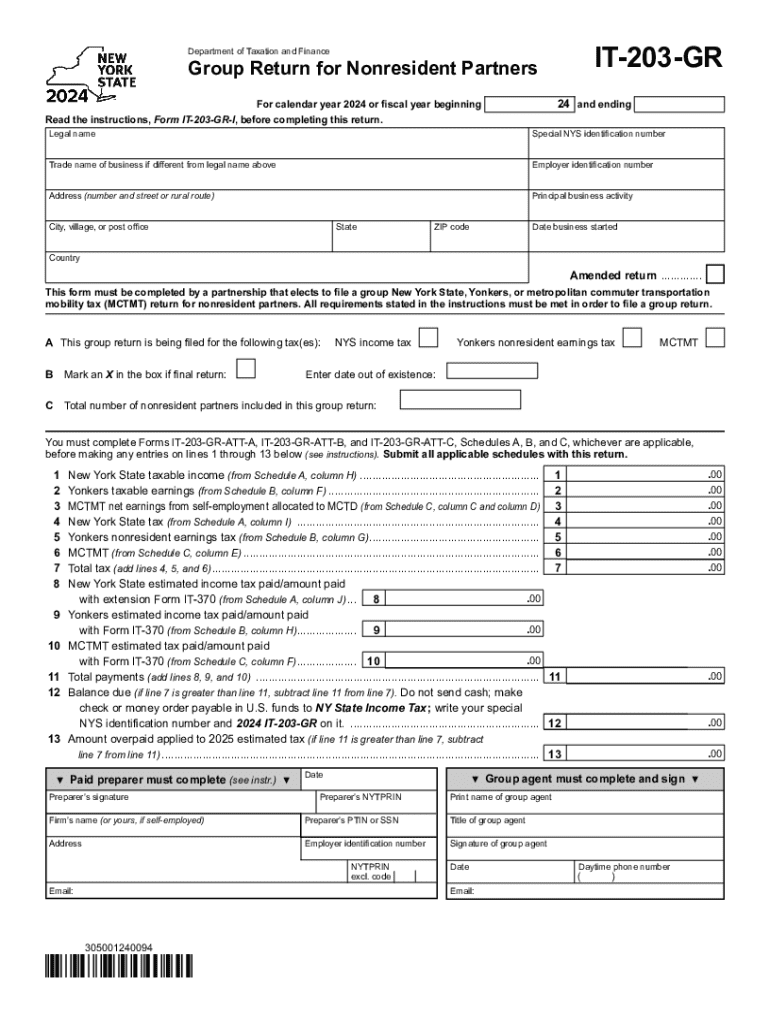

The Form IT 203 GR is a tax form used by partnerships in the United States to report income, gains, losses, deductions, and credits for nonresident partners. This form allows partnerships to file a single group return on behalf of multiple nonresident partners, simplifying the tax reporting process. It is specifically designed for partnerships that have nonresident members, ensuring compliance with state tax laws while providing a streamlined approach to filing.

How to use the Form IT 203 GR Group Return For Nonresident Partners Tax Year

To use the Form IT 203 GR, partnerships must first gather the necessary financial information related to each nonresident partner. This includes details about income, deductions, and credits attributable to each partner. The form must be filled out accurately, reflecting the partnership's overall financial activities for the tax year. Once completed, the form can be submitted to the appropriate state tax authority, ensuring that all nonresident partners are accounted for in the tax filing process.

Steps to complete the Form IT 203 GR Group Return For Nonresident Partners Tax Year

Completing the Form IT 203 GR involves several key steps:

- Collect financial data for the partnership and each nonresident partner.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total income, deductions, and credits for the partnership.

- Review the form for accuracy and completeness.

- Submit the form to the relevant state tax authority by the designated deadline.

Legal use of the Form IT 203 GR Group Return For Nonresident Partners Tax Year

The legal use of the Form IT 203 GR is essential for compliance with state tax regulations. Partnerships must ensure that they are eligible to file this group return on behalf of their nonresident partners. Accurate reporting is crucial, as it helps avoid potential penalties for non-compliance. Understanding the legal implications and requirements associated with this form can aid partnerships in maintaining proper tax practices.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR vary depending on the state in which the partnership operates. Typically, the form must be submitted by the due date for the partnership's tax return. It is important for partnerships to be aware of these deadlines to avoid late filing penalties. Keeping track of important dates helps ensure timely compliance with tax obligations.

Required Documents

To successfully complete the Form IT 203 GR, partnerships must gather several required documents, including:

- Partnership tax return information.

- Income statements for each nonresident partner.

- Deductions and credits documentation.

- Any additional state-specific forms or schedules that may be required.

Who Issues the Form

The Form IT 203 GR is issued by the state tax authority where the partnership is registered. Each state has its own regulations and guidelines regarding the use of this form, so it is important for partnerships to refer to their specific state tax agency for the most accurate and up-to-date information regarding the form and its requirements.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr group return for nonresident partners tax year 772079652

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr group return for nonresident partners tax year 772079652

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 GR Group Return For Nonresident Partners Tax Year?

The Form IT 203 GR Group Return For Nonresident Partners Tax Year is a tax form used by partnerships to report income and deductions for nonresident partners. This form simplifies the tax filing process for partnerships with nonresident members, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the Form IT 203 GR Group Return For Nonresident Partners Tax Year?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our solution streamlines the document management process, making it easier for businesses to handle tax forms securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. By choosing our service, you can efficiently manage the Form IT 203 GR Group Return For Nonresident Partners Tax Year without breaking the bank.

-

Is airSlate SignNow compliant with tax regulations for the Form IT 203 GR Group Return?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our platform ensures that your documents are handled securely and in accordance with legal requirements.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features make it easy to prepare and submit the Form IT 203 GR Group Return For Nonresident Partners Tax Year efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow. This integration allows you to manage the Form IT 203 GR Group Return For Nonresident Partners Tax Year alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Form IT 203 GR Group Return For Nonresident Partners Tax Year offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, allowing you to focus on your business.

Get more for Form IT 203 GR Group Return For Nonresident Partners Tax Year

Find out other Form IT 203 GR Group Return For Nonresident Partners Tax Year

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer