Schedule 1 Form 1040 Sp Additional Income and Adjustments to Income Spanish Version 2024

What is the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

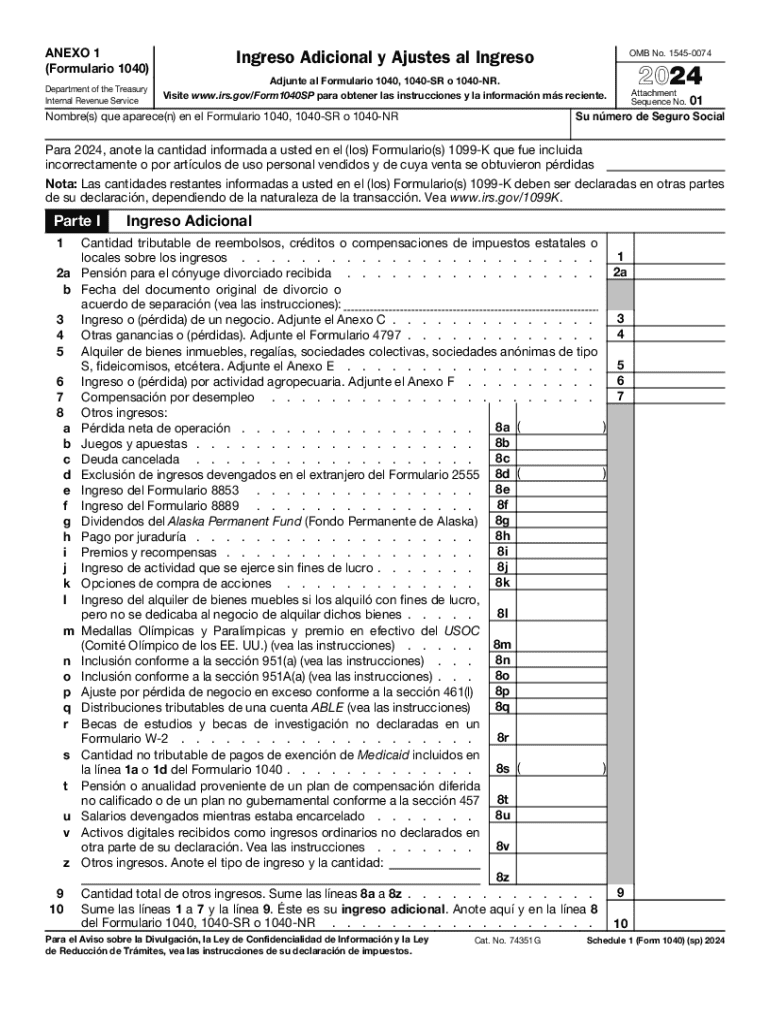

The Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version is a tax form used by individuals in the United States to report additional income and adjustments to income. This form is essential for taxpayers who have income sources beyond wages, such as rental income, unemployment compensation, or certain business income. It allows taxpayers to accurately report these amounts, which can affect their overall tax liability.

How to use the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

To use the Schedule 1 Form 1040 sp, taxpayers should first gather all relevant income documents, including W-2s, 1099s, and records of any additional income sources. After completing the form, it should be attached to the main Form 1040 when filing taxes. It is important to ensure that all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

Completing the Schedule 1 Form 1040 sp involves several steps:

- Begin by entering your personal information at the top of the form.

- Report additional income in Part I, including amounts from self-employment, rental properties, and other sources.

- In Part II, list any adjustments to income, such as educator expenses or student loan interest deductions.

- Double-check all entries for accuracy before submitting.

Key elements of the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

Key elements of this form include sections for reporting various types of additional income and adjustments. Taxpayers must provide detailed information about each income source, including the amount and type. Adjustments to income are equally important, as they can reduce taxable income and ultimately lower tax liability. Understanding these elements helps ensure accurate reporting and compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 1 Form 1040 sp. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, required documentation, and filing procedures. Adhering to these guidelines is crucial for a smooth filing process and to avoid potential penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1 Form 1040 sp align with the general tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to be aware of these dates to ensure timely submission and avoid late fees.

Create this form in 5 minutes or less

Find and fill out the correct schedule 1 form 1040 sp additional income and adjustments to income spanish version 770493948

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 form 1040 sp additional income and adjustments to income spanish version 770493948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

The Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version is a tax form used to report additional income and adjustments to income for individuals filing their taxes in Spanish. This form helps taxpayers accurately report various types of income and deductions, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help me with the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version. Our solution streamlines the process, making it simple to manage your tax documents securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking for the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version. These tools enhance your workflow, making it easier to complete and manage your tax documents.

-

Can I integrate airSlate SignNow with other software for the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version alongside your existing tools. This flexibility enhances your productivity and streamlines your document management process.

-

What are the benefits of using airSlate SignNow for the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

Using airSlate SignNow for the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on what matters most—your business.

-

Is airSlate SignNow user-friendly for completing the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface makes it easy for anyone to navigate and complete the Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version, regardless of their technical expertise.

Get more for Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

- Mcu dca diploma download form

- Indian hotel bill format in word download

- Rajpatra form pdf

- Bwc 1101 rev 6 12 form

- Application for general registration as an enrolled nurse form

- College of laws clinical experience module cem form

- Certificate of exemption regarding sale of a motor vehicle form

- Apv9t 485796370 form

Find out other Schedule 1 Form 1040 sp Additional Income And Adjustments To Income Spanish Version

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement