Schedule 1 Form 1040 SP Additional Income and Adjustments to Income Spanish Version 2022

Understanding the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

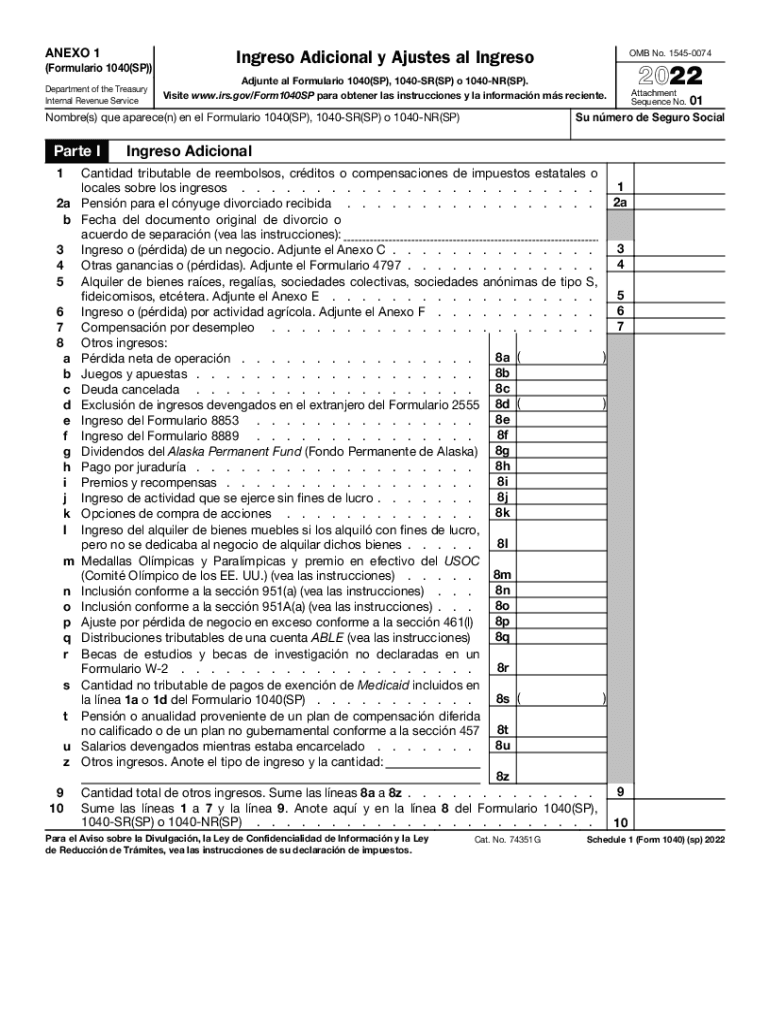

The Schedule 1 Form 1040 SP is a crucial document for taxpayers in the United States who need to report additional income and adjustments to income. This Spanish version is specifically designed for Spanish-speaking individuals, ensuring that language barriers do not hinder the tax filing process. The form allows taxpayers to include various types of income that are not reported directly on the main Form 1040, such as unemployment compensation, rental income, and certain deductions. Understanding this form is essential for accurately reporting your financial situation to the IRS.

Steps to Complete the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

Completing the Schedule 1 Form 1040 SP involves several steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary financial documents, including W-2s, 1099s, and records of any additional income. Next, fill out the form by entering your additional income in the appropriate sections, such as line one for unemployment compensation or line two for other income. After reporting your income, proceed to the adjustments section to claim deductions like educator expenses or student loan interest. Finally, review the completed form for errors before submitting it along with your main Form 1040.

How to Obtain the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

The Schedule 1 Form 1040 SP can be obtained through various channels. The most straightforward method is to visit the IRS website, where you can download the form directly in Spanish. Additionally, local tax offices and community organizations may provide printed copies. If you prefer a digital approach, tax preparation software often includes this form as part of their package, allowing you to fill it out electronically. Ensure that you are using the latest version to comply with current tax laws.

Key Elements of the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

Key elements of the Schedule 1 Form 1040 SP include sections for reporting additional income and adjustments. The form typically features lines for various income types, including unemployment benefits, business income, and rental income. Additionally, it includes spaces for adjustments such as educator expenses, health savings account deductions, and IRA contributions. Each line must be filled out carefully to ensure that all applicable income and deductions are accurately reported, which can significantly affect your overall tax liability.

IRS Guidelines for the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

The IRS provides specific guidelines for completing the Schedule 1 Form 1040 SP, emphasizing the importance of accuracy and completeness. Taxpayers are advised to refer to the IRS instructions for detailed information on what constitutes additional income and allowable adjustments. It is essential to keep records of all income sources and deductions claimed, as the IRS may request documentation during audits. Familiarizing yourself with these guidelines can help ensure a smooth filing process and reduce the risk of errors.

Filing Deadlines for the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

Filing deadlines for the Schedule 1 Form 1040 SP align with the deadlines for the main Form 1040. Typically, individual income tax returns are due on April fifteenth of each year. However, if you need additional time, you can file for an extension, which grants you until October fifteenth to submit your return. It is important to note that any taxes owed are still due by the original deadline to avoid penalties and interest. Keeping track of these dates is crucial for timely and compliant tax filing.

Quick guide on how to complete schedule 1 form 1040 sp additional income and adjustments to income spanish version

Accomplish Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, since you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without interruptions. Manage Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and eSign Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version without hassle

- Obtain Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version and then click Get Form to commence.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the concerns of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 1 form 1040 sp additional income and adjustments to income spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 form 1040 sp additional income and adjustments to income spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

The Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version is a tax form that reports additional income and adjustments to income for U.S. taxpayers who prefer to complete their tax filings in Spanish. This form helps individuals detail their income sources and claim relevant deductions effectively.

-

How can I access the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

You can easily access the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version through our online platform. airSlate SignNow provides a user-friendly interface that allows users to download the form directly or fill it out digitally for convenience.

-

Is there a cost associated with using airSlate SignNow for the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While some features are available for free, premium plans provide advanced functionalities, making it easy to manage the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version efficiently.

-

What features does airSlate SignNow provide for managing the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

airSlate SignNow includes features such as eSigning, document tracking, and customizable templates specifically for handling the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version. These tools streamline the filing process and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other applications for filing the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing users to enhance their workflow when filing the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version. Popular integrations include Google Drive, Dropbox, and Microsoft Office.

-

How does using airSlate SignNow benefit me when working with the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

Using airSlate SignNow provides numerous benefits, including a simplified eSignature process, secure document storage, and real-time collaboration. This enhances your experience when handling the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version, saving you valuable time and effort.

-

Is customer support available for questions related to the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version?

Yes, our customer support team is always available to assist you with any questions regarding the Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

- How can i check the status of my immigration application form

- Rw1123 form

- Foot locker sales associate resume form

- Ehere would i go to get a marriage reguest form for mens central jail

- Employment application corydon cinemas form

- 5 year inspection formworksheet pdf wkjeepscom

- To download an application the century corporation form

- Household worksheet form

Find out other Schedule 1 Form 1040 SP Additional Income And Adjustments To Income Spanish Version

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF